Professional management mutual funds typically have professional managers choosing where to invest your money. You can hold investments such as stocks bonds cash and yes.

Investing In Index Funds For Beginners

Investing In Index Funds For Beginners

can you invest in mutual funds without an ira

can you invest in mutual funds without an ira is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in can you invest in mutual funds without an ira content depends on the source site. We hope you do not use it for commercial purposes.

Ira financials adam bergman discusses whether or not you can invest in art or other collectibles with an ira.

Can you invest in mutual funds without an ira. A wide selection of exchange traded funds etfs and mutual funds that invest in bonds and equities with different. When an investor buys a mutual fund they contribute to a pool of money to be managed by a team of investment professionals. Here are the basics of investing in a mutual fund or your ira.

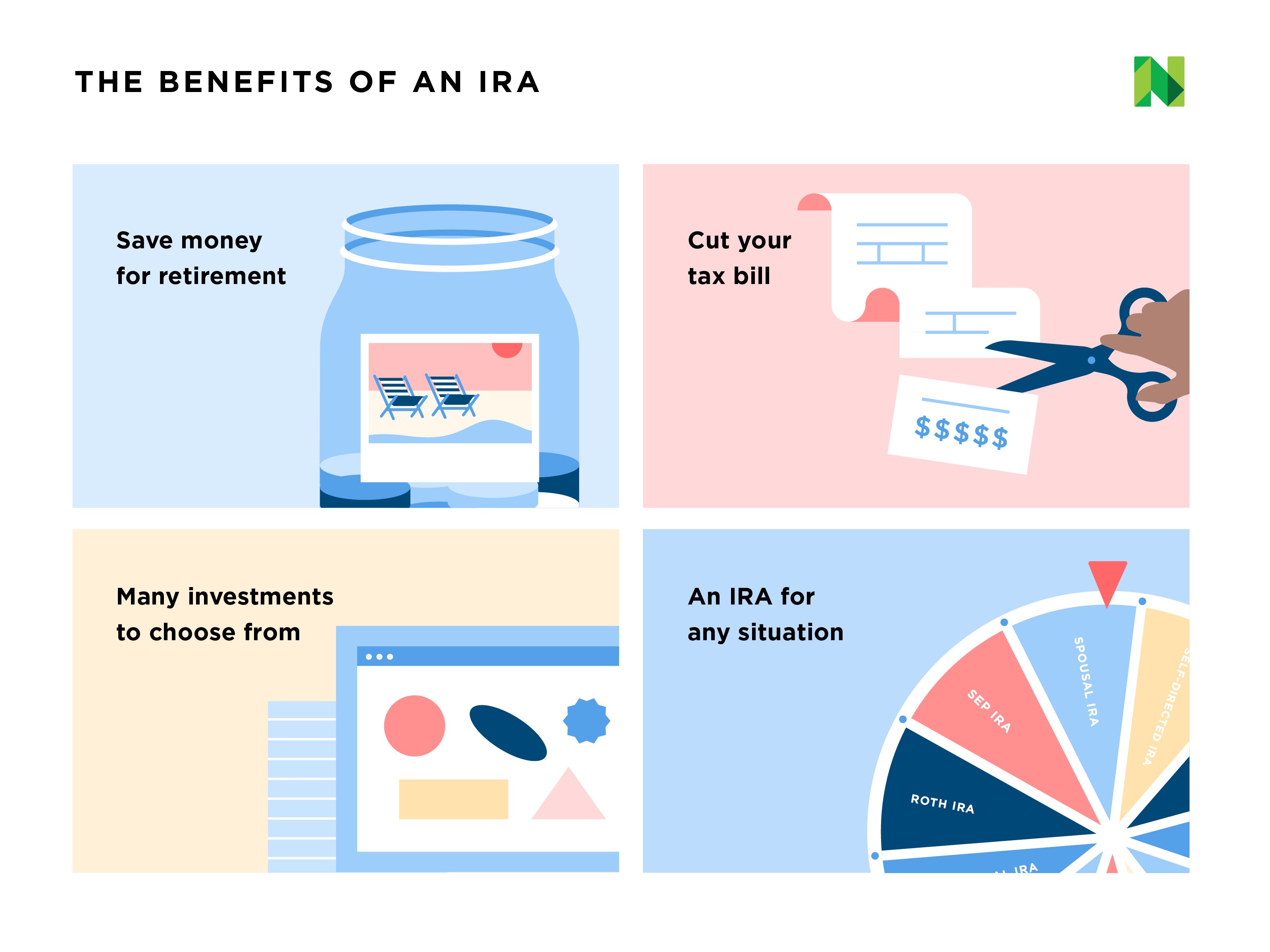

You can invest in stocks bonds mutual funds commodities certificates of deposit you name it. Can i invest in mutual funds without putting money into an ira or 401k. I would call it a savings account on steroids.

A roth ira is a type of account. Ira investment options are virtually limitless. You can buy and sell shares at any time during the day at.

Sep ira account right for you. There are several differences between a roth ira and a mutual fund such as the fact that unlike a mutual fund a roth ira is not a type of investment. Are there minimum initial amounts required.

Vanguard mutual funds and exchange. If you invested in mutual funds inside of a retirement account like an ira or 401k you may be charged an early withdrawal penalty if you are under the age of 59 and a half. Can you withdraw money from mutual funds without penalty.

Mutual funds make a great tool to use for those that are investing for retirement. With an ira you have nothing but your initial cash contribution sitting in an account likely a money market fund until you decide how to invest it. Before we look at how to invest in mutual funds lets define what a mutual fund is.

