Purchase or sale of government securities regulates the money that banks can lend. A government investment in businesses guaranteeing repayment.

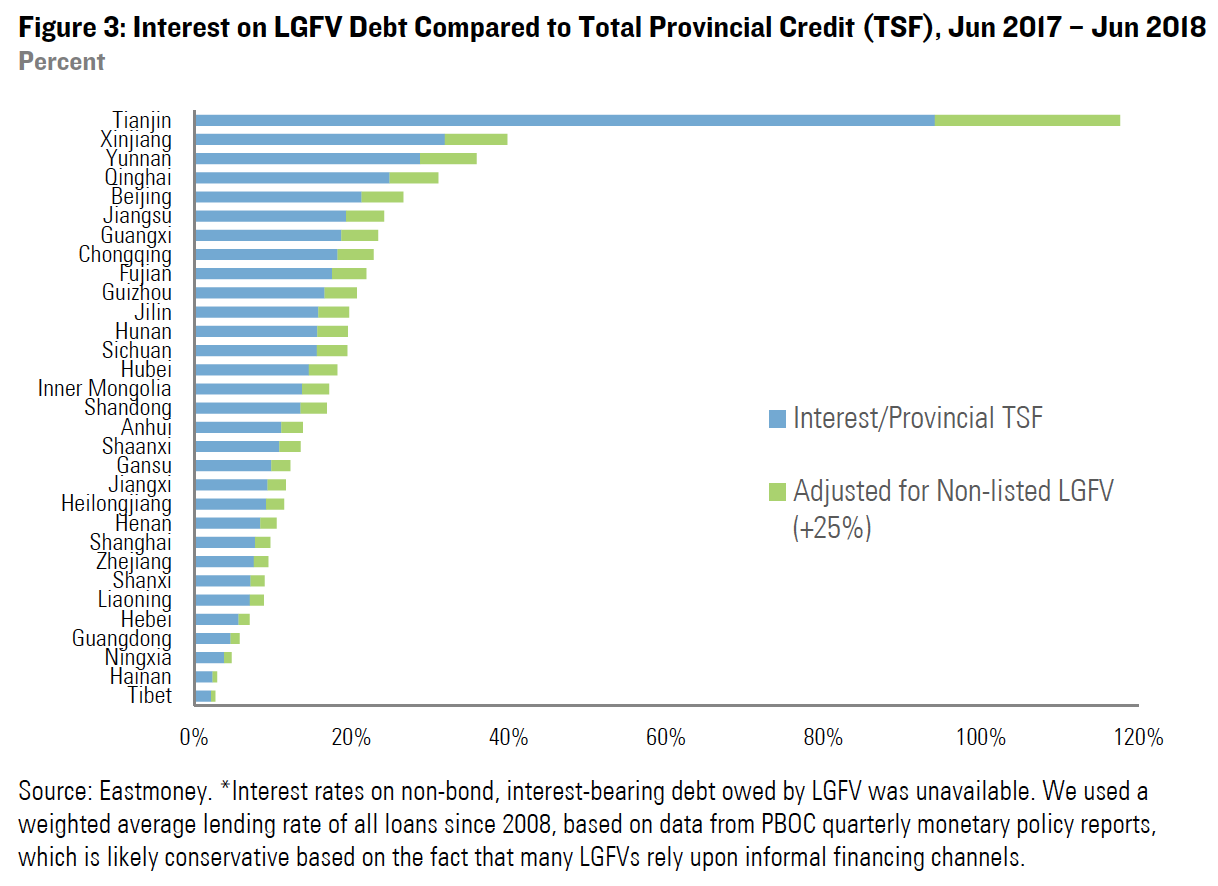

Credit Risk Shifts To Lgfvs Rhodium Group

Credit Risk Shifts To Lgfvs Rhodium Group

a government investment in businesses guaranteeing repayment

a government investment in businesses guaranteeing repayment is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in a government investment in businesses guaranteeing repayment content depends on the source site. We hope you do not use it for commercial purposes.

