Year cash flow 1 1375 2 1495 3 1580 4 1630 if the discount rate is 8 percent what is the future value of the cash flows in year 4. What is the future value at a discount rate of 24.

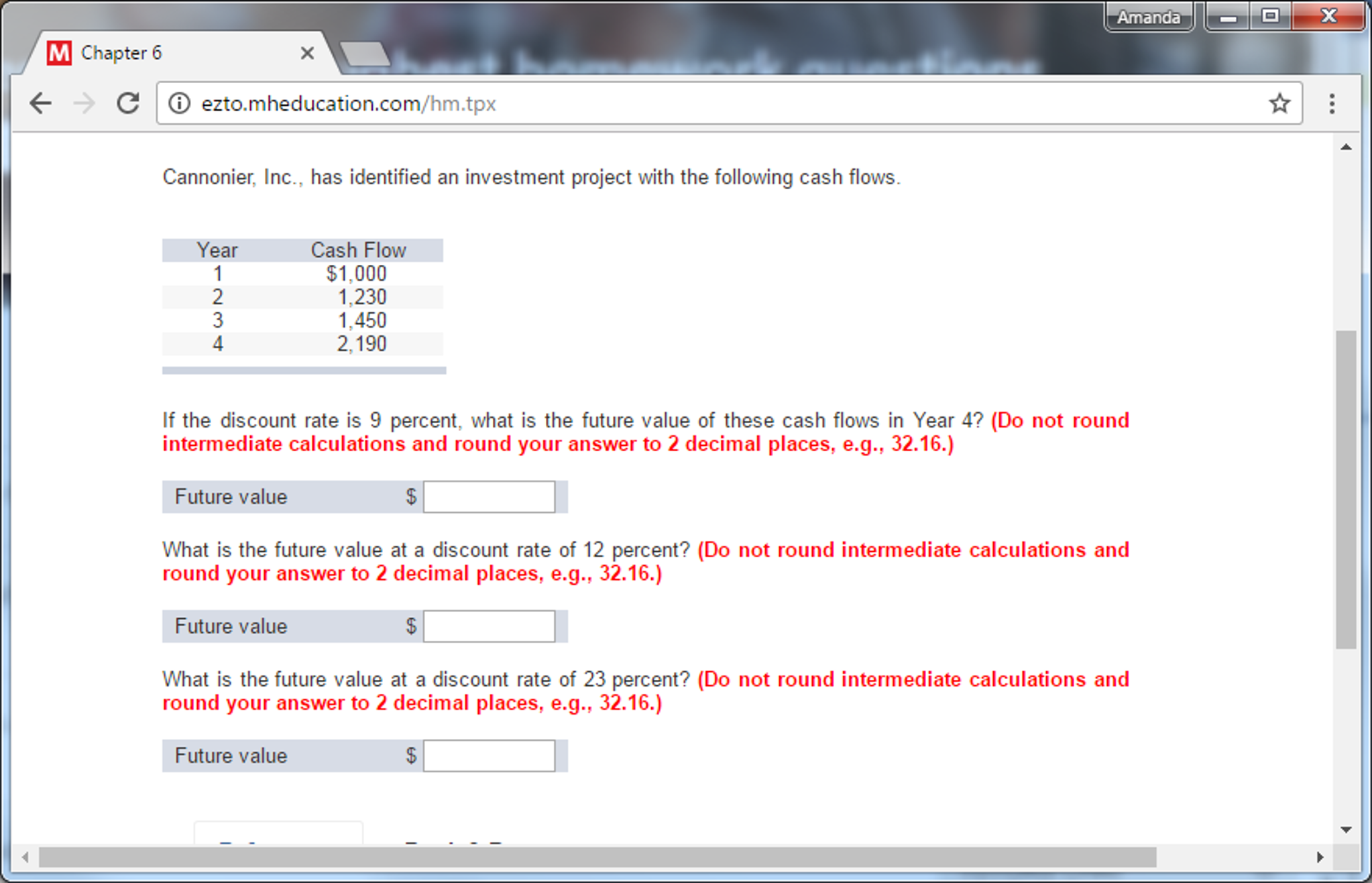

Solved Cannonier Inc Has Identified An Investment Proj

Solved Cannonier Inc Has Identified An Investment Proj

cannonier inc has identified an investment project

cannonier inc has identified an investment project is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in cannonier inc has identified an investment project content depends on the source site. We hope you do not use it for commercial purposes.

