New tax law could change how clients invest. Under current law investment expenses are deductible as a.

Taking The Standard Deduction Or Itemizing Under The New Tax

Taking The Standard Deduction Or Itemizing Under The New Tax

are investment fees deductible in new tax law

are investment fees deductible in new tax law is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in are investment fees deductible in new tax law content depends on the source site. We hope you do not use it for commercial purposes.

Tax cuts and jobs act of 2017 is changing many aspects of the tax planning process and we discussed many of them in this post.

Are investment fees deductible in new tax law. Investment management and financial planning fees were tax deductible through tax year 2017. They have been deducting in the past will no longer be deductible. The tax cuts and jobs act eliminated the deduction for investment expenses starting in 2018.

One area in particular is important to our firm and its clients as it involves investment management expenses including gordian advisors fees. There are a few steps investors can take to ease the impact. Tts traders can continue to deduct tax compliance fees as a.

Andy friedman the repeal of the deduction for investment fees for example could have a big effect on advisors and their clients friedman tells. Another example of such a unique administration expense is the tax preparation fee for estates and nongrantor 2 trusts. The recent tax overhaul repealed a deduction for investment advisory fees that effectively will raise fees for millions of investors.

How the tax cut bill impacts traders and investment managers. They fell into the category of miscellaneous itemized deductions and these deductions were eliminated from the tax code by the tax cuts and jobs act tcja effective tax year 2018. This supports a position that administration expenses that are unique to an estate or trust such as fiduciary fees are still deductible under the new law.

Fees for investment costs were deductible as a miscellaneous itemized deduction to the extent they. The tax cuts and jobs act suspended certain miscellaneous itemized deductions subject to the two percent floor which includes investment fees and expenses however the new law. The itemized deduction for investment fees may have been.

The new tax law could have an adverse effect on individuals who pay fees for investment advice. Congressional intent is instructive. Federal benefits expert ed zurndorfer suggests what federal employees should do and be aware of in order to not pay more than they should when it comes to investment fees.

What the new tax law means for investment advisory fees by.

