For example we should sale out our new shares borrowing from a bank or taking credit from the suppliers. Separation of investing and financing decisions we have already seen that there are a lot of differences that arise between what we have learned in accounting and how we use it in corporate finance.

difference between investment decision and financing decision

difference between investment decision and financing decision is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in difference between investment decision and financing decision content depends on the source site. We hope you do not use it for commercial purposes.

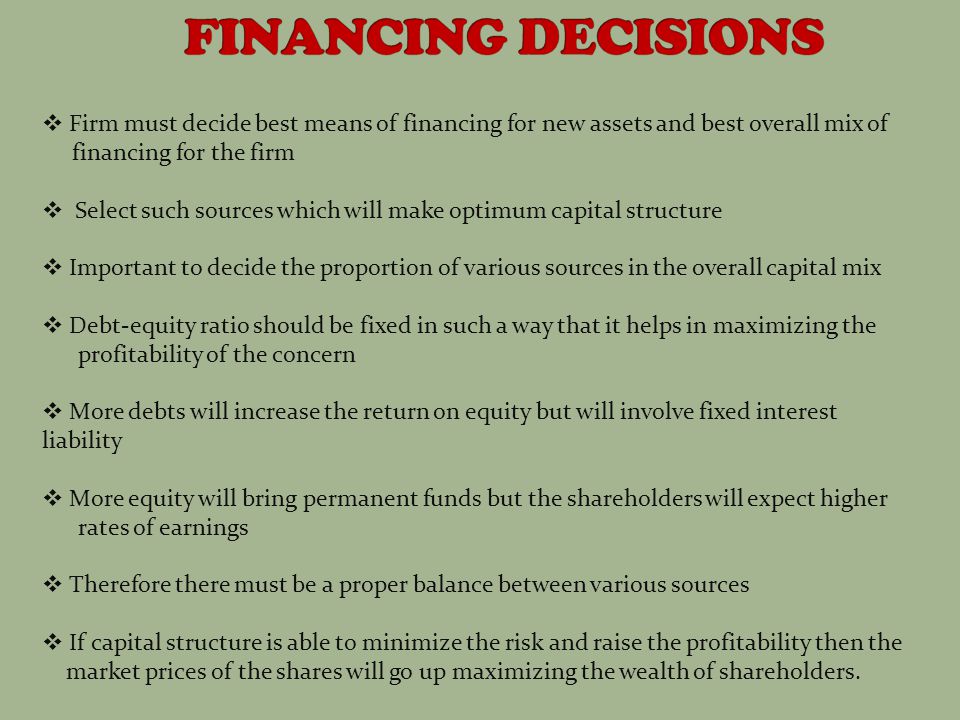

The financing decision is yet another crucial decision made by the financial manager relating to the financing mix of an organization.

Difference between investment decision and financing decision. Hurdle rate that is the minimum rate of return you can accept to generate from a long term investment is commonly used to account for the cost of capital and the underlying risk premium. Since firms regularly make new investments. The financing decision involves the sources of funds which are needed for the business investment.

Hence a firm will be continuously planning for new financial needs. It is concerned with the borrowing and allocation of funds required for the investment decisions. An investment decision revolves around spending capital on assets that will yield the highest return for the company over a desired time period.

In other words the decision is about what to buy so that the company will gain the most value. To do so the company needs to find a balance between its short term and long term goals. While in the investment decision the funds acquired are.

Capital budgeting and financing decisions are dependent on the levels of returns and borrowing costs respectively. Once the requirement of funds has been estimated the next important step is to determine the sources of finance. The separation of financing and investing decisions is one such important concept.

The manager should try to maintain a balance between debt and equity so as to ensure minimized risk and maximum profitability to business. The needs for financing and financial decisions are ongoing. We choose among different resources to acquire funds from them.

Once the firm has taken the investment decision and committed itself to new investment it must decide the best means of financing these commitments. N the context of corporate finance the main point of discussion is always financing decisions versus investment decisionsthe ones who take the important decisions in a corporate entity have to choose between giving priority to either the financing decisions or the investment decisions. The difference is that the investment decision results in out go of cash financing decisions results into in flow of cash and distributions decisions involves both but not direct as cash is used to set up distribution channels and networks.

Chapter 14 Corporate Financing Decisions And Market

Chapter 14 Corporate Financing Decisions And Market

Introduction To Corporate Finance Ppt Download

Introduction To Corporate Finance Ppt Download

1 Introduction To Corporate Finance

1 Introduction To Corporate Finance

Topics 1 Financial Decisions Investment Decisions And

Topics 1 Financial Decisions Investment Decisions And

The Financial Manager And The Firm Wollongong Uni Student

Pdf The Causal Relationship Between Financial Decisions And

Pdf The Causal Relationship Between Financial Decisions And

Copyright C 2003 Mcgraw Hill Ryerson Limited 12 1 Prepared

Copyright C 2003 Mcgraw Hill Ryerson Limited 12 1 Prepared

Introduction To Corporate Finance Ppt Download

Introduction To Corporate Finance Ppt Download

Topics 1 Financial Decisions Investment Decisions And

Topics 1 Financial Decisions Investment Decisions And

Drivers Of Differences Between Crowdfunding And Traditional

Drivers Of Differences Between Crowdfunding And Traditional