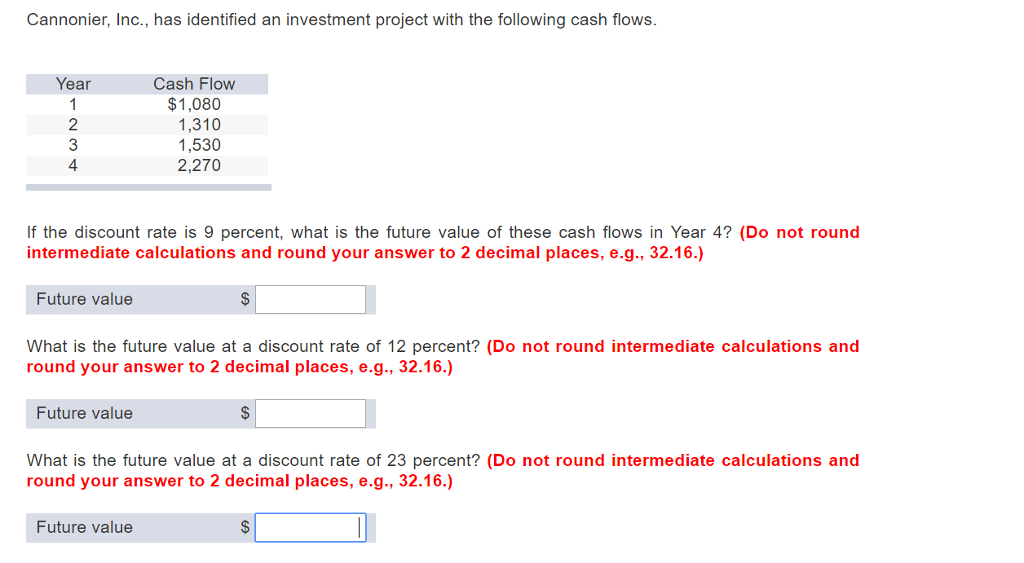

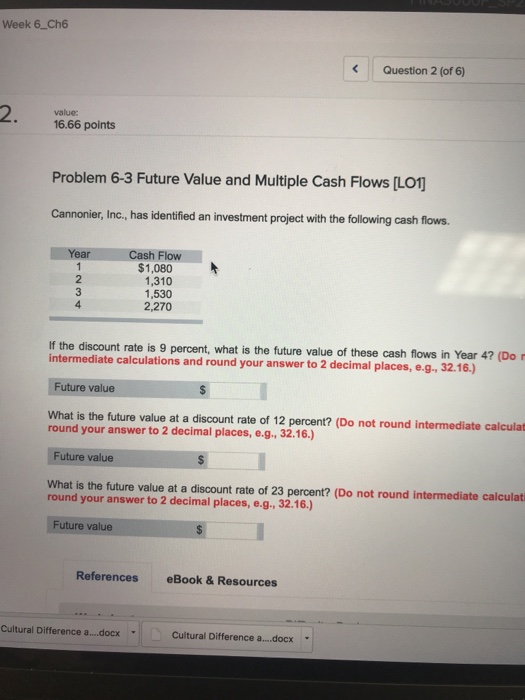

Year cash flow 1 1080 2 1310 3 1530 4 2270 if the discount rate is 9 percent what is the future value of these cash flows in year 4.

