The irs reminds you to report your worldwide income on your us. Are exempt from state income taxes while most states do not tax interest on municipal.

Four Things To Know About Net Investment Income Tax

Four Things To Know About Net Investment Income Tax

do you have to pay taxes on investment income

do you have to pay taxes on investment income is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in do you have to pay taxes on investment income content depends on the source site. We hope you do not use it for commercial purposes.

The irs interest however extends beyond bank accounts in liechtenstein to financial accounts anywhere in the world.

Do you have to pay taxes on investment income. Real estate is another asset you will need to pay capital gains tax on when you sell it. Tax return and lists the possible consequences of hiding income overseas. You dont have to pay federal income tax if you make.

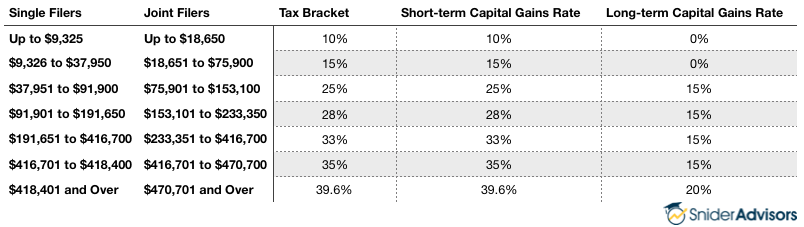

The amount you owe in this respect is determined by how long you held the investment your filing status and the tax bracket you fall into. When you make money you usually owe taxes. There have been recent reports about the interest of the internal revenue service irs in taxpayers with bank accounts in liechtenstein.

How tax lots help you pay less. Some taxes are due only when you sell investments at a profit while other taxes are due when your investments pay you a distribution. Its a lesson you probably learned early in your working life.

State taxes may still apply but even in states with higher tax rates paying no federal taxes remains a huge benefit. Minors even toddlers need to pay income tax and you as the parent need to know how to file a tax return for your under age child. If you are selling.

Age for filing income tax first children are never too young nor too old to file income taxes if they have earned income or income from savings or investments. This is also true of money you make on your investments. As of the 2018 tax year individuals who make less than 38600 in taxable income and married couples who make less than 77200 do not pay federal taxes on qualified dividends and long term capital gains.

Do i need to pay capital gains on real estate. Keep in mind how long youve owned the security and the amount in which you are selling it at since that will have an effect on the taxes youre required to pay he says. 2018 caused by investment losses you can carry that loss forward.

The federal government taxes not only investment incomedividends. From social security and medicare taxes. If you are a cash basis taxpayer you report rental income on your return.

If you sell your shares in a mutual fund any amount of the proceeds that is a return of your original investment is not taxable since you already paid income taxes on those dollars when you. Even if you dont have. If you own rental real estate you should be aware of your federal tax responsibilities.

All rental income must be reported on your tax return and in general the associated expenses can be deducted from your rental income.

Taxation Of Investment Income Within A Corporation

Corporate Tax In Singapore How To Pay Tax Rate Exemptions

Corporate Tax In Singapore How To Pay Tax Rate Exemptions

9 Common Questions About Investment Income Tax

9 Common Questions About Investment Income Tax

How To Figure Out If You Should Do Your Own Taxes Or Hire A

How To Figure Out If You Should Do Your Own Taxes Or Hire A

American Expats And The Net Investment Income Tax

American Expats And The Net Investment Income Tax

Singapore Personal Income Tax Guide Guidemesingapore By

Singapore Personal Income Tax Guide Guidemesingapore By

How To Invest Tax Efficiently Fidelity

How To Invest Tax Efficiently Fidelity

Do I Have To Pay Taxes Of A Money I Invested In A Company

:max_bytes(150000):strip_icc()/TaxPolicy.Paul.4.2.1_-_figure_1-512c20575f6b4bc6bf23ef34dee0f9c4.png)