What is more neither you nor any disqualified party may liveuse the solo 401k owned property even if it is just once a year or if you pay market rate rent to the solo 401k plan. The rules for 401k real estate investment.

Can You Use Your 401k To Make Real Estate Investments

Can You Use Your 401k To Make Real Estate Investments

can you use 401k to invest in real estate

can you use 401k to invest in real estate is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in can you use 401k to invest in real estate content depends on the source site. We hope you do not use it for commercial purposes.

The purpose of this article is to help you understand how you can use your self directed ira to invest in real estate.

Can you use 401k to invest in real estate. Our clients want to diversify their investments into more than just a retirement account thus theyre drawn to real estate which is enticing because of the cash flow it creates. Nowadays nearly 20 percent of catchfire fundings clients use our self directed 401k program to invest in real estate as a business. However what many retirement account investors are not aware of is that hidden in the tax code is a noteworthy provision that allows a 401k plan to purchase real estate with leverage without.

On the other hand if it is a former employer plan you can open a self directed solo 401k if you are self employed or a self directed ira and then transfer the 401k to one of these vehicles which can then be invested in real estate. If you have a 401k and a company match it would be great to use it to invest in real estate right. The easiest way is to simply borrow up to 50000 and invest it any way you choose.

A checkbook 401k enables you to invest in real estate via rental property house flipping and more while still receiving the tax advantages of traditional 401ks. Simply stated the solo 401k real estate investment has to be hands off. You can only use a self directed solo 401k to invest in real estate.

The rules governing the use of 401k funds for real estate investment are not complicated. Using retirement accounts to invest in real estate has a downside first and foremost you need to realize that if you take out a loan against your 401k the loan must be repaid by the deadline. What a solo 401k is how it works.

Whether you want to defer taxes increase your income or diversify your retirement nest egg there are many benefits that can be enjoyed when you leverage the potential of a sdira. Using your 401k to invest in real estate. However if you are talking about a current employer 401k this option wont be available.

No worriesyou can roll over your 401k into an ira tax free then use the proceeds to invest in real estate that way. Remember though this is not entirely passive and may require ongoing oversight or work from you. You will have to talk to your employer but once self direction is available you can start to take advantage of real estate benefits.

If you purchase real estate through a retirement account all funds used to purchase the property must come from the account and any proceeds such as rental income or sales.

