Foreign portfolio investment. The real difference between the two is that while fdi aims to take control of the company in which investment is made fpi aims to reap profits by investing in shares and bonds of the invested entity without controlling the company.

Foreign Portfolio Investments In India

Foreign Portfolio Investments In India

foreign portfolio investment in india means

foreign portfolio investment in india means is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in foreign portfolio investment in india means content depends on the source site. We hope you do not use it for commercial purposes.

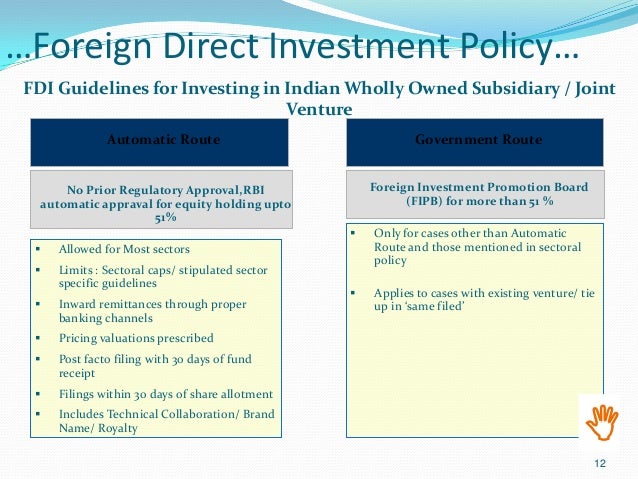

Foreign investment means any investment made by a person resident outside india on a repatriable basis in capital instruments of an indian company or to the capital of an llp.

