The 38 net investment income tax is imposed to the extent the taxpayers modified adjusted gross income exceeds 250000 for married couples and 200000 for individuals. And dana rountree andrassy.

It S Tax Time Implications Of Tax Reform For Banks Mercer

closely held c corporation net investment income tax

closely held c corporation net investment income tax is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in closely held c corporation net investment income tax content depends on the source site. We hope you do not use it for commercial purposes.

Presenting a live 110minute teleconference with interactive qa new 38 net investment income tax.

/171116298-56a938775f9b58b7d0f95c8c.jpg)

Closely held c corporation net investment income tax. Planning for closely held companies navigating new medicare tax selfemployment tax and capital gains issues. This podcast was originally recorded dec. The self rental exclusion extends to real estate leased to a closely held c corporation activity in which.

Good news on the 38 net investment income tax. If you are the owner of an s corp. The tax applies to net investment income including to net gain to the extent taken into account in computing taxable income attributable to the disposition of property other than property held in a trade or business5 when a disposition of an active equity interest in a partnership or s corporation is made rather than a disposition of the.

Although the net investment income tax generally excludes from net investment income disposition of active interests in partnerships and s corporations the same treatment does not extend to c corporation stock. An s corporation can save certain shareholdersshareholders who are treated as non passive under section 469the 38 net investment income tax. Net investment income also does not include net gains from property held in a trade or business other than trading in financial.

In addition a new 38 surtax is imposed on an individuals net investment income nii for the year. And you are active in your business and you sell the stock in your business at a ga. On behalf of the personal financial planning and tax divisions of the aicpa this is bob keebler to discuss understanding the 38 net investment income tax and its impact on individuals trusts estates and closely held business entities.

One of the factors to consider in regards to deciding to do business as a c corporation or utilize the sub s election where there are 100 stockholders or less is the 38 net investment income tax. 1469 4d is not permitted. Tax law for the closely held business.

An opportunity for shareholders to avoid the imposition of a surtax on net investment income nii. Since the tax only applies to the nii of individual taxpayers the sale of assets by a c corporation does not trigger the tax. Tax saving opportunities for active business owners s corporations now provide business owners with a unique opportunity to minimize earnings subject to both the recently imposed additional tax on net investment income and increased employment taxes.

Conducted in a c corporation and grouping under reg. Tax law for the closely held business. A recent development provides yet another advantage for an s corporation over a c corporation.

