Read this article to learn about the difference between return on investment roi and residual income ri. Residual income is the amount of net income generated in excess of the minimum rate of return.

difference between return on investment and residual income

difference between return on investment and residual income is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in difference between return on investment and residual income content depends on the source site. We hope you do not use it for commercial purposes.

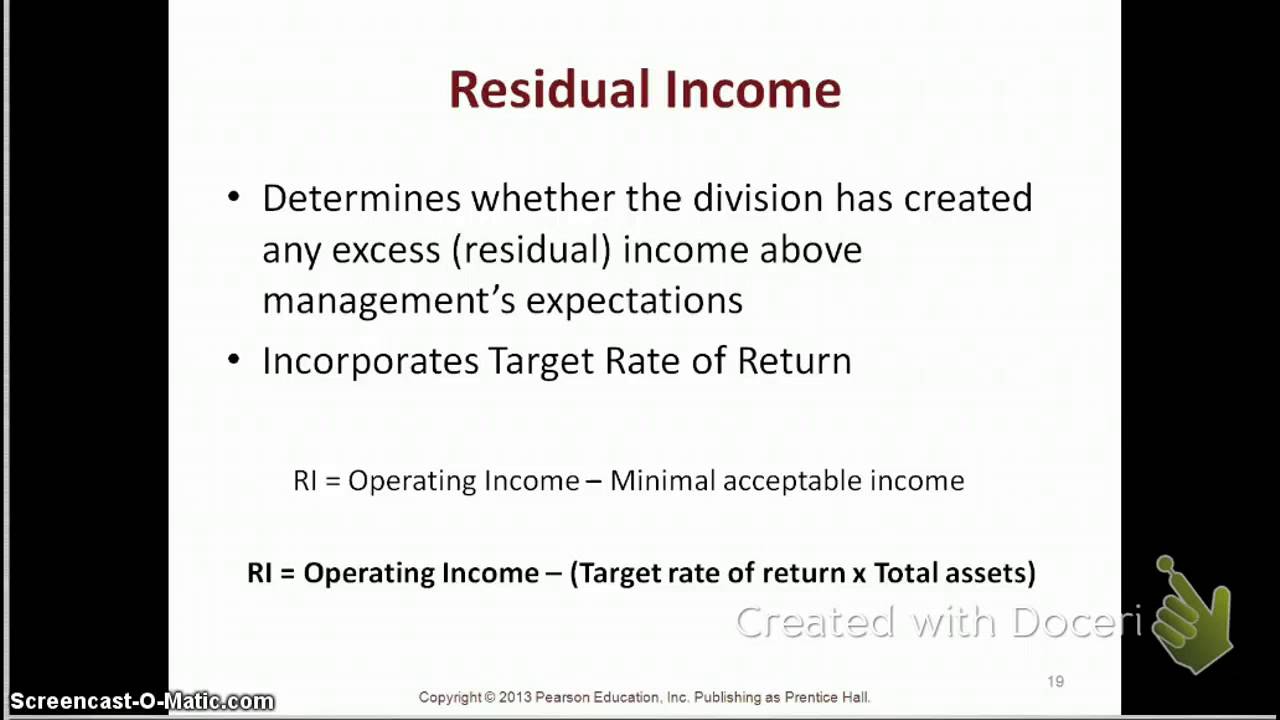

Ri is favoured for reasons of goal congruence and managerial effort.

