Higher income taxpayers as well as taxpayers with sources of income that are defined as net investment income in the statute pay an additional 38 tax to offset the costs of the affordable care act. This tax first took effect in 2013.

The Affordable Care Act And The 3 8 Medicare Tax

The Affordable Care Act And The 3 8 Medicare Tax

affordable care act tax on investment income

affordable care act tax on investment income is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in affordable care act tax on investment income content depends on the source site. We hope you do not use it for commercial purposes.

Marketplace savings are based on your expected household income for the year you want coverage not last years income.

Affordable care act tax on investment income. When you fill out a marketplace application youll need to estimate what your household income is likely to be for the year. The affordable care act is the federal statute signed into law in 2010 as a part of the healthcare reform agenda of the obama. The patient protection and affordable care act aca of 2010 known as obamacare imposed a lot of changes to the tax lawheres a summary of the major taxes penalties fines and tax credits.

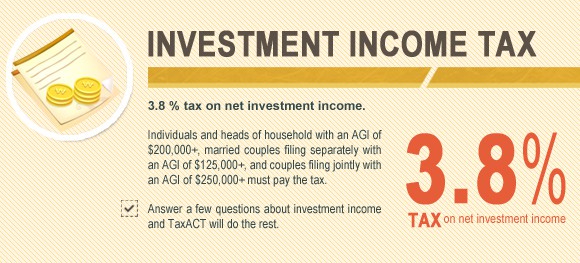

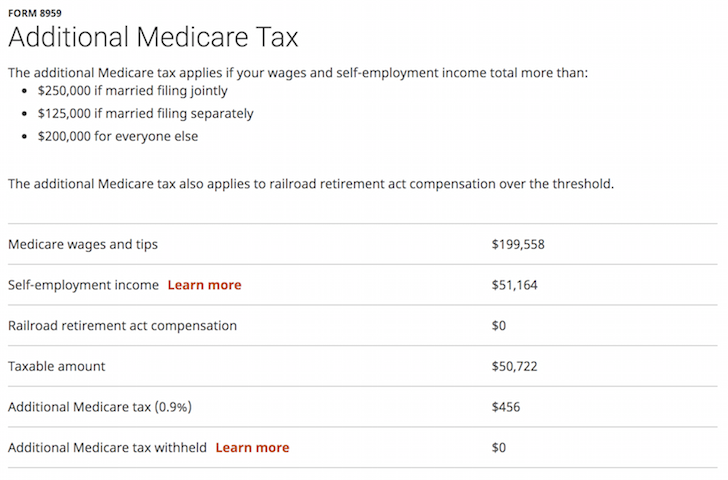

For more information related to the adoption credit for tax years 2010 and 2011 see our news release tax tip notice 2010 66 pdf revenue procedure 2010 31 pdf revenue procedure 2010 35 pdf and revenue procedure 2011 52 pdf. Affordable care act tax law changes for higher income taxpayers by sally herigstad most taxpayers dont need to worry about the new additional 38 tax on net investment income or the additional 09 medicare tax. Meet the 38 net investment income tax.

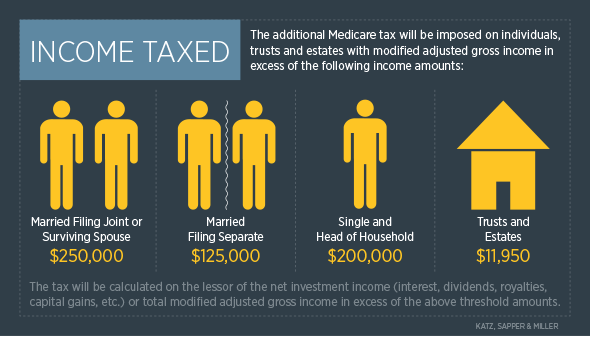

The affordable care act aca made several changes to the tax code intended to increase health insurance coverage reduce health care costs. It applies to investment income of married couples with more. The 38 percent net investment income tax applies to individuals estates and trusts that have certain investment income above certain threshold amounts.