The australian government financially supports many small businesses and startups each year.

A government investment in businesses guaranteeing repayment. The cosigner is a person who would be guaranteeing the loan repayment if you were to default. The yukon venture loan guarantee program is a partnership between the government of yukon and participating financial institutions to encourage commercial lenders to invest in local businesses by guaranteeing a portion of the loan. No other resource exists that is as dynamic and beneficial to the small business owner as the sba.

There are hundreds of grants available at any given time worth billions of dollars in total each with. Wiki user april 15. Obviously a decent credit report is important and you will have to follow the guidelines regarding the repayment period and the interest rate set by the government but usually the interest rates charged by government loans are lower than those you could expect in the private sector.

The small business administration sba is an agency of the federal government that provides loans counseling and procurement opportunities with the federal government. The sba helps americans start build and grow businesses. Group of cooperating companies has control of the supply of the product.

Purchase or sale of government securities to increase or decrease amount of money banks can land. The sba does not offer loans to certain types of businesses such as insurance companies and real estate investors. For a full view see the sbas ineligible businesses list.

The sba reduces risk to lenders by guaranteeing major portions of loans made to small businesses. Some businesses have stricter guidelines. That is not the case with government small business loans.

A government investment and businesses guaranteeing repayment. Government business loans vs. 7a loan guaranty program the 7a loan guaranty program is the sbas primary loan program.

Though government business loans are similar to traditional bank loans in many ways there are some differences. A government invest in businesses guarantee repayment. This enables the lenders to provide financing to small businesses when funding is otherwise unavailable on reasonable terms.

A government investment in businesses guaranteeing repayment. Government board of directors individual worker. A government investment in businesses guaranteeing repayment government securities purchase or sale of government securities increasing or decreasing amount of money banks lend.

