When you pay extra on your principal balance you reduce the amount of your loan and save money on interest. Making extra payments is an investment.

Spreadsheet Investing Vs Extra Mortgage Payments Calculator Spreadsheet Apple Numbers And Excel

Spreadsheet Investing Vs Extra Mortgage Payments Calculator Spreadsheet Apple Numbers And Excel

extra mortgage payment vs investment calculator

extra mortgage payment vs investment calculator is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in extra mortgage payment vs investment calculator content depends on the source site. We hope you do not use it for commercial purposes.

Depending on your finances you can make the added payments on a regular basis for example some people make a half payment every two weeks instead of one payment a month which adds up to 13 months worth of payments a year.

Extra mortgage payment vs investment calculator. Comparing mortgage terms ie. On a 30 year mortgage with the original principal total of 250000 and an interest rate of 65 percent the monthly payment is 1580 including both principal and interest. Keep in mind that you may pay for other costs in your monthly payment such as homeowners insurance property taxes and private mortgage insurance pmi.

To use this financial tool you will need to enter information about your loan terms as well as information about the investment that you are considering. The purpose of the investment loan calculator is to illustrate how financing your investments with borrowed money can increase your return potential. You can also make one time payments toward your principal with your yearly bonus from work tax refunds investment dividends or insurance payments.

Extra mortgage payments calculator. Should i convert to a bi weekly payment schedule. Compare a no cost vs.

I suggest you try using this bi weekly mortgage calculator with extra payment capability to test both this early payoff strategy and the previous one. Your mortgage payment is defined as your principal and interest payment in this mortgage payoff calculator. Prepay vs invest calculator.

Investment versus loan payoff a scenario calculator. This calculator allows you to compare what would happen if you took one of two choices with some extra cash you have prepaying your mortgage each month or investing it instead. Pay off mortgage early or invest.

This tool can not only help to illustrate the potential benefits for a particular. What are the tax savings generated by my mortgage. 15 20 30 year should i pay discount points for a lower interest rate.

Should i refinance my mortgage. Should i rent or buy a home. Prepay vs invest calculator.

15 year vs 30 year loans. This form allows you to compare what would happen if you took one of two choices with a big chunk of cash you have paying off your mortgage or investing it instead. Payments are made every two weeks not just twice a month which results in an extra mortgage payment each year.

One of the best written articles on debt vs. Investment ive ever read. If your interest rate is 55 percent paying off an extra 1000 of the mortgage principle each year equals 1000 at 55 percent.

If a borrower makes an extra annual payment the savings on interest can be quite substantial.

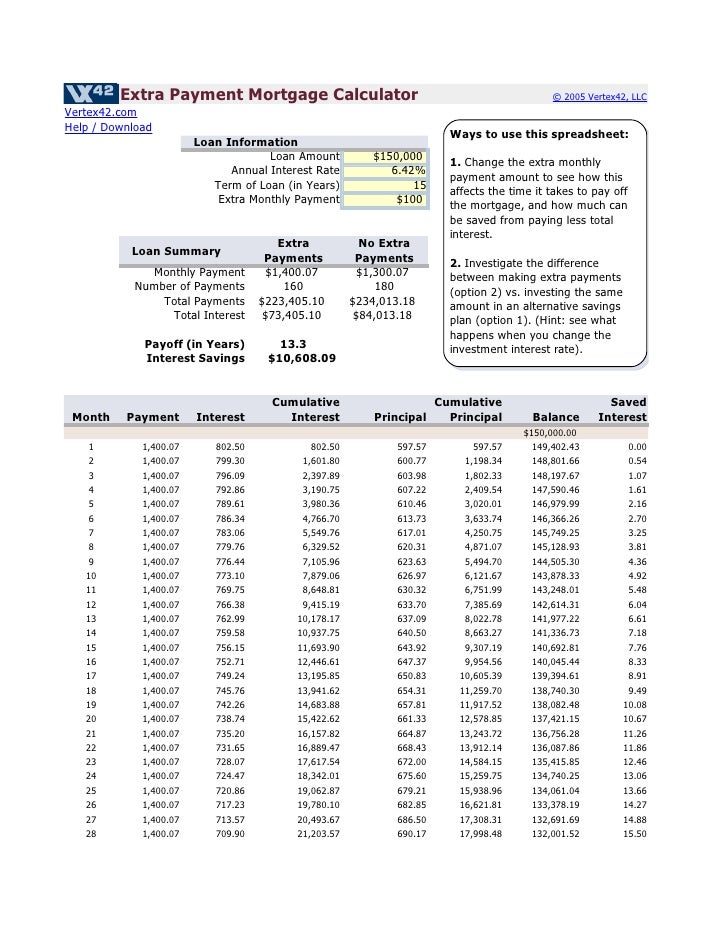

Extra Payment Mortgage Calculator For Excel

Extra Payment Mortgage Calculator For Excel

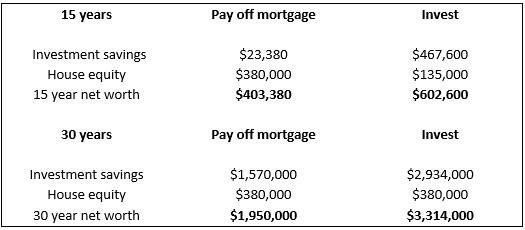

Deciding The Pay Down Mortgage Or Invest Debate Esi Money

Deciding The Pay Down Mortgage Or Invest Debate Esi Money

Deciding The Pay Down Mortgage Or Invest Debate Esi Money

Deciding The Pay Down Mortgage Or Invest Debate Esi Money

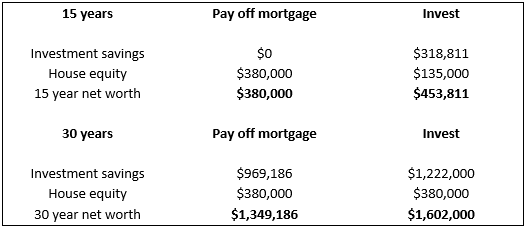

Should You Pay Off Your Mortgage Or Invest The Cash

Should You Pay Off Your Mortgage Or Invest The Cash

Extra Payment Calculator Is It The Right Thing To Do

Extra Payment Calculator Is It The Right Thing To Do

Compound Interest Calculator For Excel

Compound Interest Calculator For Excel

Pay Off Mortgage Early Or Invest Here S The Math Behind The

Mortgage Repayment Calculator Vs Investment Returns Spreadsheet

Mortgage Repayment Calculator Vs Investment Returns Spreadsheet

How To Calculate A Monthly Loan Payment In Excel

How To Calculate A Monthly Loan Payment In Excel

Free Savings Calculator For Excel

Free Savings Calculator For Excel