The equity method and the proportional consolidation method are two types of accounting methods used when two companies are part of a joint venturewhich one is used depends on the way the. With the equity method the accounting for an investment tracks the equity of the investee.

Equity Method Accounting Definition Explanation Examples

Equity Method Accounting Definition Explanation Examples

equity method of accounting for investment example

equity method of accounting for investment example is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in equity method of accounting for investment example content depends on the source site. We hope you do not use it for commercial purposes.

Under this method the investor recognizes its share of the p.

Equity method of accounting for investment example. Initial equity method investment. When an investor owns between 20 and 50 of a firms stock the investor is deemed. This method is used when the investor holds significant influence over investee but not full control over it as in the relationship between parent and subsidiary.

Cash taxes are paid by the investor only on cash dividends received. For example if the investee. The first of the equity method journal entries to be recorded is the initial cost of the investment of 220000.

Investment amounting to 0 20 20 50 and more than 50 of the outstanding capital must be accounted for using fair value method equity method and consolidation respectively. Equity method overview the equity method of accounting is used to account for an organizations investment in another entity the investee. The cost and equity methods of accounting are used by companies to account for investments they make in other companies.

Equity method of accounting for acquisitions. The equity method is a type of accounting used in investments. The undistributed earnings give rise to a deferred tax liability dtl payable when the earnings are ultimately distributed or the investment is liquidated.

To exert significant influence over the investee and therefore accounts for its investment using the equity method of accounting. Investments in common stock preferred stock or any associated derivative securities of a company depends on the ownership stake. This video uses a comprehensive example to demonstrate how to account for investments using the equity method.

Accounting for equity investments ie. The equity method is an accounting technique used by a company to record the profits earned through its investment in another company. With the equity method of accounting the investor company.

This method is only used when the investor has significant influence over the investee. In general the cost method is used when the investment doesnt result in a. That is when the investee makes money and experiences a corresponding increase in equity the investor will record its share of that profit and vice versa for a loss.

This differs from the consolidation method where the investor exerts full control.

