You can also use a third party vendor like morningstar for after tax return calculations. Skip to main content.

Solved Investors Require An After Tax Rate Of Return Of 1

Solved Investors Require An After Tax Rate Of Return Of 1

after tax rate of return on investments

after tax rate of return on investments is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in after tax rate of return on investments content depends on the source site. We hope you do not use it for commercial purposes.

Get a better experience on our site by upgrading your browser.

After tax rate of return on investments. The after tax yield or after tax return is the profitability of an investment after all applicable taxes have been paid. The type of tax paid and the investors marginal tax rate affect the amount of the after tax yield. This works if your client is in the top tax bracket.

Believes location matters more for high return investments than for low return assets. Both russell investments and morningstar use the methodology that the sec mandates which takes the most conservative position by assuming the highest marginal rate applied to the funds distributions. Heres a formula for calculating the after tax return on an investment.

Crunch the numbers to determine your real after tax return on a particular investment and see whether you can improve your real return by moving you money to a different investment type. Your after tax return on a marketable security is your total profit as a percentage of the original. Boost your after tax investment returns.

When you use after tax money to purchase investments that typically deliver investment returns in the form of qualified dividends and long term capital gains you may pay fewer taxes over the long haulthese types of investment income are subject to a lower tax rateand in some cases long term capital gains are not taxed at all. If the investors tax rate is 25. Many businesses and high income investors will use the after tax return to determine their earnings.

An after tax return is any profit made on an investment after subtracting the amount due for taxes. And your dividends are taxed as ordinary income at a rate of 386 percent. A marketable security is an investment that you can easily buy or sell such as a stock or bond.

It is a more accurate measure of an investors net. When calculating your return on investment use our after tax rate of return calculator to accurately determine your return on investments. The after tax real rate of return is the actual financial benefit of an investment after accounting for the effects of inflation and taxes.

The after tax yield may vary depending on whether the investor has to pay income tax or capital gains tax.

Importance Of Rate Of Return In Investments

Importance Of Rate Of Return In Investments

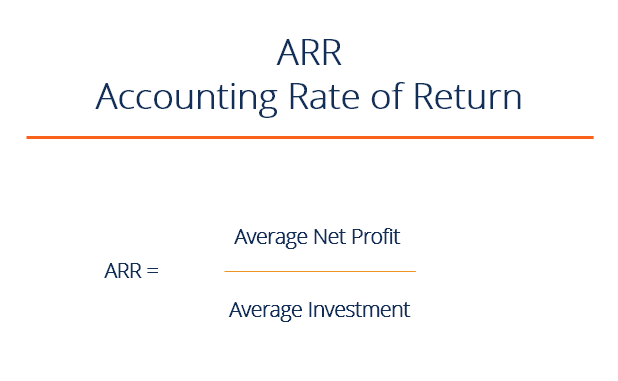

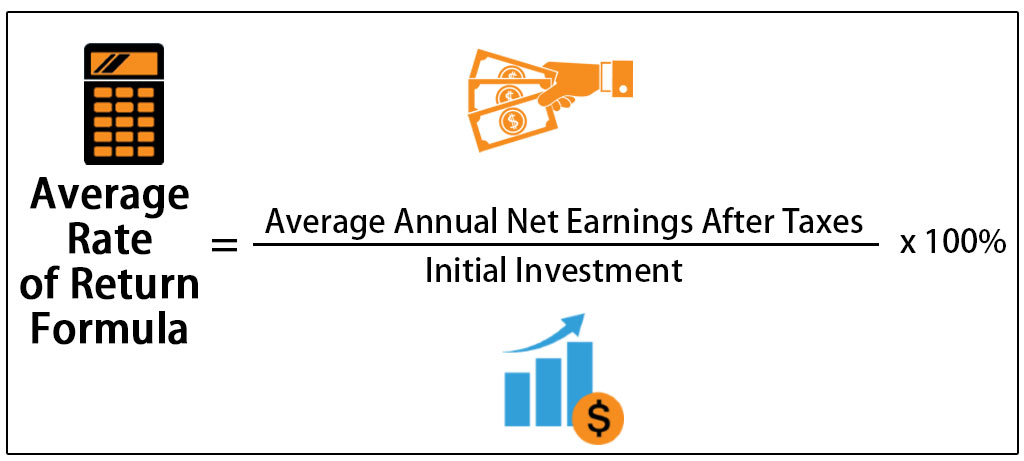

Average Rate Of Return Formula Definition Examples

Average Rate Of Return Formula Definition Examples

Chapter 11 Investments Ppt Video Online Download

Chapter 11 Investments Ppt Video Online Download

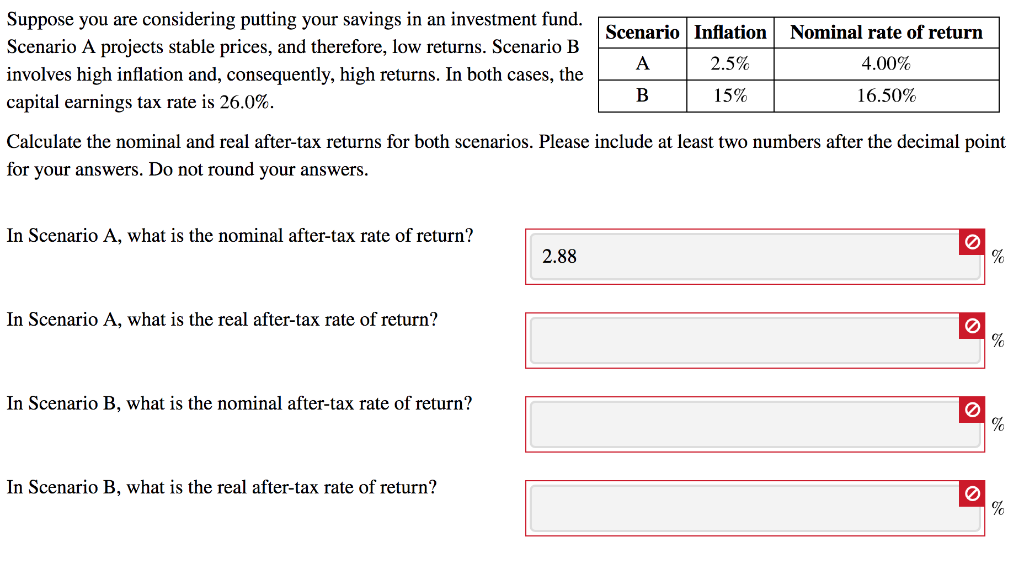

Solved Suppose You Are Considering Putting Your Savings I

Solved Suppose You Are Considering Putting Your Savings I

How To Calculate After Tax Return If Investor Can Use

How To Calculate After Tax Return If Investor Can Use

Introduction To Risk Return And The Historical Record

Introduction To Risk Return And The Historical Record

It S Tax Time Implications Of Tax Reform For Banks Mercer

Return On Equity Roe Formula Examples And Guide To Roe

Return On Equity Roe Formula Examples And Guide To Roe

:max_bytes(150000):strip_icc()/latex_bc1180286b6f82914c60e66cc2e96c8e-569c2f77f84c4de78f65b608880bb9fb.jpg)