How The Tcja Tax Law Affects Your Personal Finances

Q4 2018 Is The Perfect Time To Invest In Safety Equipment

Q4 2018 Is The Perfect Time To Invest In Safety Equipment

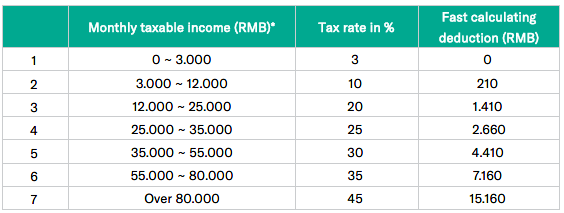

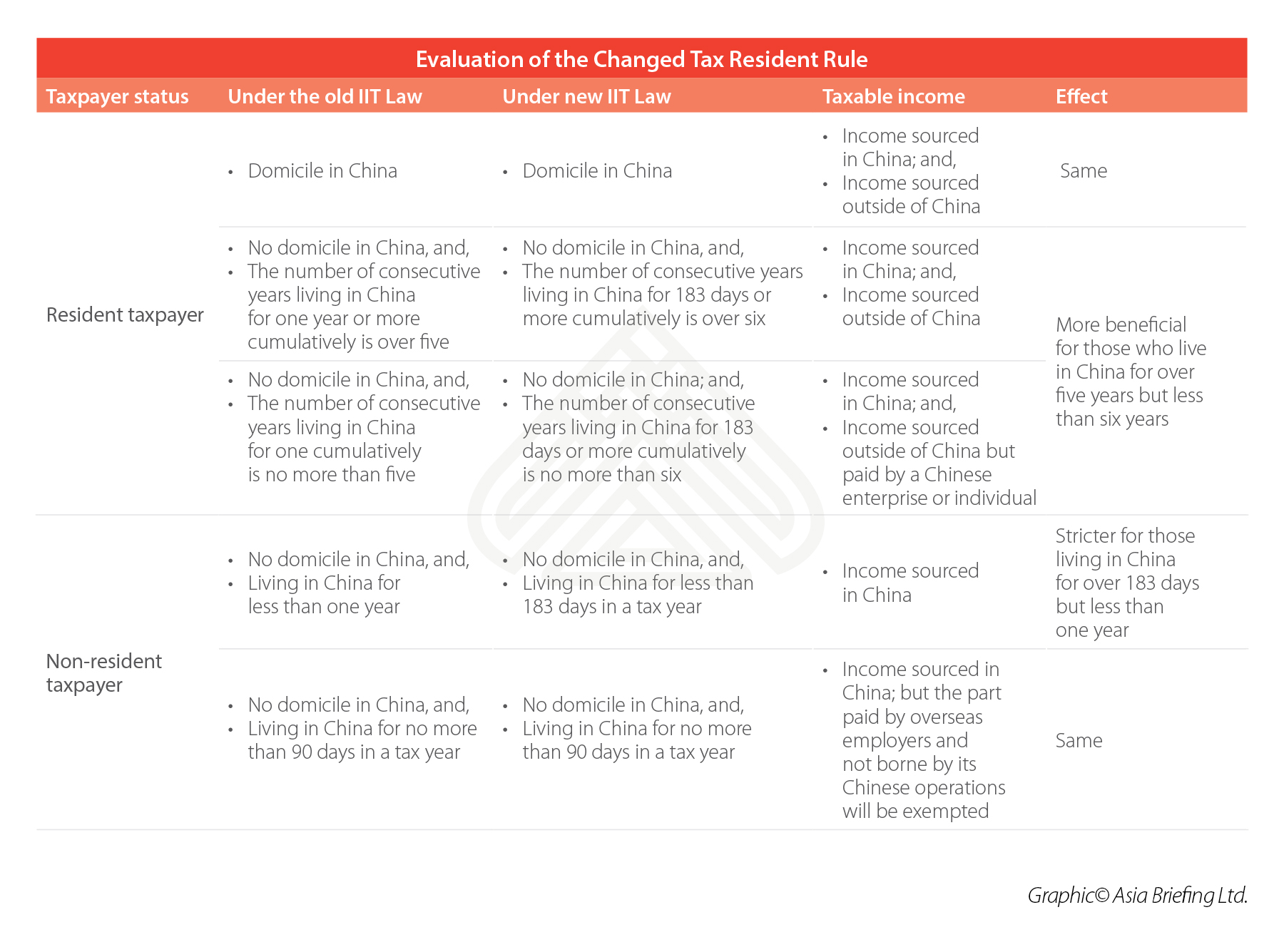

The Revolution In China Individual Income Tax Law As Of 2019

The Revolution In China Individual Income Tax Law As Of 2019

Individual Income Tax In Malaysia For Expatriates

Individual Income Tax In Malaysia For Expatriates

The 6 Best Tax Deductions For 2019 The Motley Fool

The 6 Best Tax Deductions For 2019 The Motley Fool

Hedge Fund Investors Lose Key Tax Break For Management

Hedge Fund Investors Lose Key Tax Break For Management

