What is the market approach to valuation. In this article well walk through several techniques and discuss the advantages and disadvantages of each.

Business Valuation Knowledge Grab

advantages of investment method of valuation

advantages of investment method of valuation is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in advantages of investment method of valuation content depends on the source site. We hope you do not use it for commercial purposes.

These methods of valuation are used in investment banking equity research private equity corporate development mergers acquisitions.

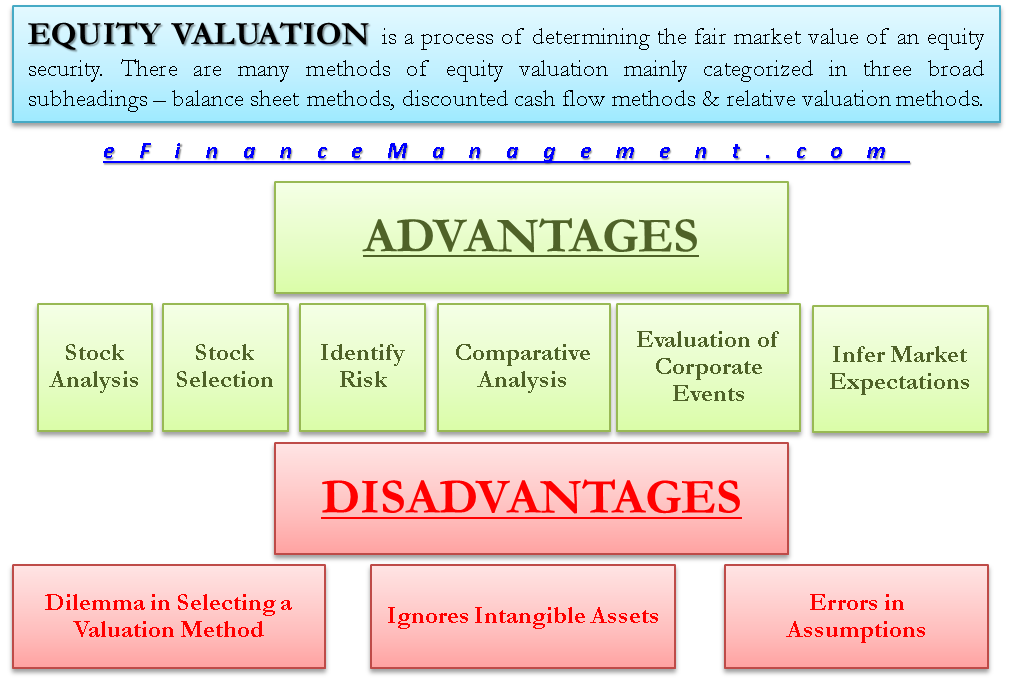

Advantages of investment method of valuation. Each valuation method naturally has its own set of advantages and disadvantages. The capitalisation of income is central to the method. There are many advantages and disadvantages of equity valuation which are as follows.

The major practical problem of this method lies in projecting the future rates of interest at which the intermediate cash inflows received will be re invested. Keep in mind there is no right or wrong valuation method. When estimating a propertys investment value there are a variety of real estate valuation methods you can use.

We need the following inputs. Traditional method of investment valuation for beginners the traditional method of investment valuation is a way to value a flow of income. Advantages of equity valuation helps in stock analysis.

