The best low risk investments for high return. Roi is a simple ratio of the gain from an investment.

Example Of A Simple Return On Investment Comparison

Example Of A Simple Return On Investment Comparison

3 examples of returns on an investment

3 examples of returns on an investment is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in 3 examples of returns on an investment content depends on the source site. We hope you do not use it for commercial purposes.

Best short term investment plan for 3 years.

3 examples of returns on an investment. Im shocked at this article. One of the main reasons new investors lose money is because they chase after unrealistic rates of return on their investments whether they are buying stocks bonds mutual funds real estate or some other asset classmost folks dont understand how compounding worksevery percentage increase in profit each year means huge increases in your ultimate wealth over time. It is important to check how the investment scheme can generate such high profits with low or no risk.

It is most commonly measured as net income divided by the original capital cost of the investment. Many investors focus solely on returns when investing. Be wary when you encounter an investment opportunity that claims to guarantee or protect your capital while promising high returns.

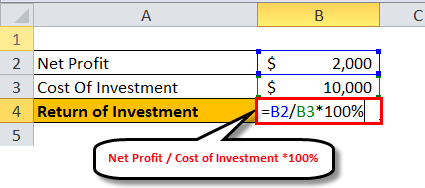

Return on investment roi is a ratio between net profit over a period and cost of investment resulting from an investment of some resources at a point in time. Such risk management is the cornerstone of syfes investment process. Investment returns vs investor returns why such a huge gap.

But the amount of risk being assumed is as important if not more so than absolute returns. A 50 drop in your portfolio value requires a 100 gain just to get back to your original investment value. Savings accounts a savings account is a type of deposit account that can be opened at financial institutions or banks.

Equity and equity based products are said to offer the best returns and bring the most capital appreciation in long run. Return on investment roi is a financial metric of profitability that is widely used to measure the return or gain from an investment. Return on investment roi formula is a financial ratio used to calculate the benefit an investor will receive in relation to their investment cost.

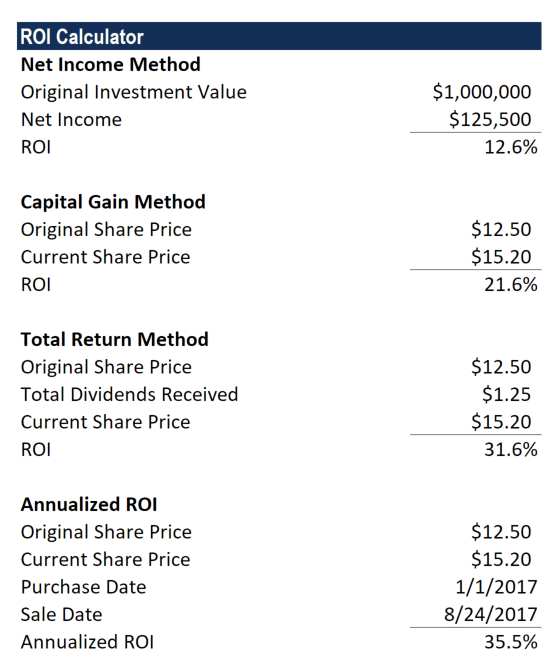

We hear about lots of full time investors like mr. The higher the ratio the greater the benefit earned. Return on investment roi is a performance measure used to evaluate the efficiency of an investment or compare the efficiency of a number of different investments.

Rakesh jhunjhunwala and azim premji who have made a fortune in the stock markets. The financial institutions would love to paint a beautiful picture of how cash value life insurance and annuities and 1 savings accounts etc everything you see in the article above can give you everything you could possibly get as far as safe returns. A high roi means the investments gains compare favorably to its cost.

Many investment scams offer such lucrative promises in order to lure investors in. Lets take a look at the best investment plans to invest in for 3 years. As a performance measure roi is used to evaluate the efficiency of an investment or to compare the efficiencies of several different investments.

How To Calculate Your Return On Investment Fat Pitch

How To Calculate Your Return On Investment Fat Pitch

Return On Investment Formula Step By Step Roi Calculation

Return On Investment Formula Step By Step Roi Calculation

Roi Formula Calculation And Examples Of Return On Investment

Roi Formula Calculation And Examples Of Return On Investment

Roi Formula Calculation And Examples Of Return On Investment

Roi Formula Calculation And Examples Of Return On Investment

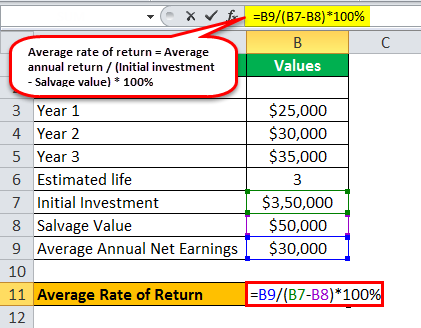

Average Rate Of Return Formula Definition Examples

Average Rate Of Return Formula Definition Examples

A Guide To Calculating Return On Investment Roi

Buffett S 3 Categories Of Returns On Capital Gurufocus Com

Buffett S 3 Categories Of Returns On Capital Gurufocus Com

Measure Your Return On Marketing Investment Track

Measure Your Return On Marketing Investment Track

Return On Investment Definition Formula Example

Return On Investment Definition Formula Example

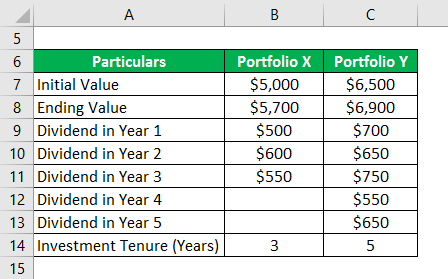

Holding Period Return Formula Calculator Excel Template

Holding Period Return Formula Calculator Excel Template

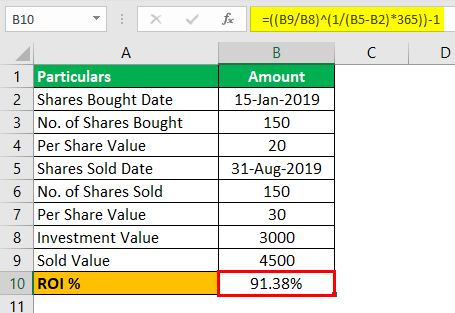

Calculating Investment Return In Excel Step By Step Examples

Calculating Investment Return In Excel Step By Step Examples