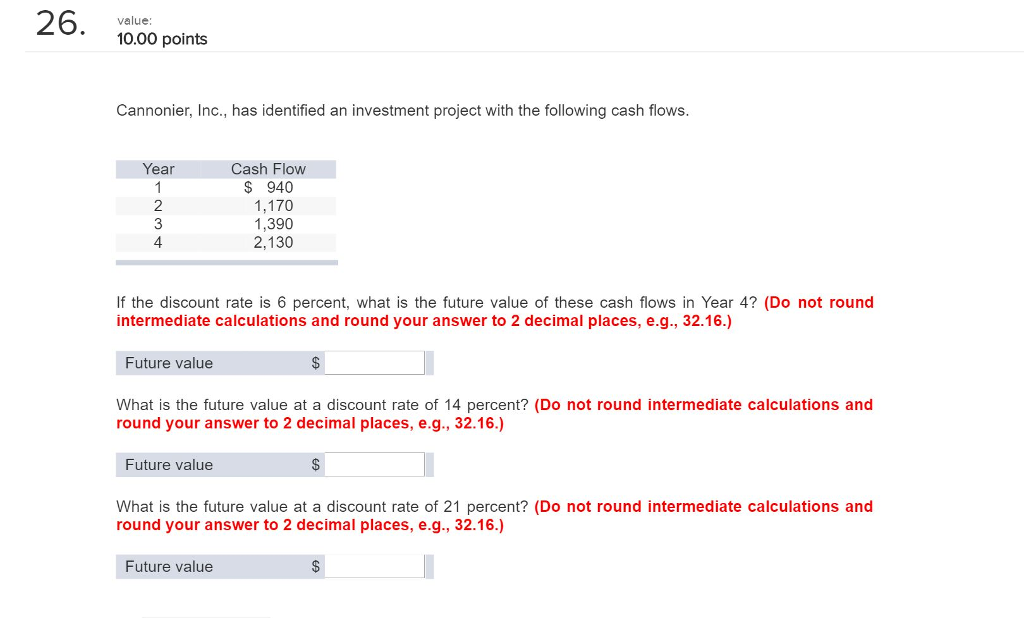

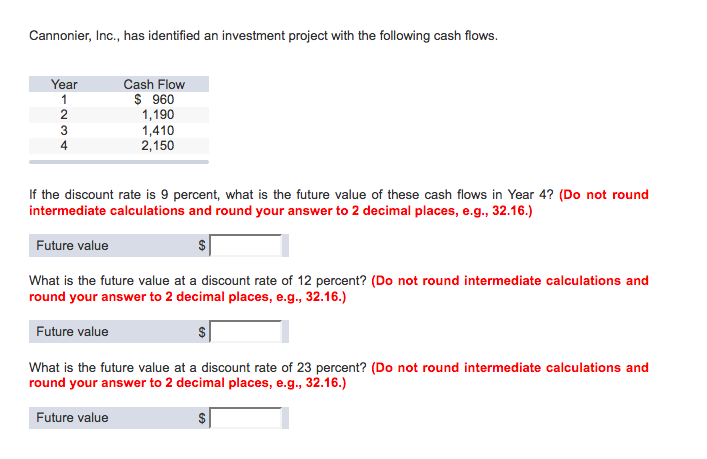

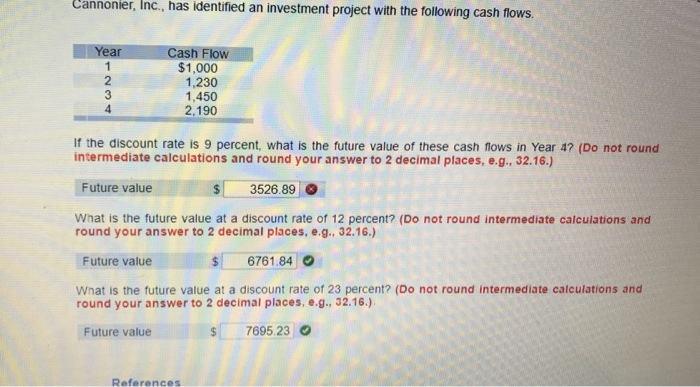

Cannonier inc has identified an investment project. Havana inc has identified an investment project with the following cash flows. Cannonier inc has identified an investment project with the following cash flows. Year cash flow 1 1090 2 1320 3 1540 4 2280 if the discount rate is 7 percent what is the future value of these cash flows in year 4.

Cannonier inc has identified an investment project with the following cash flows. What is the future value at a discount rate of 11. Do not include the dollar sign.