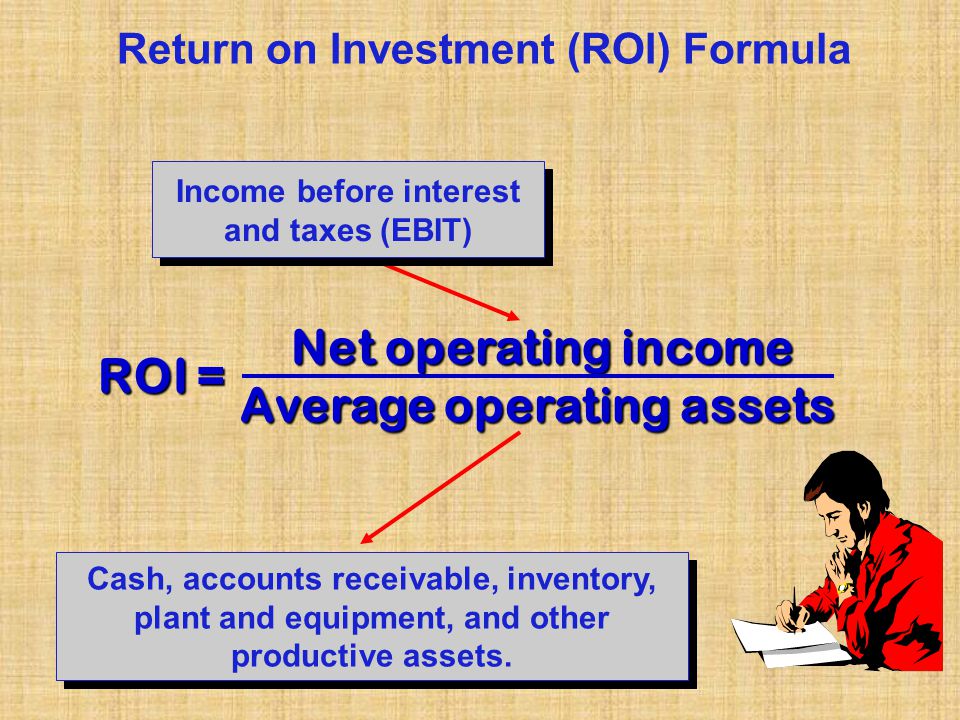

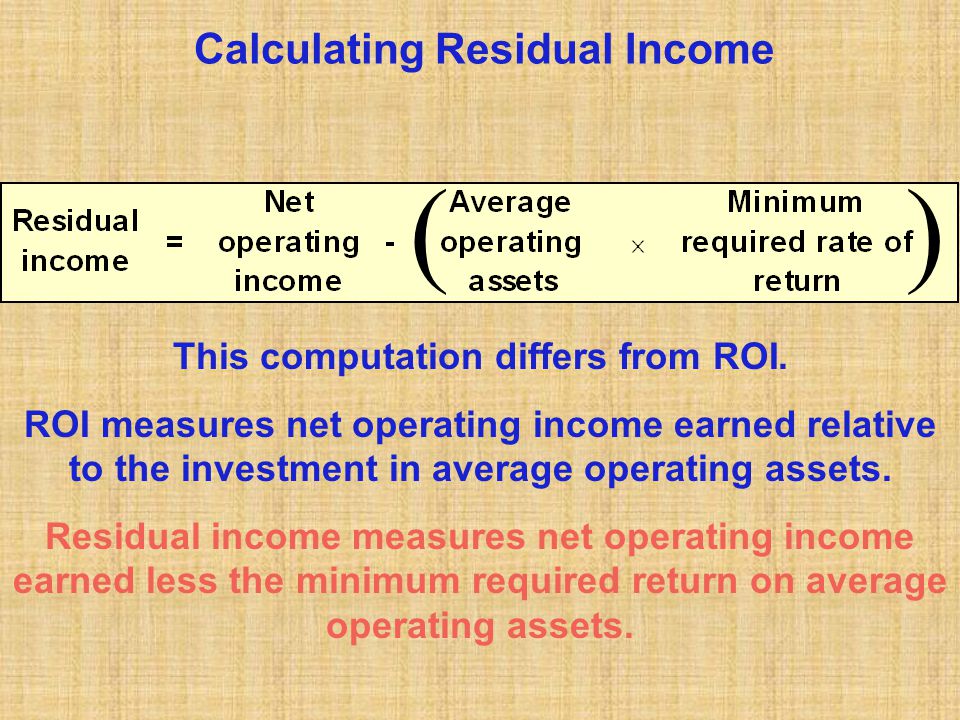

Difference between return on investment and residual income. Return on investments is a financial ratio that measures the rate of return of a companys investments. The only notable difference between residual income and eva is resulting from tax payment since residual income is calculated on net operating profit before tax whereas eva considers the profit after tax. Return on investment roi is very similar to return on capital employed roce except the focus is on controllable and traceable revenues expenses and assets.

Companies use roi to compare the efficiency of a number of investments. Summary residual income vs eva. It measures the return on the investment in assets for a business or division.

Under roi the basic objective is to maximize the rate of return percentage. Return on investment roi vs residual income ri. Whats the difference.

Return is anything what business enjoys above principal amount of investment. Eva economic value added and roi return on investment are two widely used measures for this purpose. Determine how residual income.

This video discusses the difference between roi and residual income. Income includes gain and other earnings like dividends received interest income etc. Thus managers of highly profitable.

Compare and contrast the return on investment and residual income measures of divisional performance. Return is received in many different forms like interest dividend etc but is not limited only to these two forms. However roi is expressed as a.

Return on investment roi is a measure which calculates the efficiency of an investment by calculating percentage of return earned by that investment. Where as income is not just gain from sale of asset. Residual income valuation calculation.

Residual income ri is the amount of income an investment opportunity generates above the minimum level of rate of return. It is the net operating income an investment earns. The key difference between eva and roi is that while eva is a measure to assess how effectively company assets are utilized to generate income roi calculates the return from an investment as a percentage of the original amount invested.

Residual income is another approach to measuring the performance of an investment. Residual income can be calculated by taking the difference between the companys net income and its equity charge where equity charge is the product of. Both roi and residual income are metrics frequently used to evaluate a divisions profitability.

Using Residual Income Ri To Evaluate Performance

Using Residual Income Ri To Evaluate Performance

Difference Between Roi And Ri Termscompared

Difference Between Roi And Ri Termscompared

Acct 2302 Fundamentals Of Accounting Ii Spring 2011 Lecture

Acct 2302 Fundamentals Of Accounting Ii Spring 2011 Lecture

Decentralized Performance Evaluation Ppt Download

Decentralized Performance Evaluation Ppt Download

Residual Income Definition And How Its Work

Residual Income Definition And How Its Work

10 1 Decentralization Responsibility Accounting

10 1 Decentralization Responsibility Accounting

Roi Residual Income And Economic Value Added Ppt Video

Roi Residual Income And Economic Value Added Ppt Video

Roi Residual Income And Economic Value Added Ppt Video

Roi Residual Income And Economic Value Added Ppt Video

Definitions Of Return To Capital Measures Download Table

Definitions Of Return To Capital Measures Download Table

Management Accounting Chapter 14

Management Accounting Chapter 14