Foreign direct investment fdi flows record the value of cross border transactions related to direct investment during a given period of time usually a quarter or a year with the objective of obtaining a lasting interest in an enterprise resident in another economy. Table 84 gives a clear picture about the actual inflows and approvals of fdi in india since 1991 92.

Foreign Invesments In India Slow Down To A Decade S Low

Foreign Invesments In India Slow Down To A Decade S Low

foreign investment flows into and out of india

foreign investment flows into and out of india is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in foreign investment flows into and out of india content depends on the source site. We hope you do not use it for commercial purposes.

Economic reforms introduced in india since 1991 has resulted in an acceleration in the flow of foreign investment into the country.

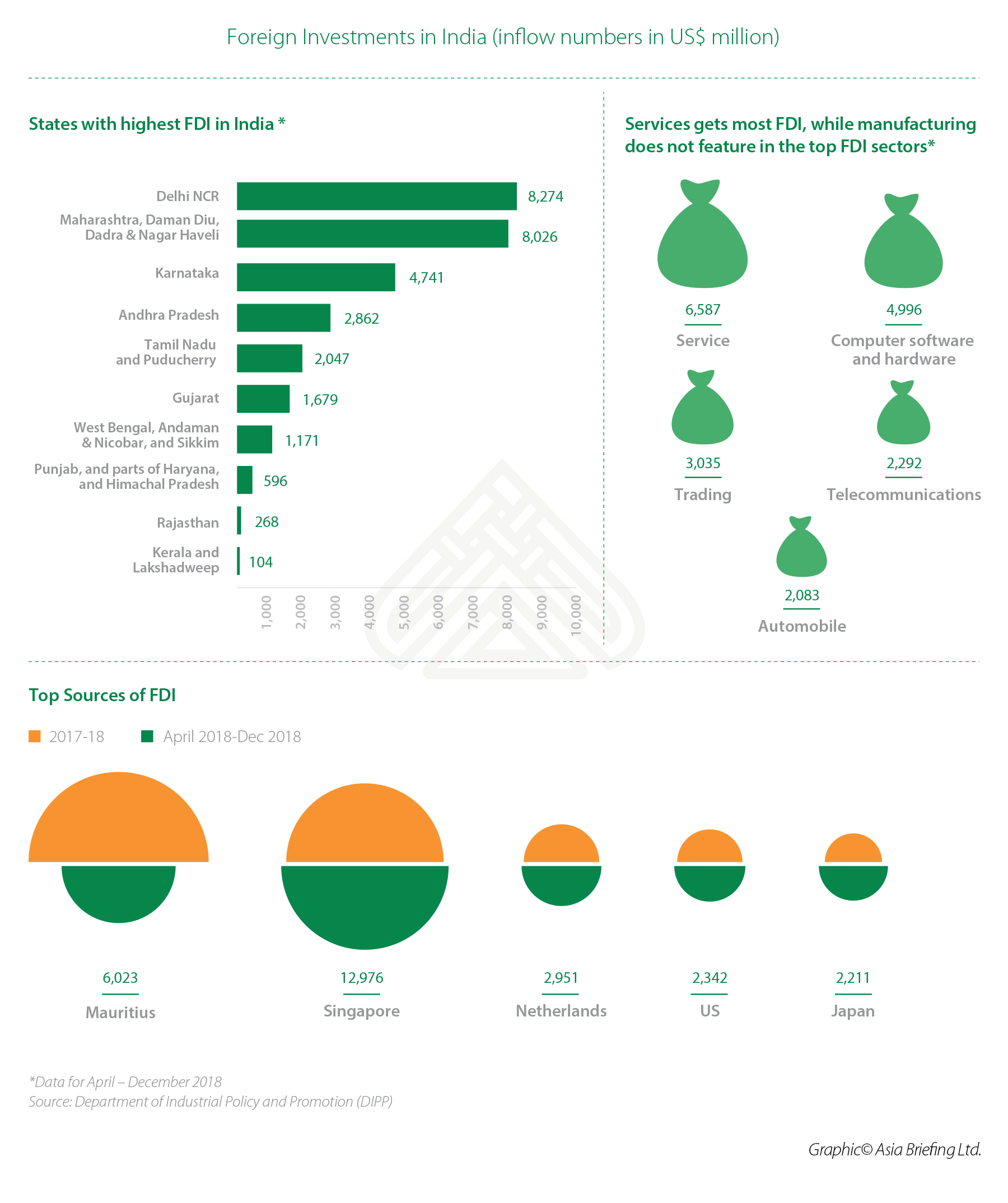

Foreign investment flows into and out of india. Foreign companies invest in india to take advantage of relatively lower wages special investment privileges such as tax exemptions etc. The investment climate in india has improved considerably since the opening up of the economy in 1991. This is largely attributed to ease in fdi norms across sectors of the economy.

Investment made by an investment vehicle into an indian company or an llp will be indirect foreign investment for the investee company or the llp as the case may be if either the sponsor or the manager or the investment manager i is not owned and not controlled by resident indian citizens or ii is owned or controlled by persons resident outside india. Foreign direct investment flows to india1 fdi inflows to india remained sluggish when global fdi flows to emes had recovered in 2010 11 despite sound domestic economic performance ahead of global recovery. Accordingly india has been experiencing a continuous flow of foreign direct investment fdi in recent years.

Foreign companies invest directly in fast growing private indian businesses to take benefits of cheaper wages and changing business environment of india. With an aim to attract and promote fdi government of india goi has put in place a policy framework on fdi which is transparent predictable and easily comprehensible. Apart from being a critical driver of economic growth foreign direct investment fdi is a major source of non debt financial resource for the economic development of india.

The paper gathers evidence through a panel exercise that actual fdi to india during the year 2010 11 fell short of. Foreign direct investment in india is expected to be 360000 usd million by the end of this quarter according to trading economics global macro models and analysts expectations. Foreign direct investment fdi in india is a major monetary source for economic development in india.

Looking forward we estimate foreign direct investment in india to stand at 280000 in 12 months time.

Foreign Invesments In India Slow Down To A Decade S Low

Foreign Invesments In India Slow Down To A Decade S Low

Foreign Invesments In India Slow Down To A Decade S Low

Foreign Invesments In India Slow Down To A Decade S Low

Flow Of Foreign Direct Investment Fdi In India

Top 10 Sectors Attracting Highest Foreign Direct Investments

Reserve Bank Of India Database

Reserve Bank Of India Database

Reserve Bank Of India Database

Reserve Bank Of India Database

Fdi In India Performance And Overview In Fy 2019 India

Fdi In India Performance And Overview In Fy 2019 India

Southeast Asia Bucks Trend Of Sinking Global Foreign Investment

Southeast Asia Bucks Trend Of Sinking Global Foreign Investment

Large Fall In Eu Foreign Direct Investment Flows In 2017

The 2019 Foreign Direct Investment Confidence Index Kearney

The 2019 Foreign Direct Investment Confidence Index Kearney

Foreign Direct Investment Economic And Financial

Foreign Direct Investment Economic And Financial