How China S New Income Tax Law Affects Expatriates

How China S New Income Tax Law Affects Expatriates

Top 25 Small Business Tax Deductions Small Business Trends

Top 25 Small Business Tax Deductions Small Business Trends

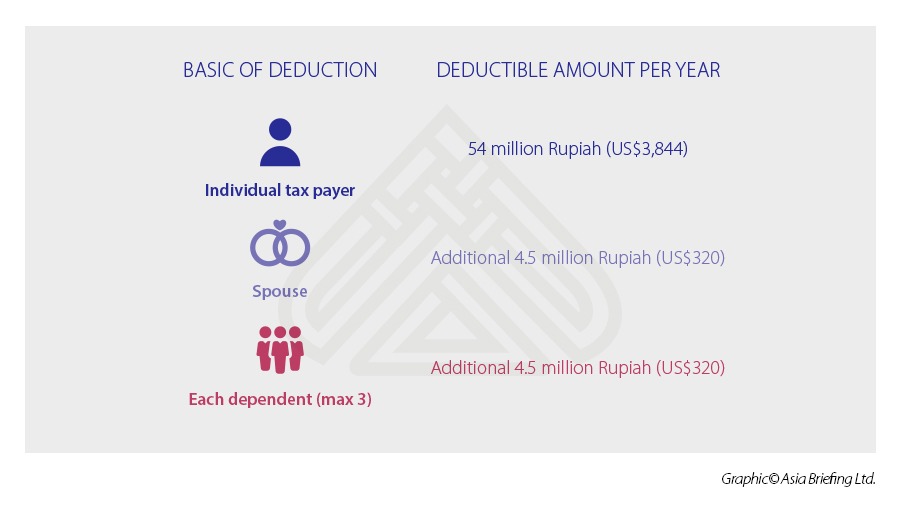

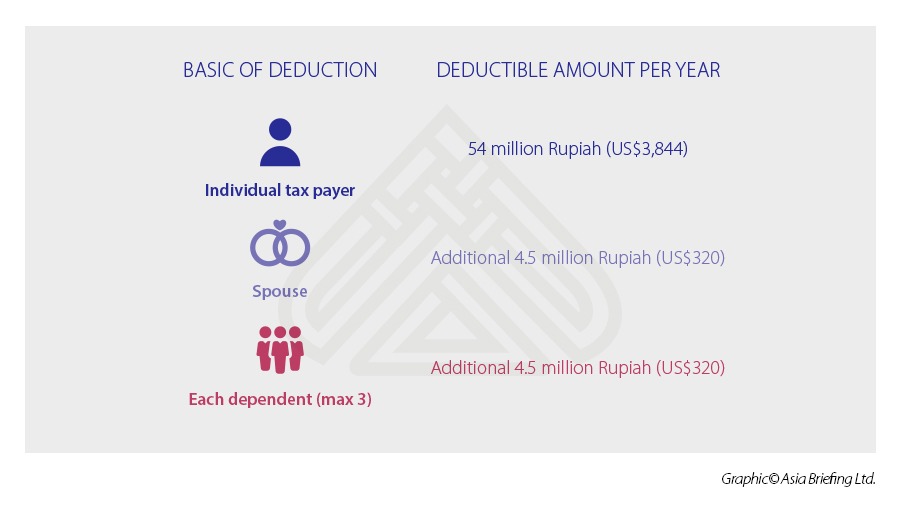

Personal Income Tax In Indonesia For Expatriate Workers

Personal Income Tax In Indonesia For Expatriate Workers

New Tax On Lawsuit Settlements Legal Fees Can T Be Deducted

New Tax On Lawsuit Settlements Legal Fees Can T Be Deducted

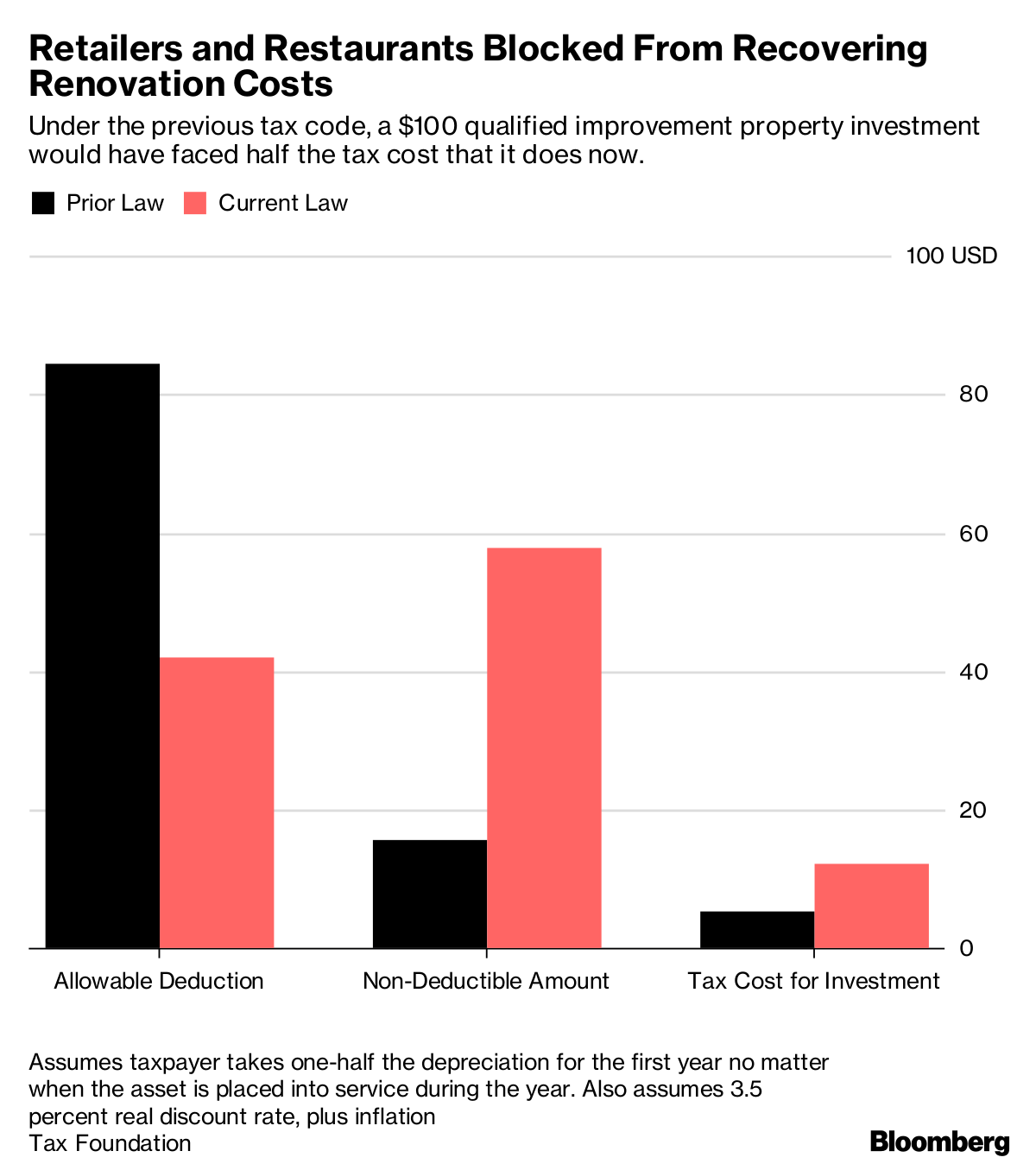

Retailers Fume Over Tax Law Typo That Makes Renovations

Retailers Fume Over Tax Law Typo That Makes Renovations