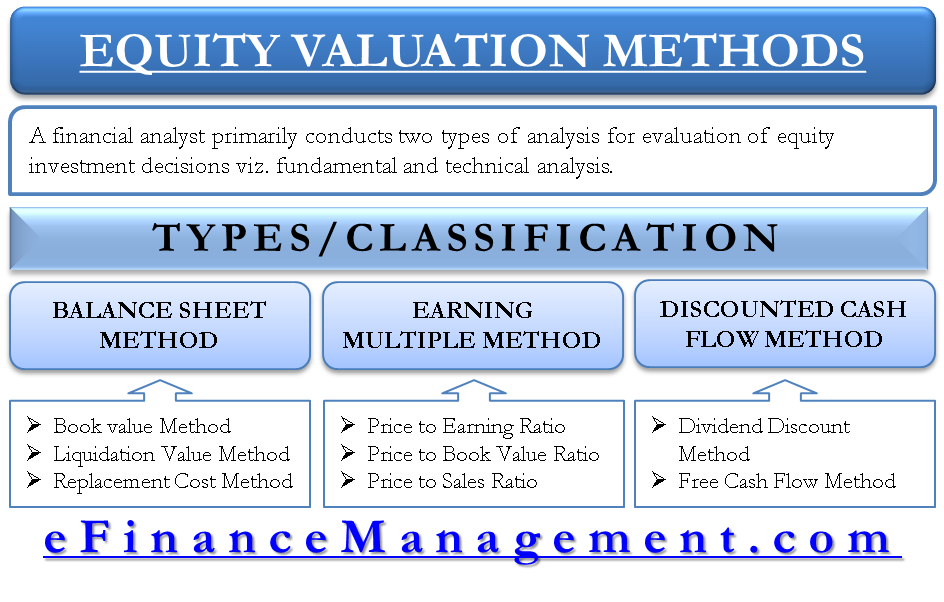

As we know there are many methods of equity valuation such as balance sheet methods discounted cash flow methods and relative valuation methods. In commercial property circles the contractors method of valuation also known as summation is a very useful valuation tool for aspiring property investors or real estate developers as it helps to identify the value of unusual or very specialist properties that rarely come to market and are generally unsuited to other more common valuation techniques. The valuation is a 2 step process.

The market approach is a valuation method valuation methods when valuing a company as a going concern there are three main valuation methods used. Dcf analysis comparable companies and precedent transactions. Second we work backwards using our desired roi and investment amount to derive the pre money valuation.

Start studying advantages and disadvantages of valuation methods. Here are the main pros and cons of each. Valuation technique advantages and disadvantages.

Some are more reliable and accurate while others are easier to perform for example. The venture capital method. Additionally some valuation methods are specifically indicated in certain circumstances.

The method enables the valuer to represent annual amounts as a capital sum. Income in property is usually the rent and we shall be using a commercial property subject to a forthcoming rent review to. Advantages of discounted cash flow methods 1 this method takes into account the entire economic life of an investment and income therefrom.

Learn vocabulary terms and more with flashcards games and other study tools. In the investment method the annual rental income presently received or expected over a period of time for the lease of the property is estimated and deducted therefrom the expenses or outgoings incidental to the ownership of the property to. Investment method of valuation this method of valuation is usually applied for investment properties.

First we want to derive the terminal value of the business in the harvest year. That would be the homeowner value.

Valuation Approaches Advantages And Disadvantages

Valuation Approaches Advantages And Disadvantages

Business Valuation Knowledge Grab

Advantages And Disadvantages Of Equity Valuation Efm

Advantages And Disadvantages Of Equity Valuation Efm

Valuation Approaches Advantages And Disadvantages

Valuation Approaches Advantages And Disadvantages

Equity Valuation Methods Types Balance Sheet Dcf

Equity Valuation Methods Types Balance Sheet Dcf

Advantages And Disadvantages Of Npv Net Present Value

Advantages And Disadvantages Of Npv Net Present Value

Advantages And Disadvantages Of Net Present Value Npv Efm

Advantages And Disadvantages Of Net Present Value Npv Efm

Advantages And Disadvantages Of Equity Valuation Investing

Advantages And Disadvantages Of Equity Valuation Investing

Valuation Methods Three Main Approaches To Value A Business

Valuation Methods Three Main Approaches To Value A Business

Advantages And Limitations Of Multi Criteria Valuation

Advantages And Limitations Of Multi Criteria Valuation

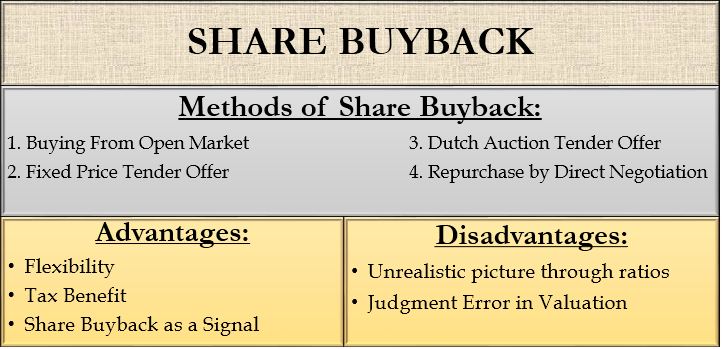

Share Buyback Methods Advantages And Disadvantages

Share Buyback Methods Advantages And Disadvantages