The net investment income tax went into effect on january 1 2013. For additional information on the net investment income tax see our questions and answers. You must make your best estimate so you qualify for the right amount of savings.

The tax actually started on january 1 2013 as a direct new tax that was explicitly intended to help fund the now not so new affordable care act. However trumps plan to weaken obamacare is currently upending many of those changes. For tax years 2010 and 2011 the affordable care act raised the maximum adoption credit per child and the credit was refundable.

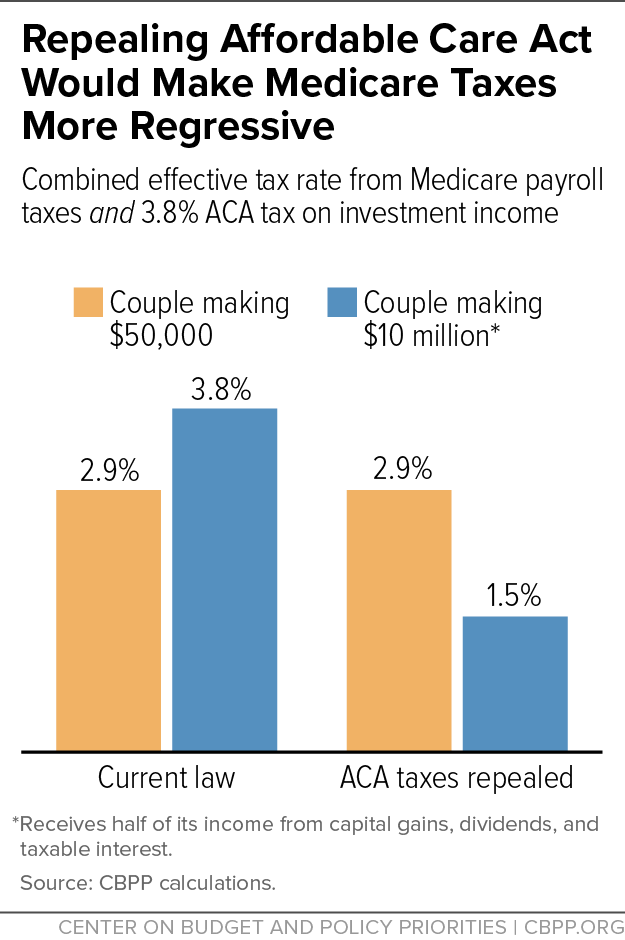

Net investment income tax. Among these is the net investment income tax that imposes a 38 percent surtax on income from investments. The house republican proposal to repeal and replace the affordable care act would eliminate several taxes imposed under the act.

An additional 09 percent medicare tax on earnings and a 38 percent tax on net investment income nii. Tax on income a new 123 billion tax on investment income.

Affordable Care Act Tax Law Changes For Higher Income Taxpayers

Affordable Care Act Tax Law Changes For Higher Income Taxpayers

House Gop Health Plan Eliminates Two Medicare Taxes Giving

House Gop Health Plan Eliminates Two Medicare Taxes Giving

How To Calculate The Net Investment Income Properly

How To Calculate The Net Investment Income Properly

Repealing Affordable Care Act Would Make Medicare Taxes More

Repealing Affordable Care Act Would Make Medicare Taxes More

Three Cheers For The Aca S Surtax On Investment Income

Three Cheers For The Aca S Surtax On Investment Income

How Ira Withdrawals Can Trigger 3 8 Medicare Surtax

How Ira Withdrawals Can Trigger 3 8 Medicare Surtax

What Tax Changes Did The Affordable Care Act Make Tax

What Tax Changes Did The Affordable Care Act Make Tax

American Health Care Act Of 2017 Wikipedia

American Health Care Act Of 2017 Wikipedia

Affordable Care Act Taxes Urban Institute

Affordable Care Act Taxes Urban Institute

Aca Lawsuit Would Cut Taxes For The Most Well Off While

Aca Lawsuit Would Cut Taxes For The Most Well Off While

How Roth Ira Conversions Can Escalate Capital Gains Taxes

How Roth Ira Conversions Can Escalate Capital Gains Taxes