Here are 10 facts that taxpayers should know about capital gains and losses. Capital gains rules for investment property.

How To Assess A Real Estate Investment Trust Reit

capital gains on investment property 2017

capital gains on investment property 2017 is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in capital gains on investment property 2017 content depends on the source site. We hope you do not use it for commercial purposes.

Selling rental property could result in a significant tax bite depending on the profit you realize from the salefor a married couple filing jointly with a taxable income of 480000 and capital.

Capital gains on investment property 2017. The capital gains tax rate. What you need to know for 2017 heres how your capital gains tax rates may be changing for 2017 and how to prepare. Capital gain is the taxable profit resulting from the sale of many types of investments including investment property.

Selling your rental property. Even if you acquired the property before cgt started you can still make a capital gain or loss from some capital improvements made since that date. You may make a capital gain or loss when you sell or otherwise dispose of a rental property unless you acquired it before cgt started on 20 september 1985.

Selling assets such as real estate shares or managed fund investments is the most common way to make a capital gain or a capital loss. It relies on the fact that money you lose on an investment can offset your capital gains on other investments. Using the capital gains tax calculator.

Irs tax tip 2017 18 february 22 2017 when a person sells a capital asset the sale normally results in a capital gain or loss. When you make a profit in any business the government takes a share of the gains you make by charging you with tax. Capital gains are classified as short term if you hold the property for less than one year and long term if you hold for a year or more.

Capital gains tax cgt is the tax you pay on a capital gain. The capital gains tax estimator provides an indication of the amount of capital gains tax you may be required to pay on an investment property. Under the new capital gains tax legislation which came into effect on the 30th of september 1999 it is possible for an individual to calculate the cgt they will have to pay in one of two ways.

About the capital gains tax estimator. Capital gains as a formula is your sales price minus sales costs original purchase price and the cost of capital improvements plus depreciation you have previously claimed on the property. A capital asset includes inherited property or property someone owns for personal use or as an investment.

It is not a separate tax just part of your income tax. The same goes with property investments when you record a profit or gain after selling your investment property you are expected to paying your share of capital gains tax. Tax loss harvesting is a way to avoid paying capital gains taxes.

By selling unprofitable investments you can offset the capital gains that you realized from selling the profitable ones.

12 Ways To Beat Capital Gains Tax In The Age Of Trump

12 Ways To Beat Capital Gains Tax In The Age Of Trump

Frasers Logistics Trust Investor Relations

Frasers Logistics Trust Investor Relations

:max_bytes(150000):strip_icc()/Exxonbalancesheet10Q09302018-5c53bbe546e0fb000152e504.jpg) Property Plant And Equipment Pp E Definition

Property Plant And Equipment Pp E Definition

Singapore Personal Individual Income Tax Rate Singapore 2017

Singapore Personal Individual Income Tax Rate Singapore 2017

4 Ways To Reduce Your Income Tax In 2017

4 Ways To Reduce Your Income Tax In 2017

Singapore S Outbound Property Investments Hit Record In 2017

How Do Net Income And Operating Cash Flow Differ

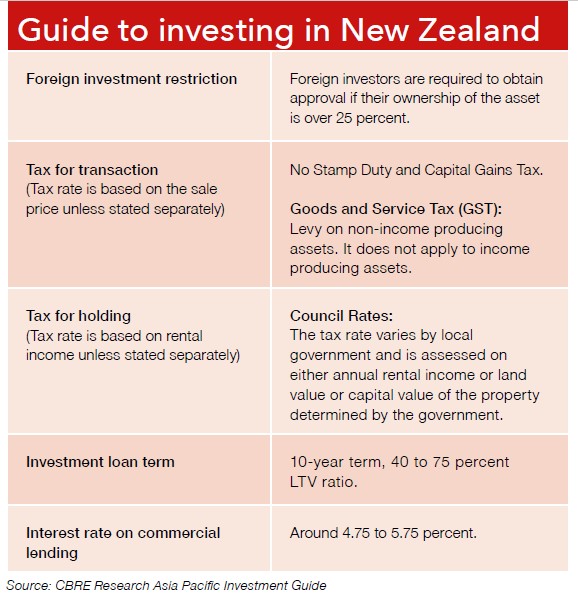

New Zealand Attracting The Rich And Famous Overseas

New Zealand Attracting The Rich And Famous Overseas

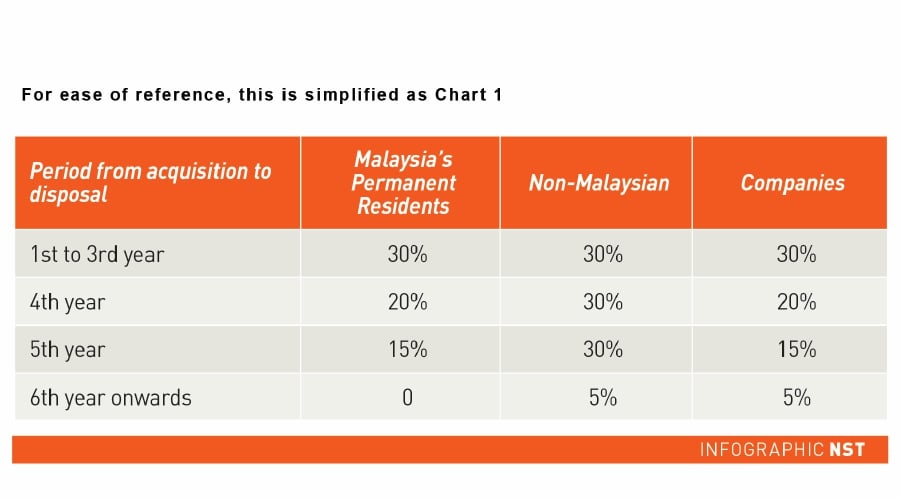

Investment Real Ising Property Gain Tax New Straits Times

Investment Real Ising Property Gain Tax New Straits Times

How To Assess A Real Estate Investment Trust Reit

Buying Private Property While Owning Hdb Flat

Buying Private Property While Owning Hdb Flat