Equity Method Accounting Definition Explanation Examples

Equity Method Accounting Definition Explanation Examples

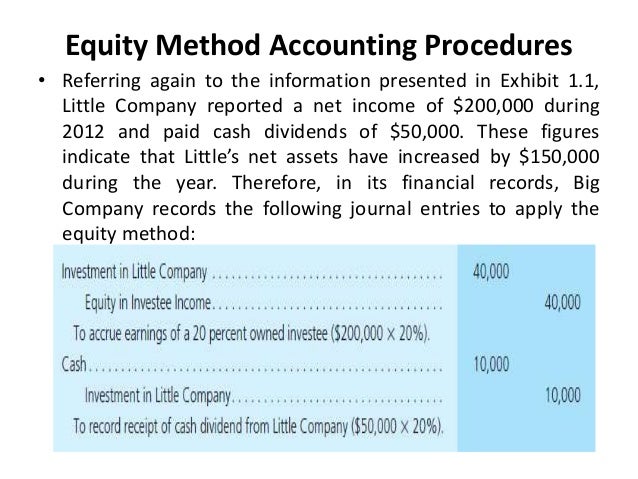

Advansed Accounting Ch 1 The Equity Method Of Accounting

Advansed Accounting Ch 1 The Equity Method Of Accounting

Fasb Issues Proposed Asu To Amend Equity Method Accounting

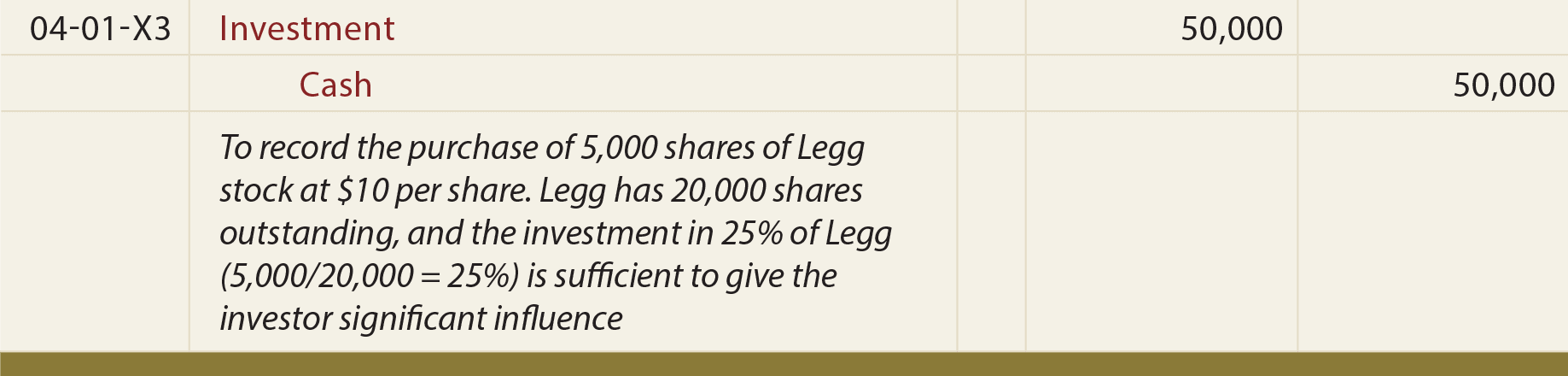

Equity Method Of Accounting For Investments

Equity Method Of Accounting For Investments

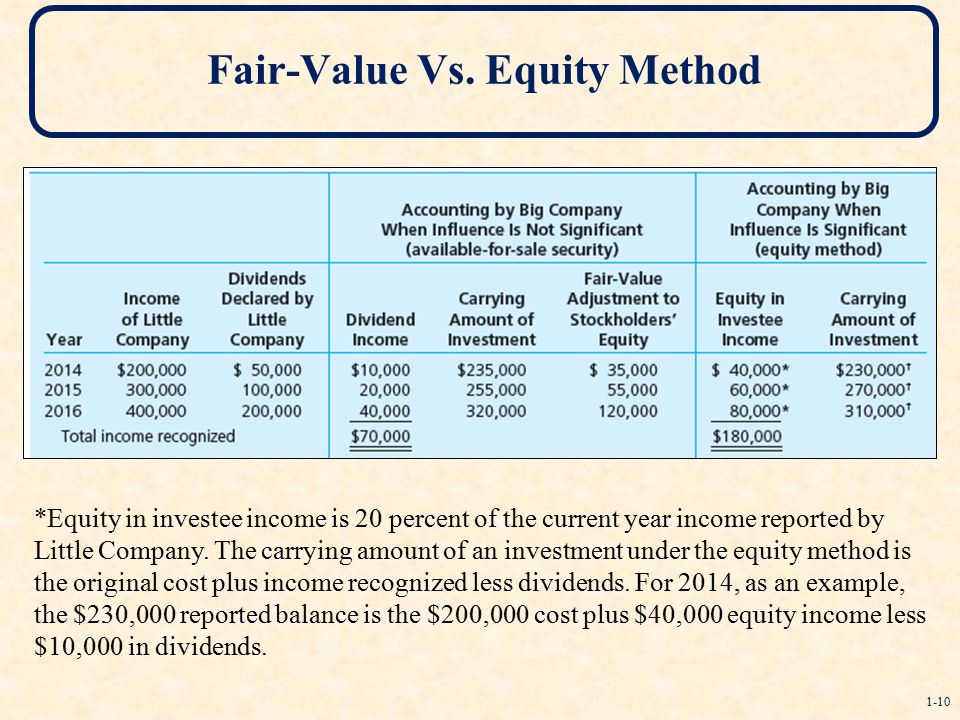

Chapter One The Equity Method Of Accounting For Investments

Chapter One The Equity Method Of Accounting For Investments

Investment In Associates Definition Accounting Top 3

Investment In Associates Definition Accounting Top 3

Equity Securities Principlesofaccounting Com

Equity Securities Principlesofaccounting Com

Minority Active Investments And The Equity Method For

Minority Active Investments And The Equity Method For

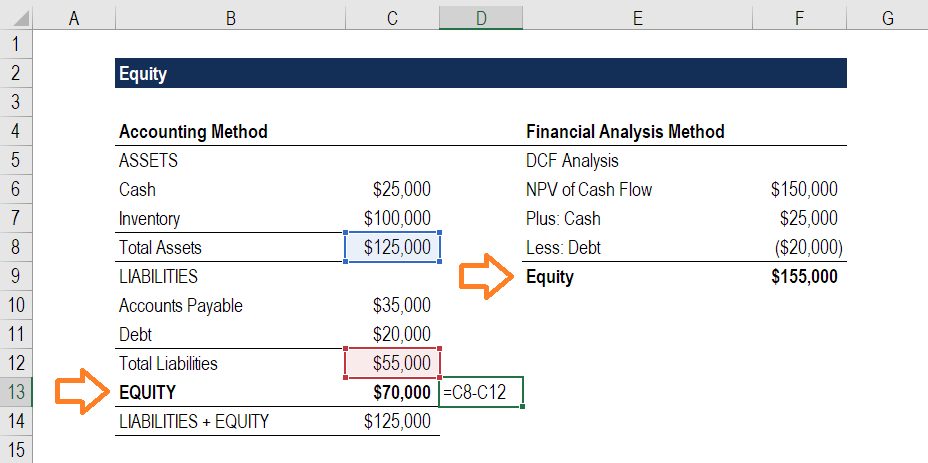

What Is Equity Definition Example Guide To Understanding

What Is Equity Definition Example Guide To Understanding