You dont have to pay any tax on your investment. The law does not permit ira funds to be invested in life insurance or collectibles. Mutual funds are bought and sold at their net asset value or nav which is calculated at the end of the dayetfs trade just like stocks.

Mutual fund ira investing can provide you with a steady source of growth for your retirement funds. If you invest your ira in collectibles the amount invested is considered distributed in the year invested and you may have to pay a 10 additional tax on early distributions. An individual retirement account provides a tax shield for any investments you put into it.

This question cant really be directly answered because its comparing an apple to an orange. I want it to be fairly liquid and not have to deal with penalties for early withdrawl etc. Ira investing an individual.

The tax consequences of mutual funds not in an ira. Would one of the big firms out there like ameritrade handle this.

How And Where To Open An Ira Nerdwallet

How And Where To Open An Ira Nerdwallet

How To Invest In Mutual Funds A Step By Step Guide Nerdwallet

How To Invest In Mutual Funds A Step By Step Guide Nerdwallet

What Is An Index Fund Definition How Funds Work The

What Is An Index Fund Definition How Funds Work The

/cdn.vox-cdn.com/uploads/chorus_image/image/45636392/7408506410_fbd7bc0fcd_k.0.0.jpg) How To Pick A Mutual Fund Without Getting Ripped Off Vox

How To Pick A Mutual Fund Without Getting Ripped Off Vox

:max_bytes(150000):strip_icc()/roth-ira-v-mutual-funds-59cbcb8ad963ac0011ee1cec.jpg) Top Tips For Picking A Winning Mutual Fund

Top Tips For Picking A Winning Mutual Fund

The Tax Consequences Of Mutual Funds Not In An Ira Finance

The Tax Consequences Of Mutual Funds Not In An Ira Finance

/How-To-Invest-in-Mutual-Funds-for-Beginners-583b4a9c5f9b58d5b1f525e7.jpg) How To Buy Shares Of A Mutual Fund

How To Buy Shares Of A Mutual Fund

:max_bytes(150000):strip_icc()/analyzing-data--629202004-7cd722bd7f084be28f25792b872bdf18.jpg) Can You Become Rich Investing In Mutual Funds

Can You Become Rich Investing In Mutual Funds

Hsa Investment Advice Should You Spend Or Invest Your Hsa

Hsa Investment Advice Should You Spend Or Invest Your Hsa

:max_bytes(150000):strip_icc()/MutualFund2-0ca2ba12fdc4424cb0e4155bf9ef3c25.png)

/MutualFund2-0ca2ba12fdc4424cb0e4155bf9ef3c25.png)