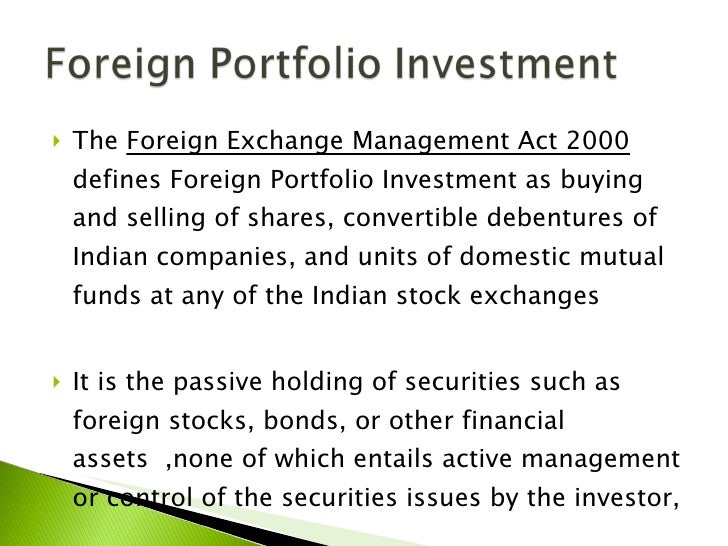

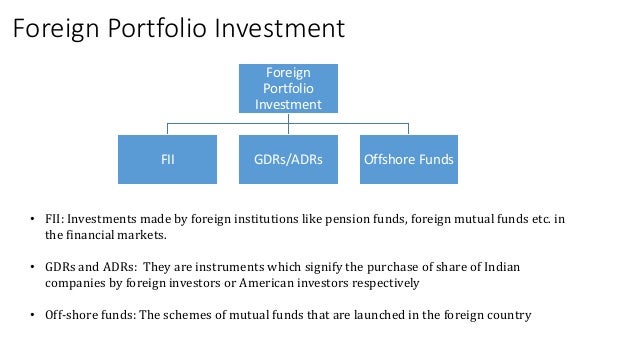

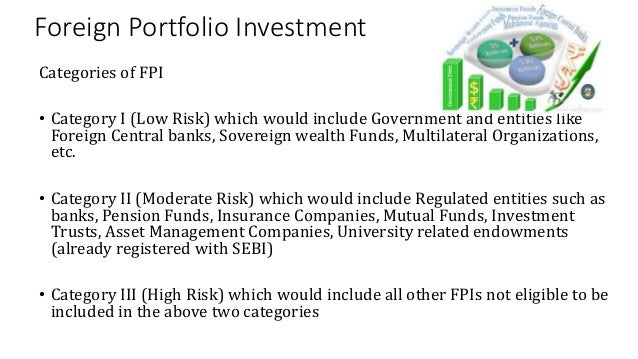

Foreign portfolio investment in india means. Foreign direct investment. The term fpi was defined to align the nomenclature of categorizing investments of foreign investors in line with international practice. Foreign direct investment fdi and foreign portfolio investment fpi are the two important forms of foreign capital.

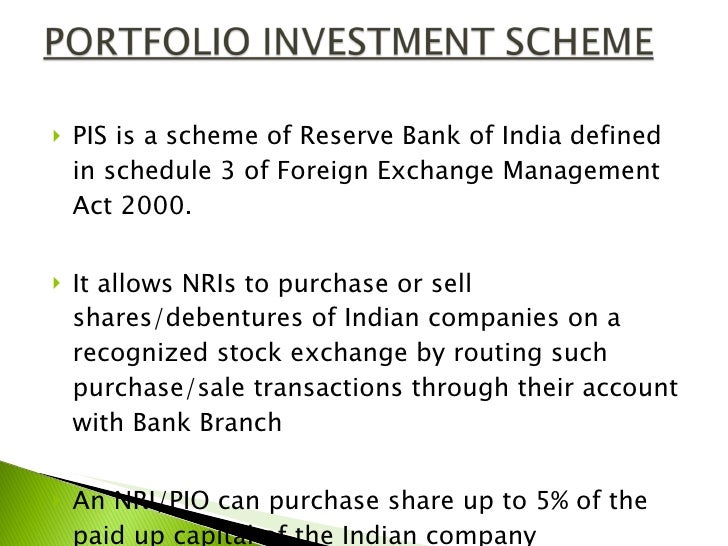

Foreign portfolio investment fpi consists of securities and other financial assets held by investors in another country. The investment may be made either inorganically by buying a company in. Foreign portfolio investment fpi is investment by non residents in indian securities including shares government bonds corporate bonds convertible securities infrastructure securities etc.

A foreign direct investment fdi is an investment in the form of a controlling ownership in a business in one country by an entity based in another country. Acquiring a controlling interest in an existing foreign company or by means of a merger or joint venture with a foreign company. It is thus distinguished from a foreign portfolio investment by a notion of direct control.

It does not provide the investor with direct ownership of a companys. In india the term foreign portfolio investor refers to fiis or their sub accounts or qualified foreign investors qfis who are permitted to hold upto 10 stake in a company. The class of investors who make investment in these securities are known as foreign portfolio investors.

In economics foreign portfolio investment is the entry of funds into a country where foreigners deposit money in a countrys bank or make purchases in the countrys stock and bond markets sometimes. What is meant by foreign investment foreign direct investment and foreign portfolio investment. A foreign portfolio investment is a grouping of assets such as stocks bonds and cash equivalentsportfolio investments are held directly by an investor or managed by financial professionals.

The origin of the investment does not impact the definition as an fdi.

Foreign Portfolio Investments In India

Foreign Portfolio Investments In India

Foreign Portfolio Investments In India

Foreign Portfolio Investments In India

Foreign Portfolio Investments In India

Foreign Portfolio Investments In India

Fdi Vs Fpi In Hindi Foreign Direct Foreign Portfolio Investment Concept Difference Ppt

Fdi Vs Fpi In Hindi Foreign Direct Foreign Portfolio Investment Concept Difference Ppt

Foreign Portfolio Investment Fpi Wikiias

What Is The Fpi Foreign Portfolio Investment Policy In India

What Is The Fpi Foreign Portfolio Investment Policy In India

Foreign Direct Investment Wikipedia

Foreign Direct Investment Wikipedia

Foreign Portfolio Investments The Backbone Of Indian Economy

Foreign Portfolio Investments The Backbone Of Indian Economy