Investment management and financial planning fees were tax deductible through tax year 2017. Alternatively the irs also allows investment advisory fees to be paid directly from a retirement account which effectively allows the fee to be paid with 100 pre tax dollars.

Maximizing Pre Tax Investment Advisory Fees After Tcja

Maximizing Pre Tax Investment Advisory Fees After Tcja

are investment advisory fees in an ira tax deductible

are investment advisory fees in an ira tax deductible is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in are investment advisory fees in an ira tax deductible content depends on the source site. We hope you do not use it for commercial purposes.

Nonetheless the bottom line is that in the current environment when investment advisory fees are no longer deductible at all in outside taxable accounts its more appealing than ever to at least bill a pro rata portion of the advisory fee from the pre tax ira.

Are investment advisory fees in an ira tax deductible. If you itemize your tax deductions your investment advisory fees may be tax deductible as either an individual deduction or as a business expense. Then the owner may do best by paying ira fees from outside the ira and leaving as much as possible in the ira to earn tax favored investment returns. Heres what that means for your ira.

They fell into the category of miscellaneous itemized deductions and these deductions were eliminated from the tax code by the tax cuts and jobs act tcja effective tax year 2018. Due to the tax cuts and jobs act tcja of 2017 certain investment related expenses are no longer deductible if you itemize. Certain ira administrative fees are tax deductible if you use assets outside of the ira to pay them.

Roth ira fees roth iras are entirely. In fact the irs even allows investment advisory fees to be deducted when paid on behalf of retirement accounts like iras and 401k plans. If you borrowed money to purchase taxable investments you may still be able to use the interest expenses from the loans to reduce your taxable investment income.

Are investment fees tax deductible. The tax deductible treatment of ira and 401k fees is a bit different. Hope you enjoyed the tax deduction you took for your investment fees because youll no longer be able to take it.

Investment advisory fees related to your ira can have a significant impact on your investment performance and the overall value of the account. If financial advisor or investment manager fees are deducted directly from an ira or 401k the fees are effectively paid with 100 pre tax dollars. Whether you can take such a deduction and how you do it for an individual retirement account or ira will depend upon the type of ira and the nature of the fee.

It makes sense to attempt to offset some of this.

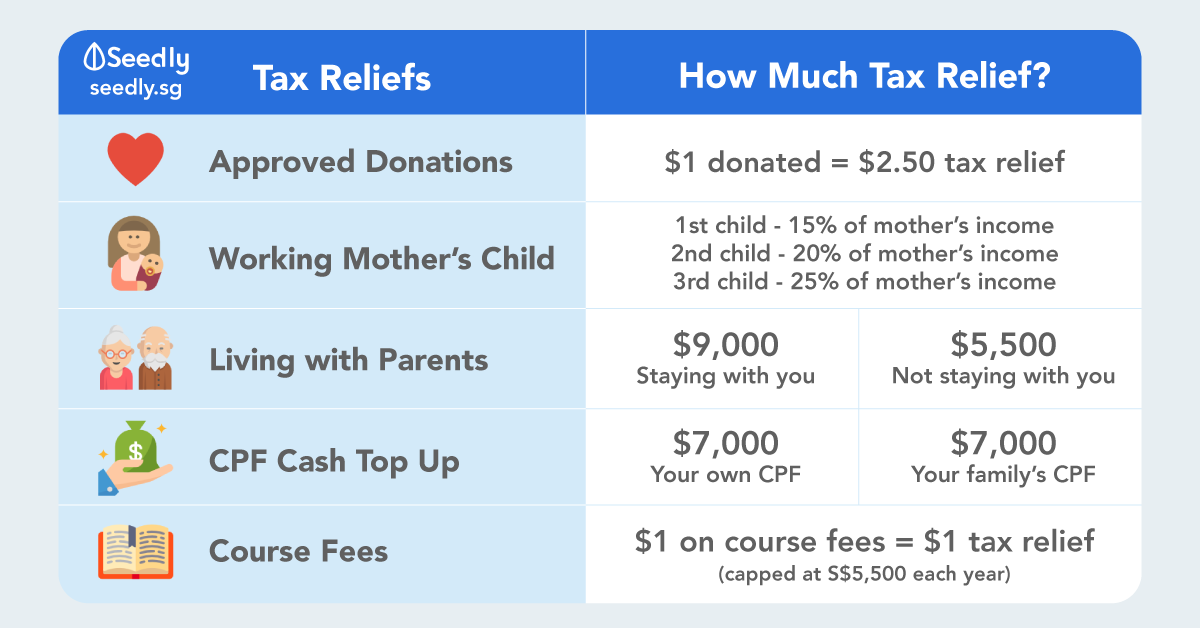

Your Cheat Sheet Personal Income Tax In Singapore Ya 2019

Your Cheat Sheet Personal Income Tax In Singapore Ya 2019

This Investment Fee Tax Break Is Gone What That Means For

This Investment Fee Tax Break Is Gone What That Means For

The New Tax Law S Impact On Investment Advisory Fees Iras

The New Tax Law S Impact On Investment Advisory Fees Iras

Maximizing Pre Tax Investment Advisory Fees After Tcja

Maximizing Pre Tax Investment Advisory Fees After Tcja

Investment Fees Are Not Deductible But Borrow Fees Are

Investment Fees Are Not Deductible But Borrow Fees Are

Maximizing Pre Tax Investment Advisory Fees After Tcja

Maximizing Pre Tax Investment Advisory Fees After Tcja

Seminar On Taxation Of Investment Holding Companies

Maximizing Pre Tax Investment Advisory Fees After Tcja

Maximizing Pre Tax Investment Advisory Fees After Tcja

7 Best Ira Accounts Brokerages In 2020 The Tokenist

7 Best Ira Accounts Brokerages In 2020 The Tokenist

Singapore Corporate Tax 2019 Guide Taxable Income Tax

Singapore Corporate Tax 2019 Guide Taxable Income Tax

Independent Financial Advisor Fee Comparison All In Costs

Independent Financial Advisor Fee Comparison All In Costs