In economics foreign portfolio investment is the entry of funds into a country where foreigners deposit money in a countrys bank or make purchases in the countrys stock and bond markets sometimes. Meaning and concept of fpi foreign portfolio investment in hindi 3.

Foreign Portfolio Investments In India

Foreign Portfolio Investments In India

example of foreign portfolio investment in india

example of foreign portfolio investment in india is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in example of foreign portfolio investment in india content depends on the source site. We hope you do not use it for commercial purposes.

The entire funds of the business can be from foreign direct investment.

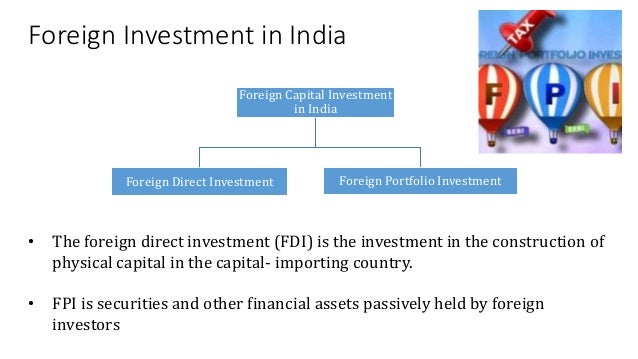

Example of foreign portfolio investment in india. Some industries allow 100 fdi ie. A foreign direct investment fdi is an investment in the form of a controlling ownership in a business in one country by an entity based in another country. Foreign direct investment in india does not have a uniform rate.

Forcing the reserve bank of india to step in and defend the currency. The percentages vary from 26 to 49 to 51. Difference between fdi fpi ie.

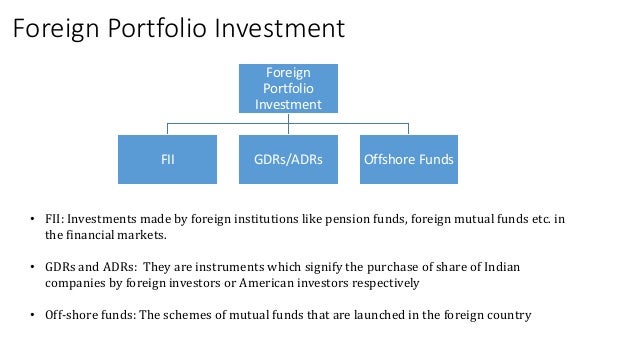

Foreign direct investment and foreign portfolio investment. Foreign portfolio investment fpi is investment by non residents in indian securities including shares government bonds corporate bonds convertible securities infrastructure securities etc. While the latter is an example of portfolio investment.

It is thus distinguished from a foreign portfolio investment by a notion of direct control. Foreign portfolio investment. Learn what a foreign investment is and some common examples that you can relate with.

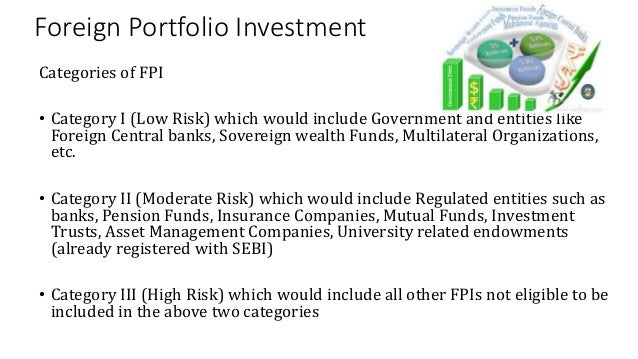

In order to harmonize the various available routes for foreign portfolio investment in india the indian securities market regulator ie. The class of investors who make investment in these securities are known as foreign portfolio investors. More than 600 new investment funds registered with the securities and exchange board of india.

In this route there is no investment without the prior approval of the government of india. Foreign direct investment briefly called or fdi is a form of investment that involves the inoculation of foreign funds into an enterprise that operates in a different country of origin from the financier. A foreign portfolio investment is a grouping of assets such as stocks bonds and cash equivalentsportfolio investments are held directly by an investor or managed by financial professionals.

Foreign direct investment and foreign portfolio investment in tabular form. Securities exchange board of india sebi has introduced a new class of foreign investors in india known as the foreign portfolio investors fpis. Example of foreign portfolio investment fpi the year 2018 was a good one for india in terms of fpi.

Find out about the different types of foreign investments and why companies and individuals invest in foreign. Foreign direct investment is vital part of an open and real international.

Foreign Portfolio Investments In India

Foreign Portfolio Investments In India

Foreign Portfolio Investments In India

Foreign Portfolio Investments In India

Budget 2019 A Red Carpet For Foreign Investors

Budget 2019 A Red Carpet For Foreign Investors

Fdi Vs Fpi In Hindi Foreign Direct Foreign Portfolio Investment Concept Difference Ppt

Fdi Vs Fpi In Hindi Foreign Direct Foreign Portfolio Investment Concept Difference Ppt

:max_bytes(150000):strip_icc()/foreign-direct-investment-fdi-pros-cons-and-importance-3306283-final-5bd08ad3c9e77c0051e61787.png) Foreign Direct Investment Definition Example Pros Cons

Foreign Direct Investment Definition Example Pros Cons

Foreign Portfolio Investment In India

Foreign Portfolio Investment In India

Foreign Portfolio Investments In India

Foreign Portfolio Investments In India

Foreign Portfolio Investments In India

Foreign Portfolio Investments In India

Foreign Portfolio Investment In India

Foreign Portfolio Investment In India

Chapter 2 The Investment Story An India Economic Strategy

Chapter 2 The Investment Story An India Economic Strategy