Recording unrealized gains and losses of investment accounts. When securities are sold at a gain cash account is debited marketable securities account and gain on sale of investment account are credited.

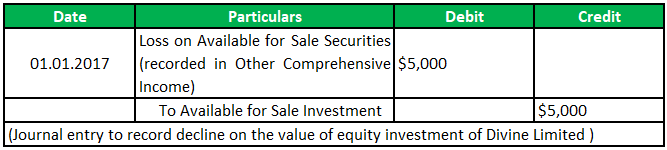

Available For Sale Securities Example Journal Entries

Available For Sale Securities Example Journal Entries

gain on sale of investment journal entry

gain on sale of investment journal entry is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in gain on sale of investment journal entry content depends on the source site. We hope you do not use it for commercial purposes.

Purchase and sale of investments.

Gain on sale of investment journal entry. If marketable securities are sold for a price that is higher than their cost the difference represents a gain on sale of marketable securities. Accounting treatment of a disposal of investment depends on. In long or short term.

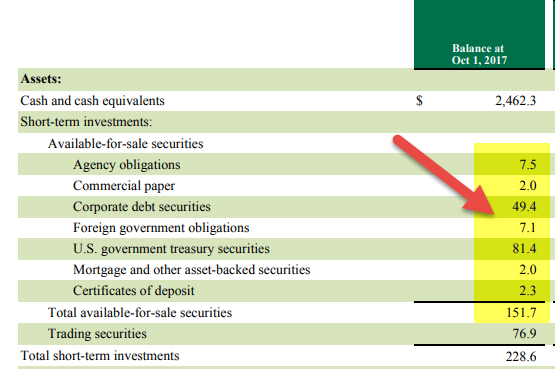

Typical examples are dividend income interest income gain or loss on the sale of stock. Close the gainloss on the sale of assets account at the appropriate time when recording closing entries at the end of your accounting period. Following this journal the available for sale securities are carried on the balance sheet at the fair value of 2000 400 1600 and the 400 unrealized loss has been debited to the unrealized gainloss other comprehensive income account in the equity section of the balance sheet.

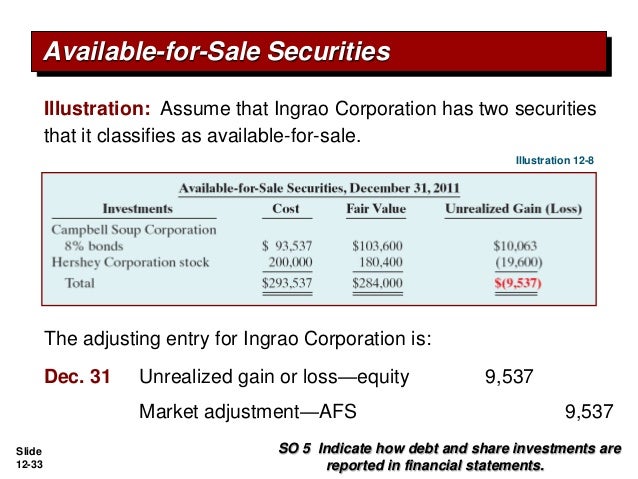

What is the journal entry for gain on sale of equipment. Debit loss on investment credit. If a business has invested in debt securities or equity securities that are classified as available for sale securities and if the equity securities have fair values that can be readily determined the company should record their fair values in the accounting records.

Sale of marketable securities at a gain. Similarly a capital loss is when the value of investment drops below its cost. Unrealized gainloss on investment credit this journal entry is increasing your asset but at the same time putting the funds it has been increased into a holding account until the gainslosses.

Government semi government corporation or trust securities such as shares bonds debentures etc. If you have a gain youll debit to close the gain on the sale of assets account and credit the income summary or retained earnings account in the journal entry. Unrealized incomeloss reflects the impact of current market conditions on your holdings.

Read this article to learn about the transactions relating to investment account with its treatment. Investments are made in various securities eg. We have several separately managed investment accounts some of which are rrsps and some are not.

The firm that manages those accounts provides monthly statements and the requisite tax slips at the end of the year but they do not provide detailed capital gainloss information for the non rrsp accounts and they provide none whatsoever for the rrsp accounts. Journal entry for sale of account is made when actual possession of goods is transferred. Available for sale securities accounting.

The nature of the investment ie. Last week i wrote about receiving stock from donors. Whether it is a share of common stock preferred stock a bond etc.

Lets walk through a sample journal entry. A gain on sale of investment arises when the disposal value of an investment exceeds its cost.

Available For Sale Securities Example Journal Entries

Available For Sale Securities Example Journal Entries

Available For Sale Securities Example Journal Entries

Available For Sale Securities Example Journal Entries

Transactions Relating To Investment Accounts With Journal

Accounting Q And A Ex 15 20 Fair Value Journal Entries

Accounting Q And A Ex 15 20 Fair Value Journal Entries

Pengantar Akuntansi 2 Ch12 Investment

Pengantar Akuntansi 2 Ch12 Investment

Available For Sale Securities Double Entry Bookkeeping

Available For Sale Securities Double Entry Bookkeeping

Motivations For Intercorporate Investments Ppt Video

Motivations For Intercorporate Investments Ppt Video

Transactions Relating To Investment Accounts With Journal

Sale Of Marketable Securities Accounting For Management

Sale Of Marketable Securities Accounting For Management