Can a business create an account at scottrade or edward jones and invest. Most small business owners and entrepreneurs are already focused on the day to day operations of the company and dont have time to keep an eye on the market much less execute a high number of stock trades.

:max_bytes(150000):strip_icc()/types-of-investments-in-small-business-357246_FINAL-5bbd12f946e0fb0026760e59.png) Two Types Of Investments In A Small Business

Two Types Of Investments In A Small Business

can a corporation invest in stocks

can a corporation invest in stocks is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in can a corporation invest in stocks content depends on the source site. We hope you do not use it for commercial purposes.

When you invest through these instruments a professional fund manager will make investment decisions for you such as choosing the right stocks to buy or sell.

Can a corporation invest in stocks. Thank you in advance. Your question is a bit vague like asking can all people wear nylon clothes. Tips s corporations are legally entitled to invest money in stocks or mutual funds as they see fit.

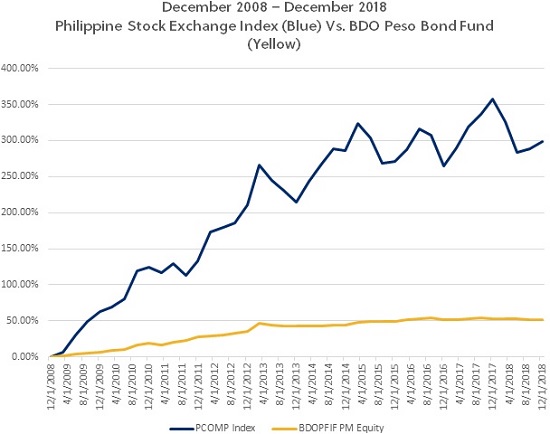

My current business entity is a s corp. If you buy a stock as an individual investor and sell it at a profit before owning it for a year youll pay taxes on the profits according to the irs schedule for individual tax filings. You can still invest in the philippine stock market through mutual funds andor variable universal life vul insurance.

Just because you can invest in stocks doesnt mean you should invest in stocks. The answer is somewhat similar to what the answer to the other question would be generally yes but companies that do hold stock are typically involved in inves. An s corporation normally can invest in stocks or mutual funds.

If i own a c corp or an s corp in the us say for example delaware and i take profits from revenue after expenses for the corporation and purchase stock in the us stock markets bonds or other investment property without selling any of those investments purchased by the time of tax filing would that reduce my corporations total tax liability. Is the profit created from this activity treated as regular business income. There are some restrictions on who can own s corporation stock and what types of stock they can issue but there are not restrictions on stock or funds that s corporations can own.

12 Investing In Stocks Stocks Shares Of Ownership In The

Differences And Definitions Of Stocks And Bonds

Differences And Definitions Of Stocks And Bonds

Chapter 16 1 C H A P T E R 16 Investments Chapter Discuss

Chapter 16 1 C H A P T E R 16 Investments Chapter Discuss

10 Investments You Can Make With Your Supplementary

10 Investments You Can Make With Your Supplementary

Setting Up An Llc For Investing Why And Where To Start

Setting Up An Llc For Investing Why And Where To Start

Can An S Corporation Invest Money In Stocks Or Mutual Funds

Can An S Corporation Invest Money In Stocks Or Mutual Funds

:max_bytes(150000):strip_icc()/the-difference-between-stocks-and-bonds-417069-final-5bbd17bd46e0fb00268fdc8c.png) Benefits Of Investing In Stocks Versus Disadvantages

Benefits Of Investing In Stocks Versus Disadvantages

How To Invest In The Stock Market Bdo Unibank Inc

How To Invest In The Stock Market Bdo Unibank Inc

Brief Consumer Mobile World Investment Corporation

Brief Consumer Mobile World Investment Corporation