1940 as amended the act and is qualified to serve as an investment manager as defined in section. 338 fiduciary how are they different.

Fiduciary Roles Under Erisa By Pentegra Issuu

Fiduciary Roles Under Erisa By Pentegra Issuu

erisa section 3 38 investment manager

erisa section 3 38 investment manager is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in erisa section 3 38 investment manager content depends on the source site. We hope you do not use it for commercial purposes.

The 38th definition in the act erisa section 338 is the definition of investment manager.

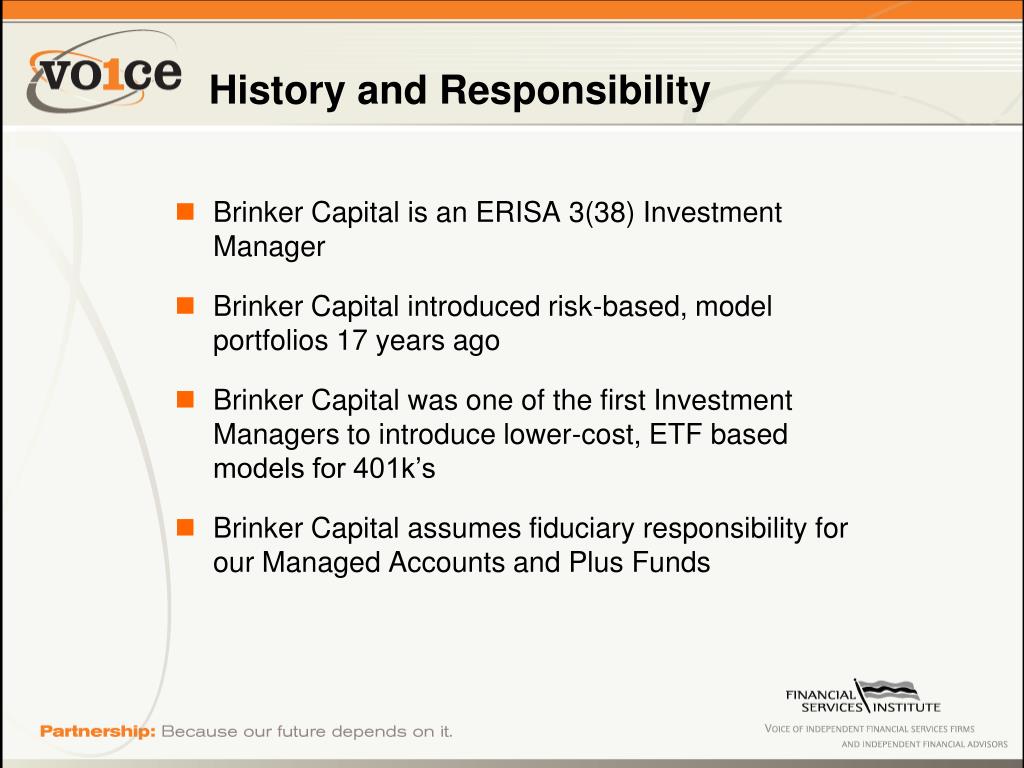

Erisa section 3 38 investment manager. The primary fiduciary liability for the investments is assumed by the 338 investment manager. Delegating control of a 401k plans investment lineup to an investment manager as defined by section 338 of erisa can be one of the easiest and most effective ways an employer can minimize their liability for poor investment selection and monitoring decisions. An investment manager is special type of fiduciary one who has been specifically appointed to have full discretionary authority and control to make the actual investment decisions.

Erisa provides that a plan sponsor can delegate the responsibility and thus likely the liability of selecting monitoring and replacing investments to a 338 investment managerfiduciary. The 321 and the 338. Section 338 defines investment manager as a fiduciary due to their responsibility to manage the plans assets.

Erisa provides that a plan sponsor can delegate the significant responsibility and significant liability of selecting monitoring and replacing of investments to the. 338 of the employee retirement income security act of 1974 as amended erisa. Essentially the 338 is responsible for selecting managing monitoring and benchmarking the investment offerings of the plan.

338 investment manager section 338 is an investment manager and by definition is a fiduciary because they take discretion authority and control of the plans assets. Since the use of 316 administrators is quite uncommon for all but the smallest of plans we will focus our attention on the erisa definitions of fiduciary and investment manager. An erisa 338 investment manager does it for you.

The name of this particular fiduciary makes it easy to guess its role. Whereas iron is registered as an investment adviser under the investment advisers act of. Named for the sections of erisa which define them 321 and 338 fiduciaries are both individuals or entities that provide investment expertise to 401k plan sponsors.

A 338 investment manager is a codified investment fiduciary on a retirement plan as defined by erisa section 338. Meeting the prudent expert standard. Under erisa section 321 a fiduciary often called a 321 fiduciary is defined as follows.

Erisa 338 and the allocation of liability that comes with using an investment manager to manage an investment portfolio is a very very dubious provision for a fiduciary committee to use if the consultant manager is not actually managing an investment portfolio. Erisa allows for businesses to hire two classes of investment fiduciaries. Either way you still have the responsibility to prudently select and periodically monitor the 321 investment advisor or the 338 investment manager.

Sponsored By Ishares Prepared By The Wagner Law Group

Sponsored By Ishares Prepared By The Wagner Law Group

The Nuts Bolts Of Managing Erisa Plan Assets Schulte

The Nuts Bolts Of Managing Erisa Plan Assets Schulte

What Is Erisa Erisa Is The Acronym For The Employee

What Is Erisa Erisa Is The Acronym For The Employee

Defining Fiduciary Roles In A Retirement Plan

Defining Fiduciary Roles In A Retirement Plan

The Advisor S Role In The New World For Producer Use Only

The Advisor S Role In The New World For Producer Use Only

Do You Need An Investment Life Guard Erisa 3 38

Do You Need An Investment Life Guard Erisa 3 38

Do You Need An Investment Life Guard Erisa 3 38

Do You Need An Investment Life Guard Erisa 3 38

3 21 Investment Advisor Or 3 38 Investment Manager Which

3 21 Investment Advisor Or 3 38 Investment Manager Which

Qualified Retirement Plans Understanding Your Fiduciary Duty

Qualified Retirement Plans Understanding Your Fiduciary Duty

Fiduciary Sudoku Part 4 Comprehending 3 38 Explaining

Fiduciary Sudoku Part 4 Comprehending 3 38 Explaining

Artifex Institutional 401 K Ser Simplebooklet Com

Artifex Institutional 401 K Ser Simplebooklet Com