As per the rbi notification in liberalised remittance scheme lrs an indian resident individual can only invest up to 250000 overseas per yearwith the current exchange rate of 1 rs 68 this amount turns out to be over 17 crores. Few critical points to know before you invest in foreign stocks.

How Can A Foreigner Invest In India The Economic Times

How Can A Foreigner Invest In India The Economic Times

foreign investment in indian stock market

foreign investment in indian stock market is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in foreign investment in indian stock market content depends on the source site. We hope you do not use it for commercial purposes.

The bombay stock exchange bse and the national stock exchange nse.

Foreign investment in indian stock market. An introduction to the indian stock market. Apart from being a critical driver of economic growth foreign direct investment fdi is a major source of non debt financial resource for the economic development of india. Domestic institutional investors diis and foreign portfolio investors fpi together invested rs 143 lakh crore around us 20 billion in 2019.

Foreign companies invest in india to take advantage of relatively lower wages special investment privileges such as tax exemptions etc. The nse on the other hand was founded in 1992 and started trading in 1994. Up to 250000 can be invested overseas by the indian residents.

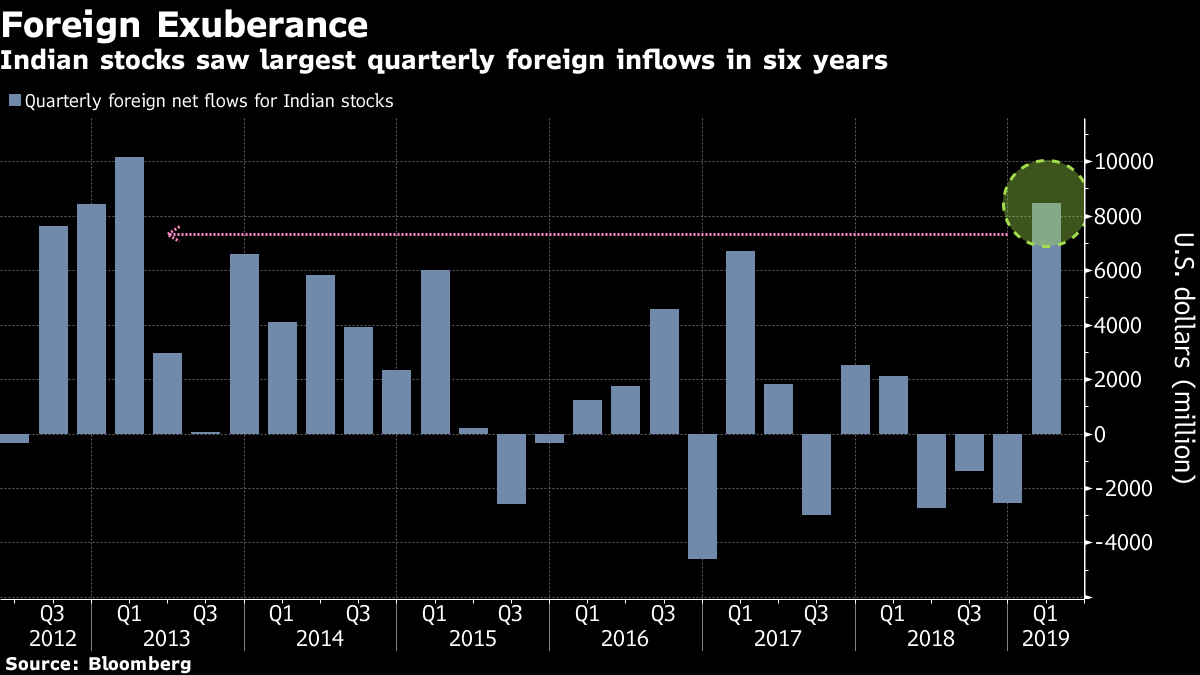

From february to june 2019 fiis invested a net of us 114 billion in indian equities. The bse has been in existence since 1875. Foreign investors are returning to indian stock markets attracted by the odds prime minister narendra modis party will win coming elections and by hopes for deeper economic reforms and more monetary policy easing.

In 2018 19 india ranked seventh with a market cap of us 21 trillion. Most of the trading in the indian stock market takes place on its two stock exchanges. Foreign direct investment fdi and foreign portfolio investment fpi.

Foreign investments are classified into two categories.

