If paid from funds inside the tax deferred account they never were deductible. January 23 2018 2018 0157.

Investment Fees Are Not Deductible But Borrow Fees Are

Investment Fees Are Not Deductible But Borrow Fees Are

can you deduct investment advisory fees in 2018

can you deduct investment advisory fees in 2018 is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in can you deduct investment advisory fees in 2018 content depends on the source site. We hope you do not use it for commercial purposes.

What the new tax law means for investment advisory fees.

/midsection-of-businessman-using-calculator-while-working-in-office-960777596-5b422a67c9e77c0037d70a94.jpg)

Can you deduct investment advisory fees in 2018. When you sell your investment. For 2017 and earlier you could take an itemized deduction for advisory fees paid only if the fees were separately paid from funds outside of the tax deferred account. Investors who are filing their 2018 tax return may be able to claim one of.

For tax years 2018 to 2025 these deductions have been eliminated. These include investment fees and expenses convenience fees for using a credit or debit card to. The entire investment interest expense is deductible.

Any portion allocable to investment management an expense commonly or customarily incurred by an individual is a miscellaneous itemized deduction. You can only deduct fees for investments that produce taxable income. Deductibility of trustee fees after the tax cuts and jobs act.

Some investments do not produce taxable income such as municipal bonds or mutual funds that distribute only tax exempt dividends. Investment advisory fees. Owners could deduct.

The tax cuts and jobs act the act signed on december 22. If you arent sure check with you broker financial management company or financial advisor. A host of other miscellaneous deductions subject to the 2 agi limitation will all be gone in 2018.

For 2018 on investment advisory fees are not deductible at all. If your agi is 100000 and you have 3000 in financial planning accounting andor investment management fees youll get no deduction for the first 2000 of fees but you will be able to deduct the last 1000the amount that exceeds 2 percent 2000 of your agi. If the interest expenses are more than the net investment income you can deduct the expenses up to the net.

These fees arent part of any particular trade so they are billed to jane as investment expenses. Such as commissions and transaction fees. Investors who itemize can deduct investment interest expense against their net.

While individual taxpayers may no longer deduct investment fees and expenses on schedule a starting in 2018 they are still entitled to deduct investment interest expenses up to net investment. Breaks that are now out the window as of 2018 include the investment expense deduction which allows you to deduct investment and custodial fees costs related trust administration and other expenses.

This Investment Fee Tax Break Is Gone What That Means For

This Investment Fee Tax Break Is Gone What That Means For

The New Tax Law S Impact On Investment Advisory Fees Iras

The New Tax Law S Impact On Investment Advisory Fees Iras

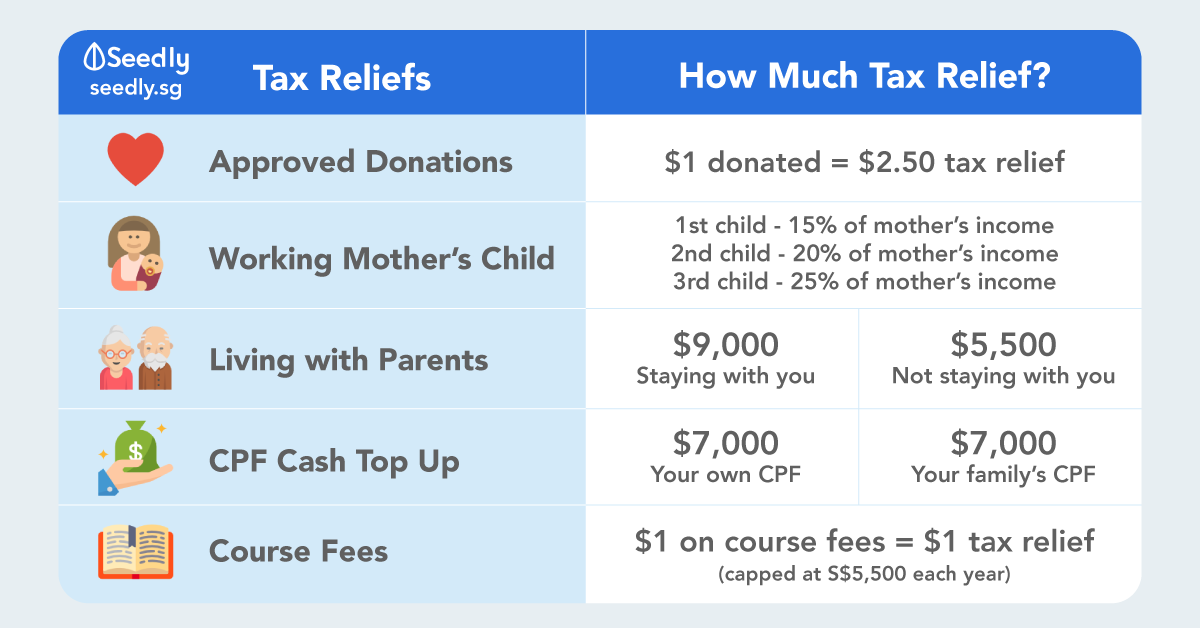

Your Cheat Sheet Personal Income Tax In Singapore Ya 2019

Your Cheat Sheet Personal Income Tax In Singapore Ya 2019

Investment Advisory Fees 2 Floor Bed Prowexhydka Cf

Investment Advisory Fees 2 Floor Bed Prowexhydka Cf

Tax Cuts And Jobs Act Tcja Extremeconsultingincblog

Tax Cuts And Jobs Act Tcja Extremeconsultingincblog

6 Ways You Can Legally Reduce Your Income Tax For Ya 2020

6 Ways You Can Legally Reduce Your Income Tax For Ya 2020

Strategies To Manage The Repeal Of The Advisory Fee Deduction

Strategies To Manage The Repeal Of The Advisory Fee Deduction

Singapore Corporate Tax 2019 Guide Taxable Income Tax

Singapore Corporate Tax 2019 Guide Taxable Income Tax

How To Avoid Irs Challenge On Your Family Office

How To Avoid Irs Challenge On Your Family Office

The New Tax Law S Impact On Investment Advisory Fees Iras

The New Tax Law S Impact On Investment Advisory Fees Iras

Iras Tax Treatment Of Business Expenses A H

Iras Tax Treatment Of Business Expenses A H