The type of tax paid and the investors marginal tax rate affect the amount of the after tax yield. After tax return percent return x 100 percent tax.

How To Calculate After Tax Return If Investor Can Use

How To Calculate After Tax Return If Investor Can Use

after tax return on investment calculator

after tax return on investment calculator is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in after tax return on investment calculator content depends on the source site. We hope you do not use it for commercial purposes.

This calculator helps you sort through these factors and determine your bottom line.

After tax return on investment calculator. This not only includes your investment capital and rate of return but inflation taxes and your time horizon. The after tax yield may vary depending on whether the investor has to pay income tax or capital gains tax. Meeting your long term investment goal is dependent on a number of factors.

Free investment calculator to evaluate various investment situations and find out corresponding schedules while considering starting and ending balance additional contributions return rate or investment length. This calculator is updated with rates and information for your 2019 taxes which youll file in early 2020. Many businesses and high income investors will use the after tax return to determine their earnings.

Use smartassets tax return calculator to see how your income withholdings deductions and credits impact your tax refund or balance due amount. Heres a formula for calculating the after tax return on an investment. This not only includes your investment capital and rate of return but inflation taxes and your time horizon.

Click the view report button for a detailed look at the results. Add your details. An after tax return is any profit made on an investment after subtracting the amount due for taxes.

The after tax real rate of return is a more accurate measure of investment earnings and usually differs significantly from an investments nominal gross rate of return or its return before fees. Crunch the numbers to determine your real after tax return on a particular investment and see whether you can improve your real return by moving you money to a different investment type. This calculator helps you sort through these factors and determine your bottom line.

The after tax yield or after tax return is the profitability of an investment after all applicable taxes have been paid. When calculating your return on investment use our after tax rate of return calculator to accurately determine your return on investments. Investment returns meeting your long term investment goal is dependent on a number of factors.

Also learn more about investments or explore hundreds of other calculators addressing finance math fitness health and many more. When calculating your return on investment use our after tax rate of return calculator to accurately determine your return on investments.

Calculating Return On Investment In Excel

Roi Formula Calculation And Examples Of Return On Investment

Roi Formula Calculation And Examples Of Return On Investment

Return On Investment Definition Example How To Interpret

Return On Investment Definition Example How To Interpret

The Realistic Investment And Retirement Calculator

The Realistic Investment And Retirement Calculator

Roic Formula How To Calculate Return On Invested Capital

Roic Formula How To Calculate Return On Invested Capital

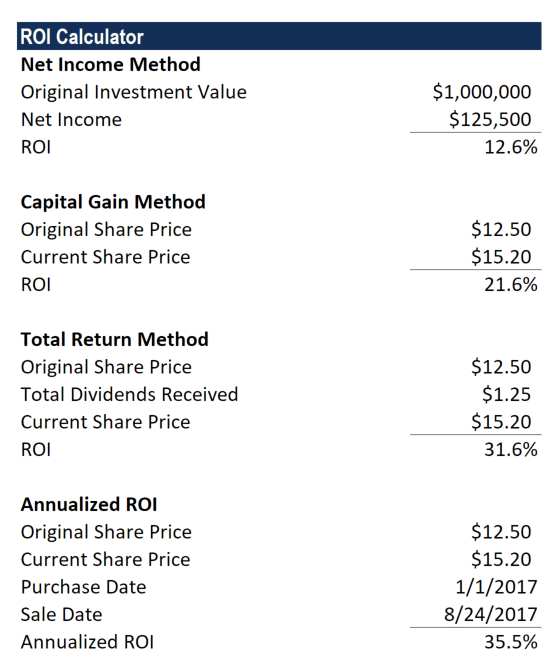

Return On Investment Roi Calculator

Return On Investment Roi Calculator

Return On Investment Definition Example How To Interpret

Return On Investment Definition Example How To Interpret

Using Return On Investment Roi To Evaluate Performance

Using Return On Investment Roi To Evaluate Performance

How To Calculate Return On Assets Roa With Examples

Average Rate Of Return Formula Definition Examples

Average Rate Of Return Formula Definition Examples