How The Tax Relief Act Affects Pdf Free Download

How The Tax Relief Act Affects Pdf Free Download

How The Tax Relief Act Affects Pdf Free Download

How The Tax Relief Act Affects Pdf Free Download

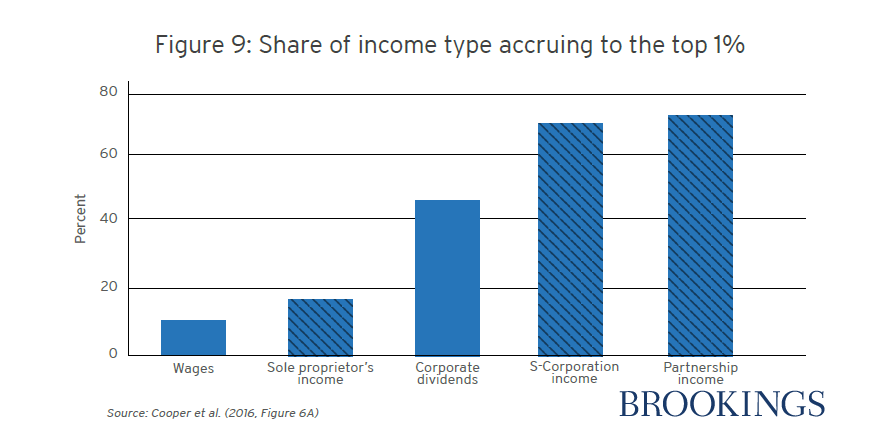

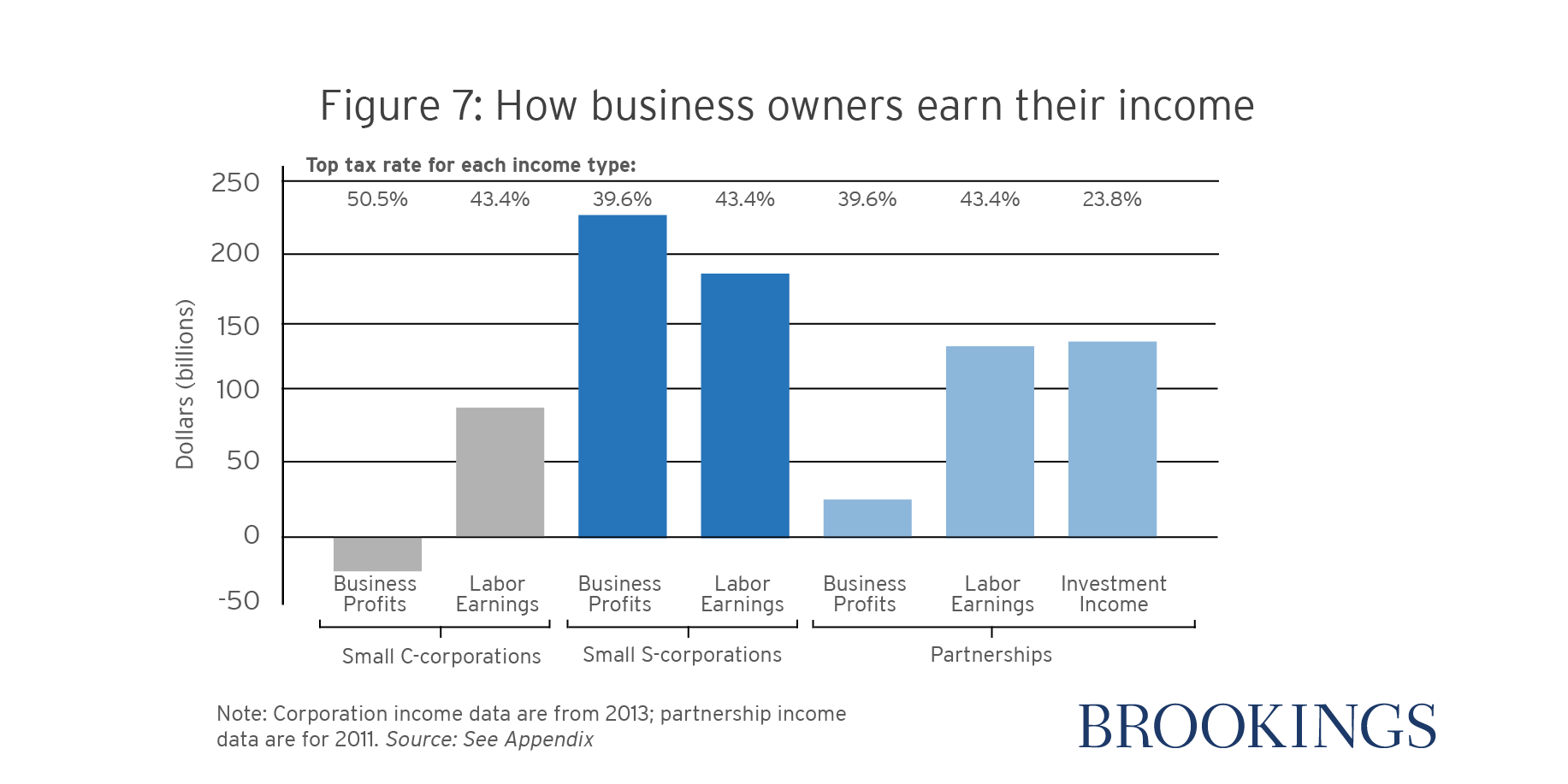

9 Facts About Pass Through Businesses

9 Facts About Pass Through Businesses

Insight Being An S Or C Corporation For Small Businesses

Insight Being An S Or C Corporation For Small Businesses

9 Facts About Pass Through Businesses

9 Facts About Pass Through Businesses

How To Decide If A C Corp Is Appropriate For Your Trading

How To Decide If A C Corp Is Appropriate For Your Trading

Insight Being An S Or C Corporation For Small Businesses

Insight Being An S Or C Corporation For Small Businesses

Which Transactions Affect Retained Earnings

9 Facts About Pass Through Businesses

9 Facts About Pass Through Businesses

2019 Tax Planning Guidelines For Individuals And Businesses

2019 Tax Planning Guidelines For Individuals And Businesses

Sale Of Business Meets Investment Income Surtax Tax Law

Sale Of Business Meets Investment Income Surtax Tax Law