What you should know about the additional medicare tax and the net investment income tax. This extra medicare tax is known as net investment income tax niit you should not confuse this extra medicare tax with 09 additional medicare tax that.

How To Calculate Additional Medicare Tax Properly

How To Calculate Additional Medicare Tax Properly

additional medicare tax on net investment income

additional medicare tax on net investment income is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in additional medicare tax on net investment income content depends on the source site. We hope you do not use it for commercial purposes.

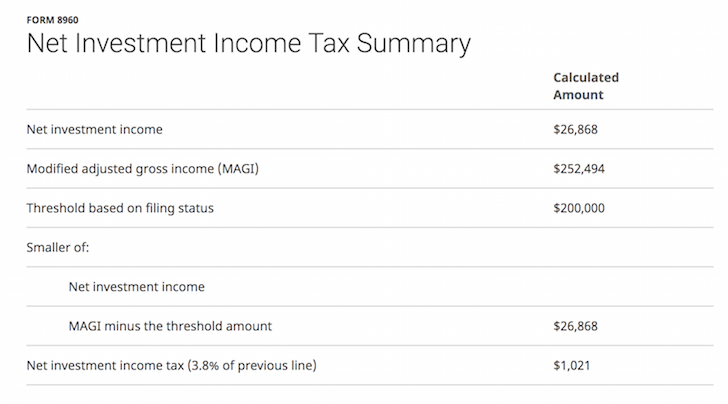

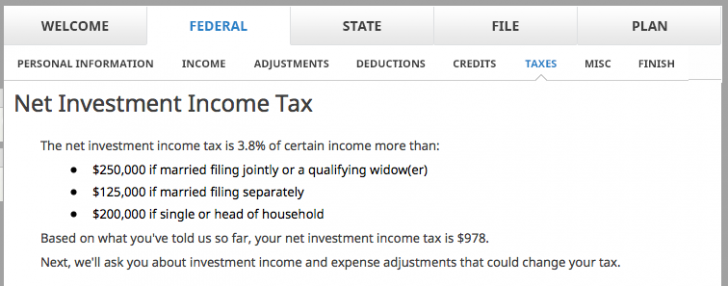

The affordable care act of 2010 included a provision for a 38 net investment income tax also known as the medicare surtax to fund medicare expansion.

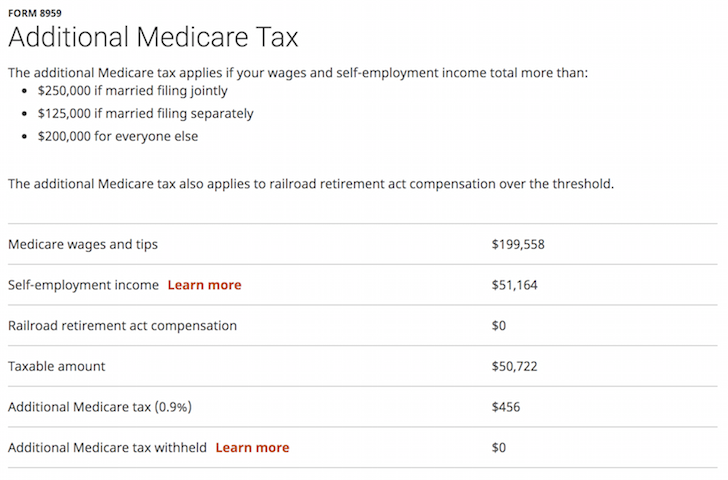

Additional medicare tax on net investment income. Net investment income tax is a medicare tax charged on individuals who have income from capital gains interest dividend exceeding a threshold specified under the internal revenue code. If i am subject to the net investment income tax how will i report and pay the tax. It applies to taxpayers above a certain modified adjusted gross income magi threshold who have unearned income including investment income such as.

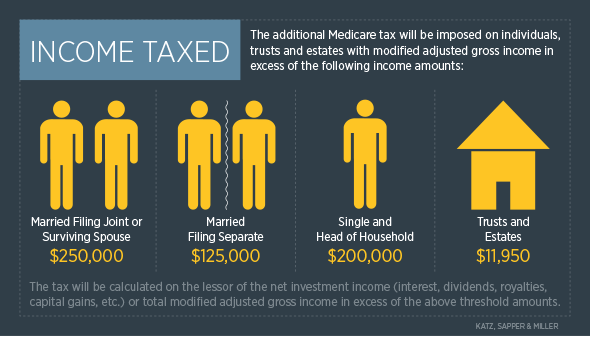

As part of the patient protection and affordable care act two new taxes took effect in the 2013 tax year. Some employees and self employed taxpayers are required to pay an additional 09 percent surtax over and above the regular medicare tax. Two new taxes in 2013 the 38 medicare tax on net investment income and the 09 additional medicare tax on wage and self employment income will potentially add thousands of dollars to the tax bills of high income americans in 2013.

A medicare contribution tax of 38 now additionally applies to unearned incomethat which is received from investments such as interest or dividends rather than from wages or salaries paid in compensation for labor. This tax is called the net investment income tax niit. 38 medicare tax on net investment income and 9 additional medicare tax on wage and self employment income.

D is liable for additional medicare tax on 115000 of wages the amount by which ds wages exceed the 125000 married filing separate threshold. C is liable for additional medicare tax on 25000 of self employment income the amount by which cs self employment income exceeds the 125000 threshold for married filing separate. The requirement is based on the amount of medicare wages and net self employment income a taxpayer earns that exceeds a threshold amount based on filing status.

The joint committee on taxation estimated that together with the additional medicare tax the net investment income tax would generate an additional 205 billion in tax revenue in 2013 the first year that this surtax would be in effect. It only affects higher income individuals but that can include anyone who has a big one time shot of investment income. See more information on the additional medicare tax.

The new 38 medicare tax on net investment income took effect on january 1. How the net investment income tax is reported and paid 15. Individuals estates and trusts will use form 8960 and instructions to compute their net investment income tax.

The net investment income tax was included as a revenue raiser in that legislation.

Ppt Cerca Spring Meeting 2013 Additional Medicare Tax And

Ppt Cerca Spring Meeting 2013 Additional Medicare Tax And

How To Calculate Additional Medicare Tax Properly

How To Calculate Additional Medicare Tax Properly

The Affordable Care Act And The 3 8 Medicare Tax

The Affordable Care Act And The 3 8 Medicare Tax

Self Employment Tax And Niit For Llcs And Higher Income

Self Employment Tax And Niit For Llcs And Higher Income

How Roth Ira Conversions Can Escalate Capital Gains Taxes

How Roth Ira Conversions Can Escalate Capital Gains Taxes

How Ira Withdrawals Can Trigger 3 8 Medicare Surtax

How Ira Withdrawals Can Trigger 3 8 Medicare Surtax

Easy Net Investment Income Tax Calculator Internal Revenue

Easy Net Investment Income Tax Calculator Internal Revenue

Tax Penalties For High Income Earners Net Investment Income

Tax Penalties For High Income Earners Net Investment Income

What The Senate S 3 8 Surtax Means For American Taxpayers Wsj

What The Senate S 3 8 Surtax Means For American Taxpayers Wsj

Today S Presenters Alissa Bowers Private Client Services

Today S Presenters Alissa Bowers Private Client Services