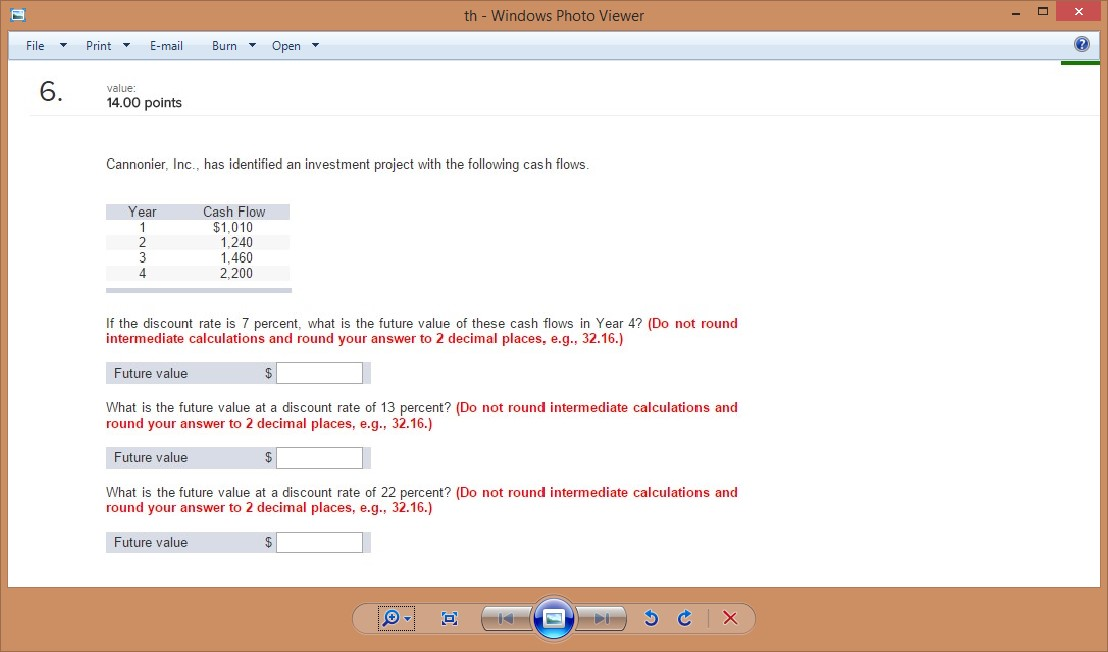

If the discount rate is 11 percent what is the future value of the cash flows in year 4. Assume the discount rate is 6 percent what is the future value of these cash flows in year 4. Year 1 1010 year 2 1240 year 3 1460 year 4.

Cannonier inc has identified an investment project with the following cash flowsdo not round intermediate calculations and round. Cannonier inc has identified an investment project with the following cash flows. Enter rounded answer as directed but do not use the rounded numbers in intermediate calculations.

Year cash flow 1 1060 2 1290 3 1510 4 2250 if the discount rate is 6 percent what is the future value of these cash flows in year 4. Year cash flow 1 1020 2 1250 3 1470 4 2210 requirement 1. Toadies inc has identified an investment project with the following cash flows.

Cannonier inc has identified an investment project with the following cash flows. Yr 1 1030 yr 2 1260 yr 3 1480 yr 4 2220 if the discount rate is 8 what is the future value of these cash flows in yr 2. Cannonier inc has identified an investment project with the following cash flows.

Solved Cannonier Inc Has Identified An Investment Proj

Solved Cannonier Inc Has Identified An Investment Proj

Solved Cannonier Inc Has Identified An Investment Proj

Solved Cannonier Inc Has Identified An Investment Proj

Solved Cannonier Inc Has Identified An Investment Proj

Solved Cannonier Inc Has Identified An Investment Proj

Solved Cannonier Inc Has Identified An Investment Proj

Solved Cannonier Inc Has Identified An Investment Proj

Get Answer Cannonier Inc Has Identified An Investment

Get Answer Cannonier Inc Has Identified An Investment

Hw Ch 6 Amp 7 Hw Ch 6 And 7 Score 10 10points100 1 Award

Hw Ch 6 Amp 7 Hw Ch 6 And 7 Score 10 10points100 1 Award

Get Answer Huggins Co Has Identified An Investment

Get Answer Huggins Co Has Identified An Investment

Finance Ch5 Havana Inc Has Identified An Investment

Finance Ch5 Havana Inc Has Identified An Investment

Finance Ch5 Havana Inc Has Identified An Investment

Finance Ch5 Havana Inc Has Identified An Investment