The rate reductions are effective january 1 of each year. As a result effective 1 july 2019 the combined federalprovincial tax rate on investment income earned by ccpcs will decline from 5067.

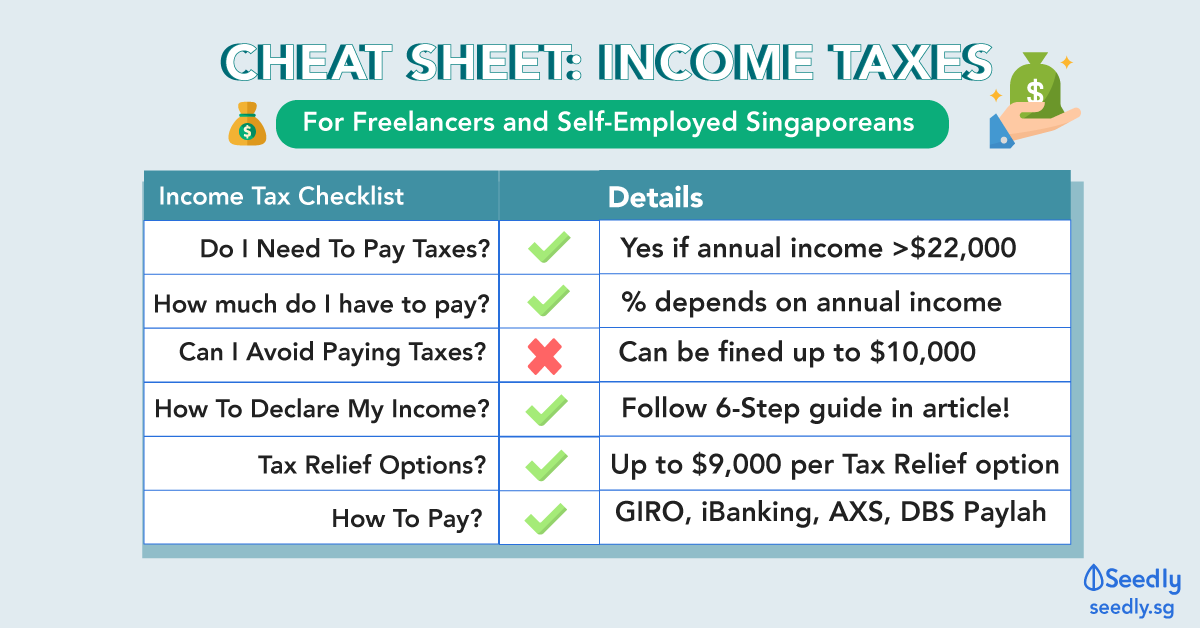

Freelancer Guide All You Need To Know About Your Income Taxes

Freelancer Guide All You Need To Know About Your Income Taxes

corporate investment income tax rate 2019

corporate investment income tax rate 2019 is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in corporate investment income tax rate 2019 content depends on the source site. We hope you do not use it for commercial purposes.

2018 includes all rate changes.

Corporate investment income tax rate 2019. Companies may incur penalties and face enforcement actions for late or non filing of their. This page provides you with guidance on setting up corppass and information on corporate income tax filing to help you better understand companies tax filing obligations. The general corporate income tax rate will be reduced to 1100 effective 1 july 2019 and will continue to decrease by 100 every 1 january until 2022.

See also corporate taxation of investment income 1 nl nt nu and pe use the federal small business limit. Corporate tax rates 4 current as of march 31 2019 77 10quebecs general corporate income tax rate for active business investment and mp income decreased to 116 from 117 in 2019 and will further decrease to 115 in 2020. The business limit is phased out for canadian controlled private.

The reason is the liberal government of canada passed a tax law effective 2019 that imposes a higher rate of tax on business income of a ccpc where the corporation is earning more than 50000 of passive investment income in the year. 42 of their income tax act for the first 3 taxation years of a new small business after incorporation. They are penalizing ccpcs for saving lots of cash and investing that cash in passive investments.

Active business income abi investment income manufacturing processing other rate income limit federal the rate on active business income abi up to the business limit decreased from 105 to 100 effective jan. 2 nova scotia provides a corporate tax holiday under s. Canadian corporate investment income tax rates.

2019 includes all rate changes announced up to 15 june 2019. The rebate will not apply to income derived by a non resident company that is subject to final withholding tax. At summer budget 2015 the government announced legislation setting the corporation tax main rate for all profits except ring fence profits at 19 for the years starting 1 april 2017 2018 and.

The due date to e file your year of assessment ya 2019 corporate income tax return form c s c is 15 dec 2019. 2019 includes all rate changes announced up to 15 june 2019. Companies need not factor in the corporate income tax rebate when filing the estimated chargeable income and the income tax return form c s c as iras will compute it and allow the rebate automatically.

The general corporate tax rate applies to active business income in excess of the business limit. Canadian provincial corporate tax rates for active business income. 1 2018 and to 9 effective jan1 2019.

State corporate income tax rates as of january 1 2019 a nevada ohio texas and washington do not have a corporate income tax but do have a gross receipts tax with rates not strictly comparable to corporate income tax rates. 2018 includes all rate changes announced up to 15 june 2018.

The Tax Impact Of The Long Term Capital Gains Bump Zone

The Tax Impact Of The Long Term Capital Gains Bump Zone

Capital Gains Tax In The United States Wikipedia

Capital Gains Tax In The United States Wikipedia

Indonesia Investments Research Report Released October

Indonesia Investments Research Report Released October

Capital Gains Tax In The United States Wikipedia

Capital Gains Tax In The United States Wikipedia

The Dual Tax Burden Of S Corporations Tax Foundation

The Dual Tax Burden Of S Corporations Tax Foundation

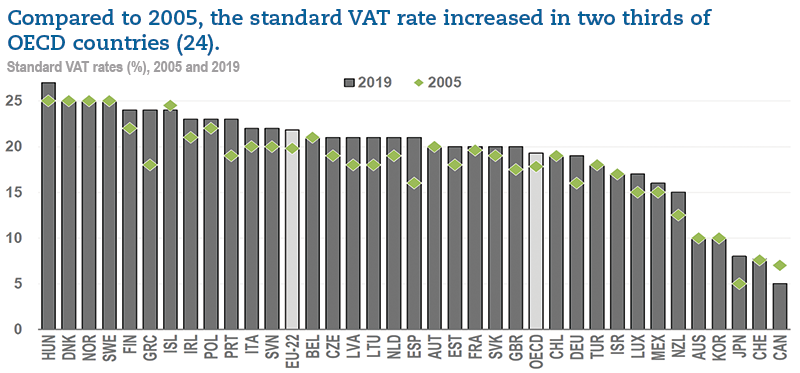

Does Denmark Need Yet Another Tax Reform Oecd Ecoscope

Does Denmark Need Yet Another Tax Reform Oecd Ecoscope

Dividend Tax Rates In Europe European Rankings Tax

Dividend Tax Rates In Europe European Rankings Tax

Individual Income Tax In Malaysia For Expatriates

Individual Income Tax In Malaysia For Expatriates

Capital Gains Tax In The United States Wikipedia

Capital Gains Tax In The United States Wikipedia