1 Describe How A Firm S Characteristics Affect Its Available

1 Describe How A Firm S Characteristics Affect Its Available

Bank Guarantee What Is It Example Feature Types Limit

Bank Guarantee What Is It Example Feature Types Limit

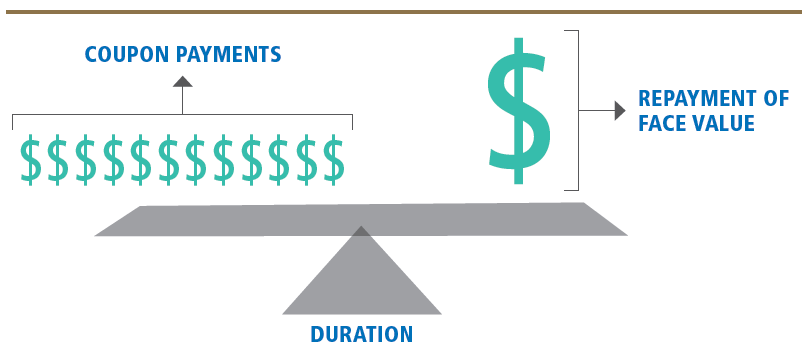

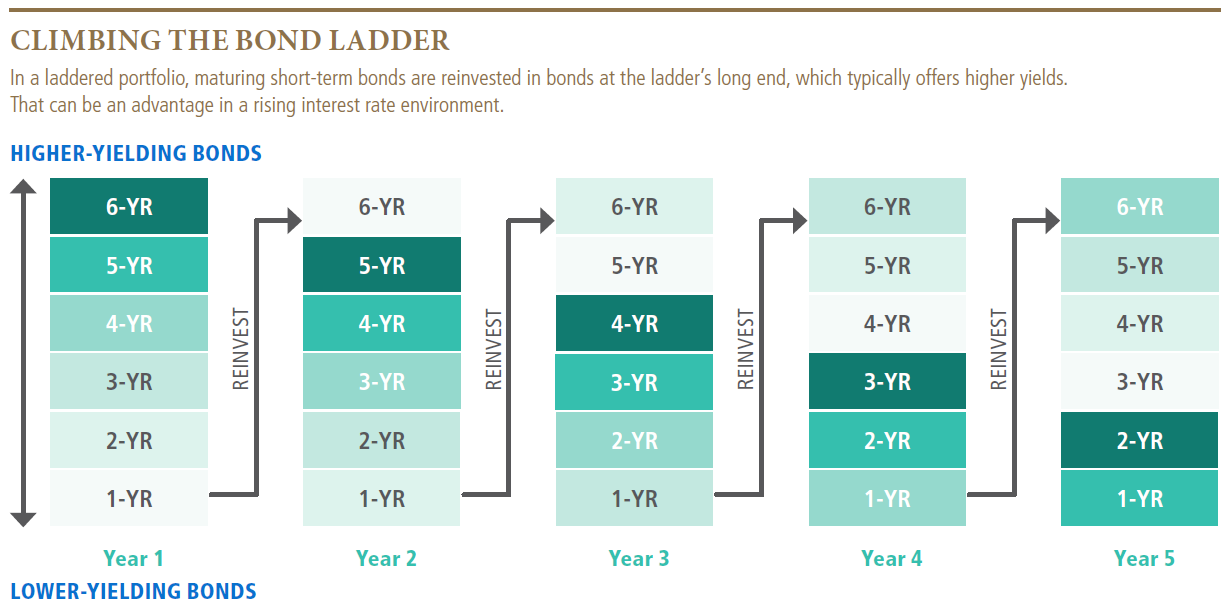

Singapore Corporate Retail Bonds A Simple Guide 2018

Singapore Corporate Retail Bonds A Simple Guide 2018

Your Passive Income Singapore Guide 5 Ideas How To Earn

Your Passive Income Singapore Guide 5 Ideas How To Earn

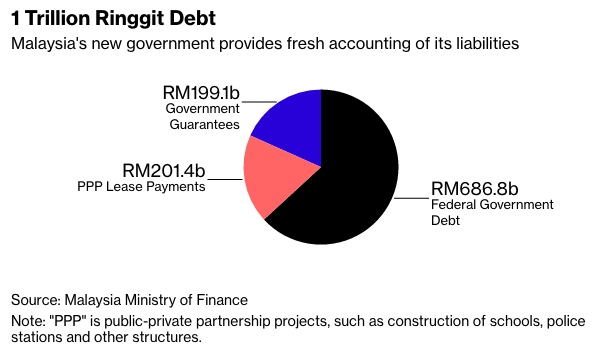

Would Toll Charges Be Abolished If Malaysia S Debts Are Only

Would Toll Charges Be Abolished If Malaysia S Debts Are Only

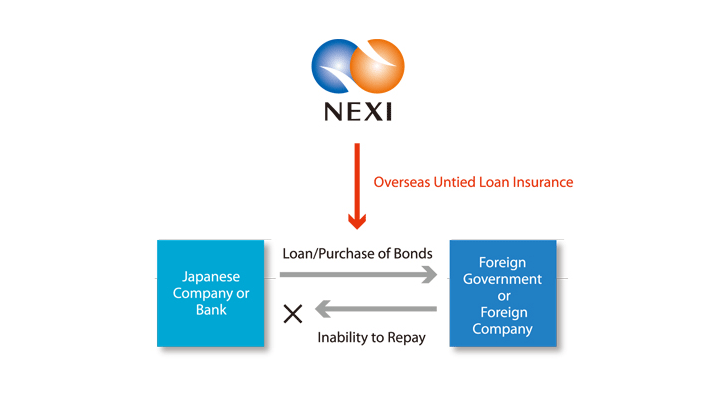

Overseas Untied Loan Insurance Our Products Services

Overseas Untied Loan Insurance Our Products Services

Understanding Real Estate Investment Trusts Reits

Understanding Real Estate Investment Trusts Reits

Retail Investor Org Investment Risks Investor Education