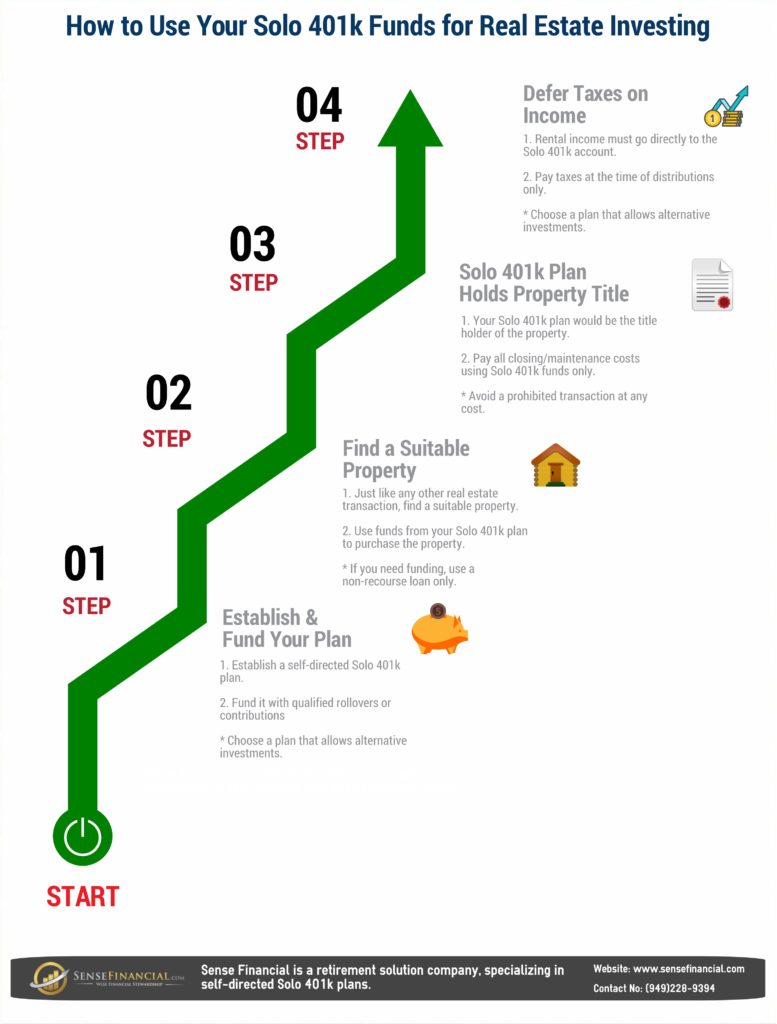

Infographic How To Use Solo 401 Plan Funds For Real Estate

Infographic How To Use Solo 401 Plan Funds For Real Estate

How To Invest In Real Estate With A Solo 401k By Brian

How To Invest In Real Estate With A Solo 401k By Brian

Cashing Out A 401k Penalty Free To Invest In Real Estate

Cashing Out A 401k Penalty Free To Invest In Real Estate

How To Invest In Real Estate With Your 401k Or Ira Ideal Rei

How To Invest In Real Estate With Your 401k Or Ira Ideal Rei

Infographic How To Use Solo 401k Funds For Real Estate

Infographic How To Use Solo 401k Funds For Real Estate

Using A 401k Withdrawal To Invest In Real Estate

Using A 401k Withdrawal To Invest In Real Estate

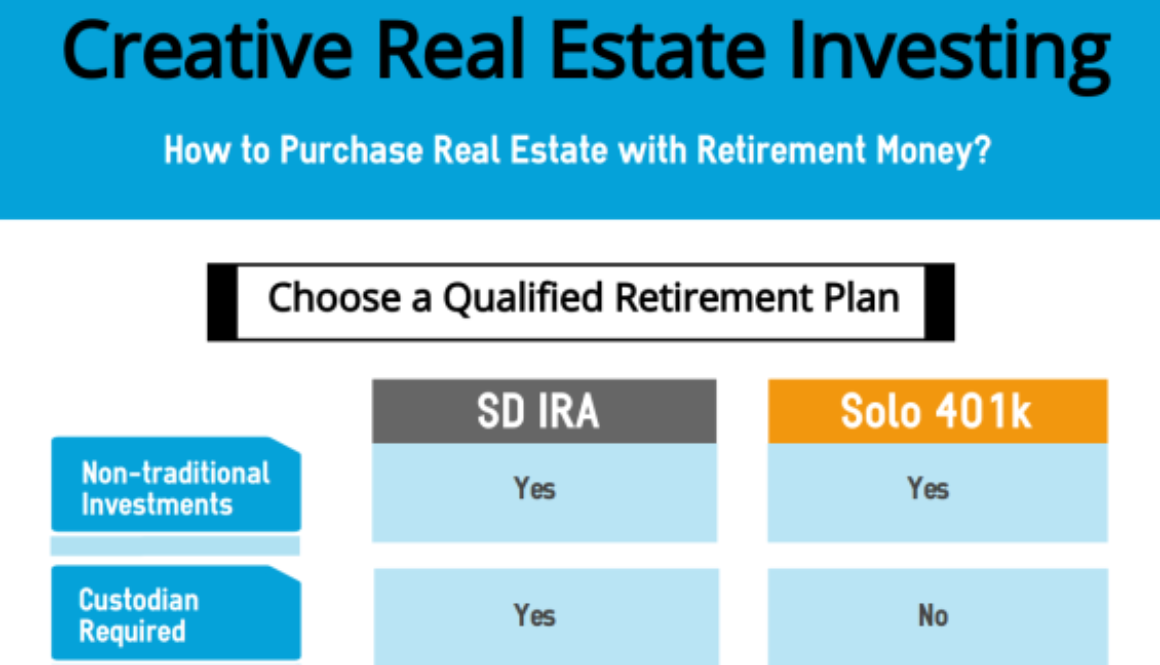

Real Estate Investing With Solo 401k And Ira Llc

Real Estate Investing With Solo 401k And Ira Llc

How To Use Your 401k To Invest In Real Estate Bodie

How To Use Your 401k To Invest In Real Estate Bodie

Download P D F How To Invest In Real Estate With Your Ira

Download P D F How To Invest In Real Estate With Your Ira

How You Ll Be Taxed Using 401k To Invest In Real Estate

How You Ll Be Taxed Using 401k To Invest In Real Estate

How To Invest In Real Estate With Your 401k Or Ira Retirement Funds

How To Invest In Real Estate With Your 401k Or Ira Retirement Funds