When you invest for retirement you typically have three main options. The best way to invest for retirement keep it simple.

:max_bytes(150000):strip_icc()/HiRes-57c48a5a5f9b5855e5d21768.jpg) How To Choose The Best Retirement Investments For Your Portfolio

How To Choose The Best Retirement Investments For Your Portfolio

best way to invest your retirement money

best way to invest your retirement money is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in best way to invest your retirement money content depends on the source site. We hope you do not use it for commercial purposes.

He suggests that they invest the rest of their money in a.

Best way to invest your retirement money. Opening an investment account through a brokerage is the best way to put money. Your investments should change to. The best way to invest for retirement.

As such finding the right balance between risk and investment return is key to a successful retirement savings strategy. They automatically invest your money in a diversified portfolio of stocks and bonds. Saving money to fund a comfortable retirement is perhaps the biggest reason people invest.

Minnucci an early retiree and self taught investor says youll be far likelier to make your retirement money last if you take a more cautious. Money for retirement. Inflation can really shrink the value of your money over time.

3 retirement income funds. The best thing you can do before you decide where to put your retirement money is to get educated and seek professional advice. They are a type of mutual fund.

You can put the money into a retirement account thats offered by your employer such as a 401k or 403b planthese plans. You can also invest your isa allowance into peer to peer through an innovative finance isa ifisa. How to invest after you retire.

Consider your risk tolerance and time horizon when choosing how to invest your money. You can do this by reading books on investing so you understand basic investment concepts or subscribing to a respected finance magazine and reading all the articles for one year. Such a withdrawal rate is unlikely to deplete your savings over a 30 year retirement.

Retirement income funds are great for folks who arent interested in keeping regular tabs on their portfolio. Here are a few suggestions for ensuring you make the smartest possible decisions with your retirement savings. Youll shift from adding to your portfolio and gradually begin to withdraw money from it.

The funds goal is to produce monthly income. Peer to peer savings is a way of lending your money to potential borrowers for a fixed return. Clearly then its best to invest your money in retirement so that it grows at least enough to keep pace with inflation.

You add your money to a peer to peer providers platform and it is lent out to borrowers who pay it back with interest. Here is how the ifisa works.

Managing Savings And Investments Before And After Retirement

Managing Savings And Investments Before And After Retirement

How To Invest For Your Retirement Complete Guide

How To Invest For Your Retirement Complete Guide

10 Investments You Can Make With Your Supplementary

10 Investments You Can Make With Your Supplementary

How To Invest Money The Smart Way To Make Your Money Grow

How To Invest Money The Smart Way To Make Your Money Grow

Where Should You Invest Your Retirement Money Business

Where Should You Invest Your Retirement Money Business

How To Manage Your 401 K To Ensure Your Retirement Doesn T

How To Manage Your 401 K To Ensure Your Retirement Doesn T

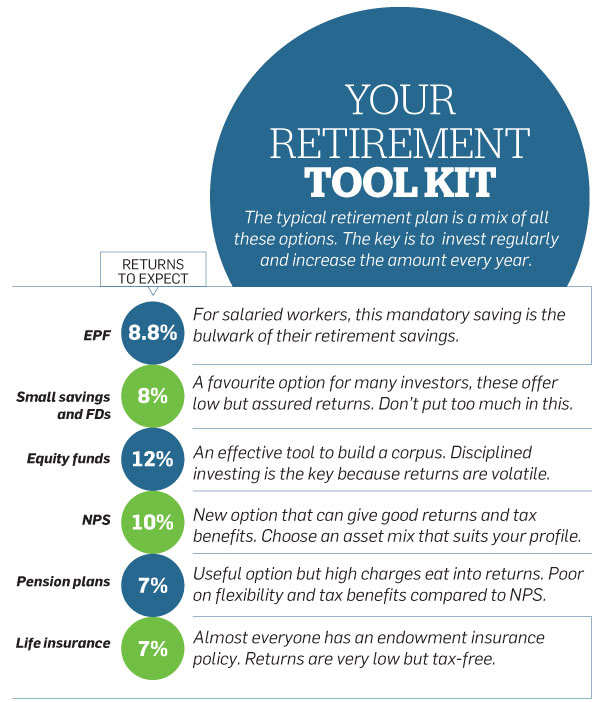

How To Save Rs 10 Crore For Retirement Without Taking Too

How To Save Rs 10 Crore For Retirement Without Taking Too

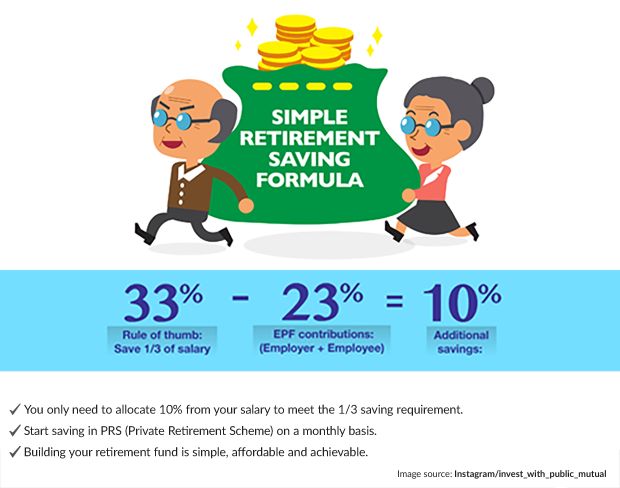

5 Most Important Rules To Halal Savings For Your Retirement

5 Most Important Rules To Halal Savings For Your Retirement

How To Start Saving For Retirement Now

How To Start Saving For Retirement Now