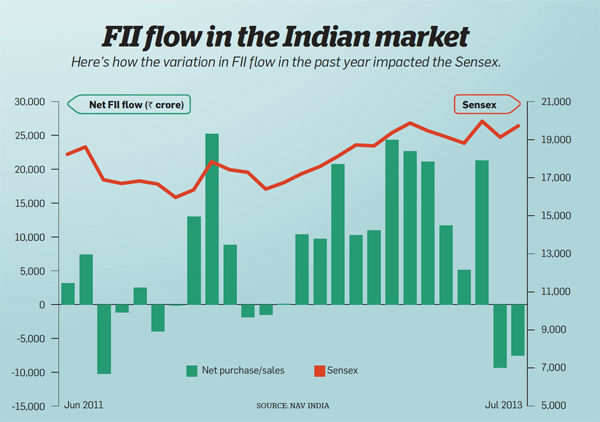

Net Fii Inflows In July But A Reversal Of Trend Is Unlikely

Net Fii Inflows In July But A Reversal Of Trend Is Unlikely

Indian Stock Market Information Analysis Advice Tips And

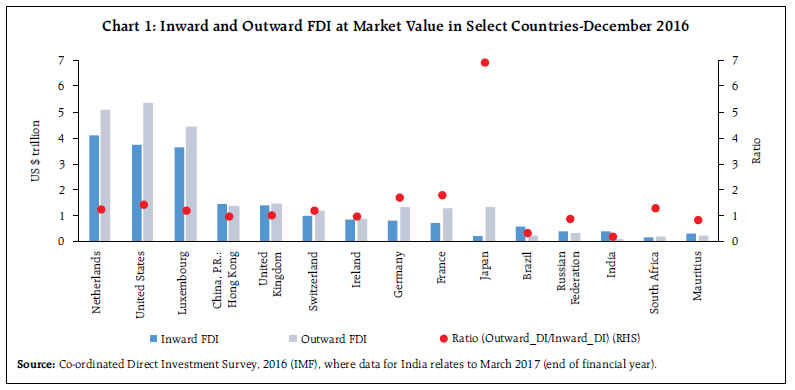

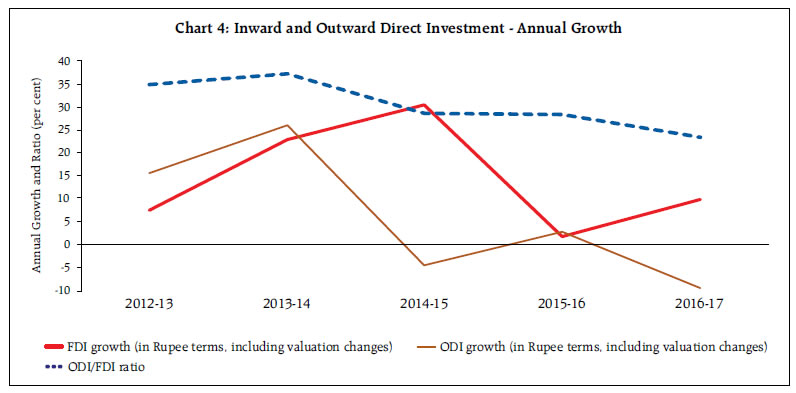

Reserve Bank Of India Rbi Bulletin

Reserve Bank Of India Rbi Bulletin

Stock Market Indian Stock Market Keeps Raising The Bar As

Stock Market Indian Stock Market Keeps Raising The Bar As

Foreign Institutional Investments In Indian Stock Market

Foreign Institutional Investments In Indian Stock Market

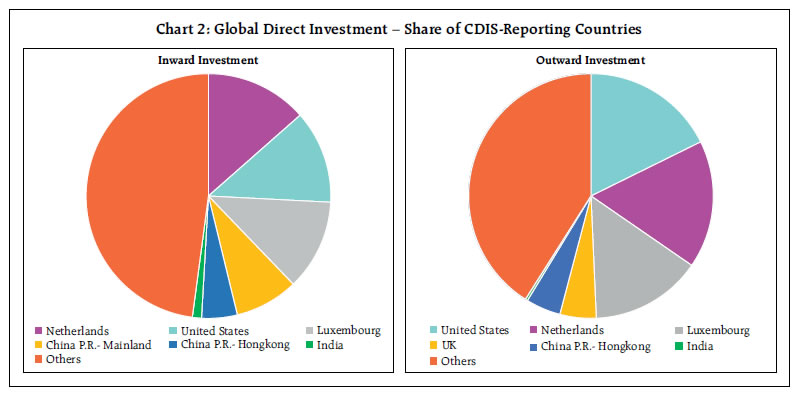

Reserve Bank Of India Rbi Bulletin

Reserve Bank Of India Rbi Bulletin

Indian Stock Market Crashes As Foreign Investors Sell Stakes

Indian Stock Market Crashes As Foreign Investors Sell Stakes

Foreign Direct Investment Wikipedia

Foreign Direct Investment Wikipedia

Diis Investments In Indian Equities At Record High So Far

Reserve Bank Of India Rbi Bulletin

Reserve Bank Of India Rbi Bulletin

This Emerging Market Economy Is Proving Tough To Beat In

This Emerging Market Economy Is Proving Tough To Beat In