The average annual return is. The figures represent the average for all mutual funds including index funds within the respective category.

The Top Index Funds For 2019 The Motley Fool

The Top Index Funds For 2019 The Motley Fool

average return on investment for mutual funds

average return on investment for mutual funds is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in average return on investment for mutual funds content depends on the source site. We hope you do not use it for commercial purposes.

Mutual fund returns can be measured either on an annual basis over the course of a single year or.

Average return on investment for mutual funds. Forbes insights with ibm services. Why the average investors investment return is. The 3 5 10 and 15 year figures represent the average annual return over given time periods.

Investors often want to know whether or not they are getting a good return on their mutual funds. Investing in mutual funds carries less risk than buying stocks directly. The average investor in a blend of equities and fixed income mutual funds has garnered only a 26 net.

Investing in mutual funds delivers a higher rate of return than other investment vehicles such as cds bonds or traditional savings accounts. The investment return calculator results show the invested total capital in green simple interest total in red and the compound interest total in blue. Read this shocking report to learn even more news about mutual funds.

This is 352 less than the average sp 500 index return. The mutual fund calculator shows the power of compounding your returns. One of the main reasons new investors lose money is because they chase after unrealistic rates of return on their investments whether they are buying stocks bonds mutual funds real estate or some other asset classmost folks dont understand how compounding worksevery percentage increase in profit each year means huge increases in your ultimate wealth over time.

Investors earned an average of 467 on mutual funds over the last 20 years. You can click on them in the bottom legend to hide or make them visible again. Investors can invest through a broker or through many online services which make investing easy and accessible.

The average annual return aar is a percentage used when reporting the historical return such as the three five and 10 year average returns of a mutual fund. Here are the average mutual fund returns for seven major categories used by morningstar inc. How to invest in mutual funds.

How to hire a financial advisor. Based on this advice it makes sense that mutual funds which are managed by seasoned investment professionals have historic annual average. Wall street financial advisors will often say that a good return on investment should be around 10 percent but they will also mention that reaching this goal requires adequate management and a solid strategy.

Dont let your opinion about whether or not you think a 12 return is possible keep you from investing. Its not difficult to find several mutual funds that average or exceed 12 long term growth even in todays market.

How To Avoid Big Negative Returns In Your Mutual Fund

Pay Attention To Your Fund S Expense Ratio

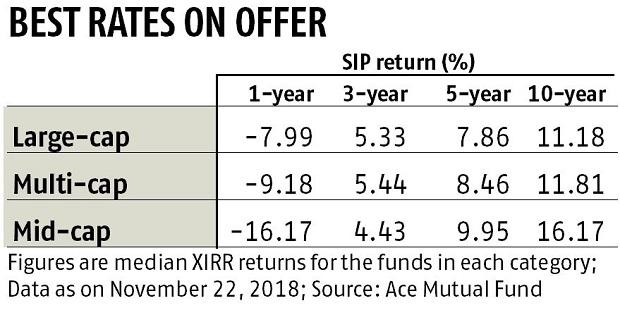

Sip Returns Turning Negative Don T Worry Rediff Com Business

Sip Returns Turning Negative Don T Worry Rediff Com Business

What Rate Of Return Should You Expect To Earn On Your

What Rate Of Return Should You Expect To Earn On Your

How To Read A Mutual Fund Prospectus

How To Read A Mutual Fund Prospectus

Chart Of The Week How Has The Average Investor Fared Over

Return On Investment The 12 Reality Daveramsey Com

Return On Investment The 12 Reality Daveramsey Com

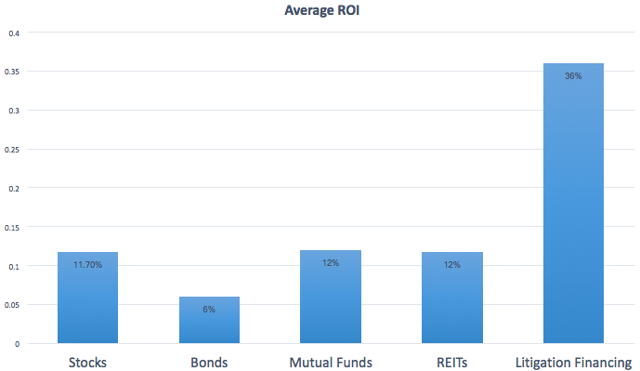

Litigation Financing An Alternate Method Of Investment That

Litigation Financing An Alternate Method Of Investment That

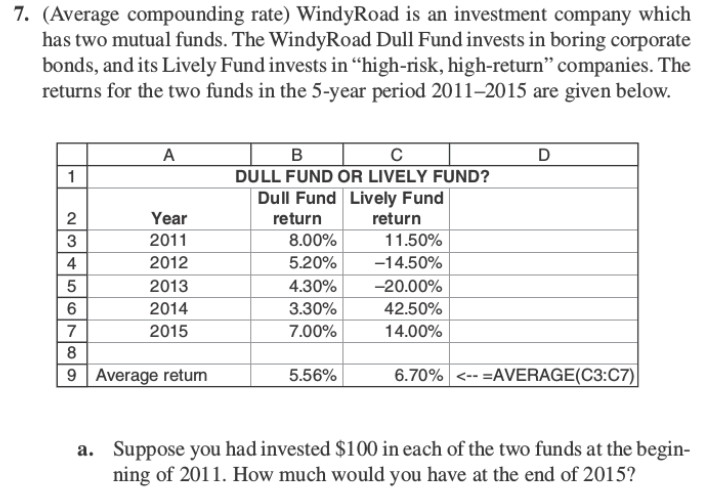

Solved 7 Average Compounding Rate Windyroad Is An Inve

Solved 7 Average Compounding Rate Windyroad Is An Inve

What Rate Of Return Should You Expect To Earn On Your

What Rate Of Return Should You Expect To Earn On Your

Pms Should You Invest In A Pms Or In Mutual Funds

Pms Should You Invest In A Pms Or In Mutual Funds