The correct title for most real estate ira investments is. Because the ira llc is such a great tool for investing in real estate it is often referred to simply as a real estate ira.

/GettyImages-512693107-593a84dc3df78c537bc8b08a.jpg) How To Invest In Real Estate With A Self Directed Ira

How To Invest In Real Estate With A Self Directed Ira

can ira funds be invested in real estate

can ira funds be invested in real estate is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in can ira funds be invested in real estate content depends on the source site. We hope you do not use it for commercial purposes.

This would be an expensive mistake.

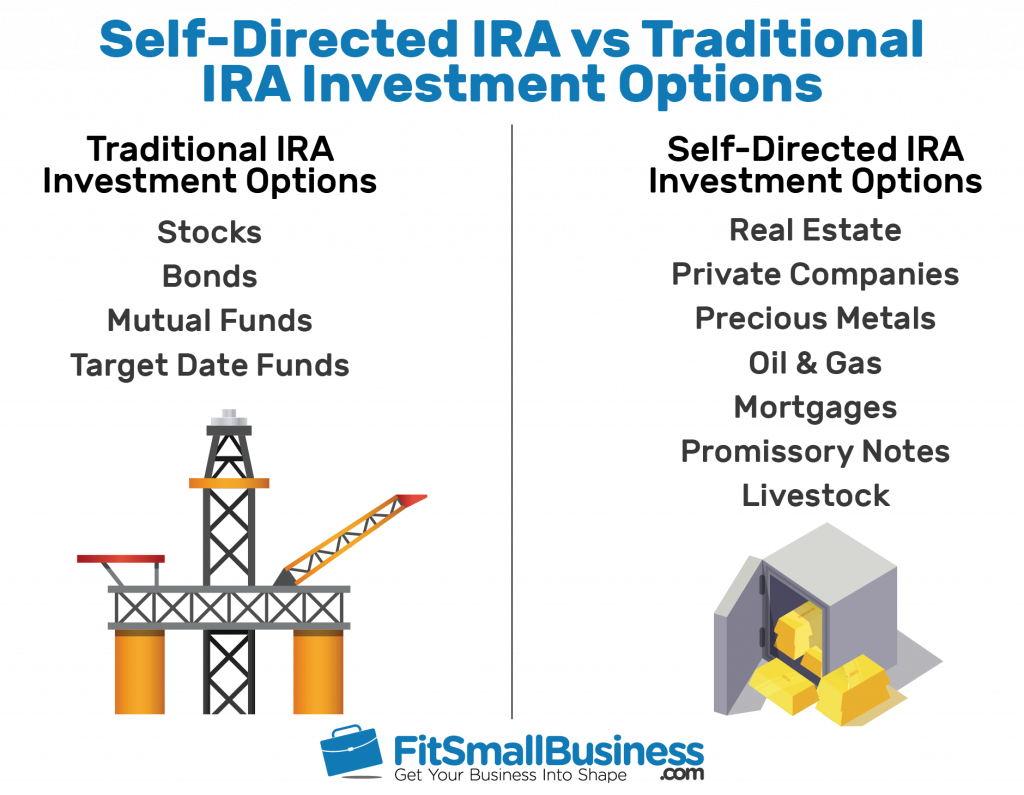

Can ira funds be invested in real estate. Real estate investment by individuals is on the rise but for the most part it has been limited to real estate investment trusts reits and real estate mutual funds. Thus investing ira money in real estate will usually call for a self directed ira. Ira law does not prohibit investing in real estate but trustees are not required to offer real estate as an option.

What is a self directed ira important definitions benefits risks of using an sdira to purchase in income property rules for 2018 tax pitfalls steps to get started more. Yes you may enjoy tax deferment but 99 percent of investors would not be well equipped for this investment. In this 9 part free investor guide youll learn how to use a self directed ira to invest in real estate.

The irs permits the use of ira and 401k funds to invest in alternate investments such as real estate. Equity trust company custodian fbo for benefit of your name ira 4. And even though many retail.

For example because of administrative burdens many ira trustees do not permit ira owners to invest ira funds in real estate. If you buy real estate with an ira improperly you can disqualify the ira which makes all of your funds taxable. The funds in your ira are tax deferred.

Because of this need to be nimble it is widely acknowledged that a self directed ira llc offering checkbook control is a superior vehicle for investing in real estate with ira funds. If your ira document contains this restriction and you ignore it and invest in real property you can end up with a taxable event and lose your retirement savings. Any real estate property you buy must be strictly for investment purposes.

You and family members cant use it. Here are the basic rules that must be followed to have a qualified real estate purchase in an ira. My biggest concern with owning real estate inside your ira is how illiquid it can be.

You can purchase property in more ways than just an outright purchase of the full amount from your account. You can hold real estate in your ira but youll need a self directed ira to do so. Even in this case you still must check the custodial agreement.

Real estate in an ira can be purchased without 100 funding from your ira. Ira trustees are permitted to impose additional restrictions on investments. Generally you need a self directed ira for alternate investing.

:brightness(10):contrast(5):no_upscale()/GettyImages-512693107-593a84dc3df78c537bc8b08a.jpg) How To Invest In Real Estate With A Self Directed Ira

How To Invest In Real Estate With A Self Directed Ira

Diversify Further Checkbook Investing With Ira Funds

Diversify Further Checkbook Investing With Ira Funds

Can I Buy Foreign Real Estate With My Ira Premier

Can I Buy Foreign Real Estate With My Ira Premier

The Real Estate Ira Transaction Process Infographic

The Real Estate Ira Transaction Process Infographic

Real Estate Ira Real Estate Investment St Louis Cpa Firm

Self Directed Ira Real Estate Investing Rules And Faqs

Self Directed Ira Real Estate Investing Rules And Faqs

How To Use A Self Directed Ira For Real Estate

Using Self Directed Iras To Purchase Real Estate Ota

Using Self Directed Iras To Purchase Real Estate Ota

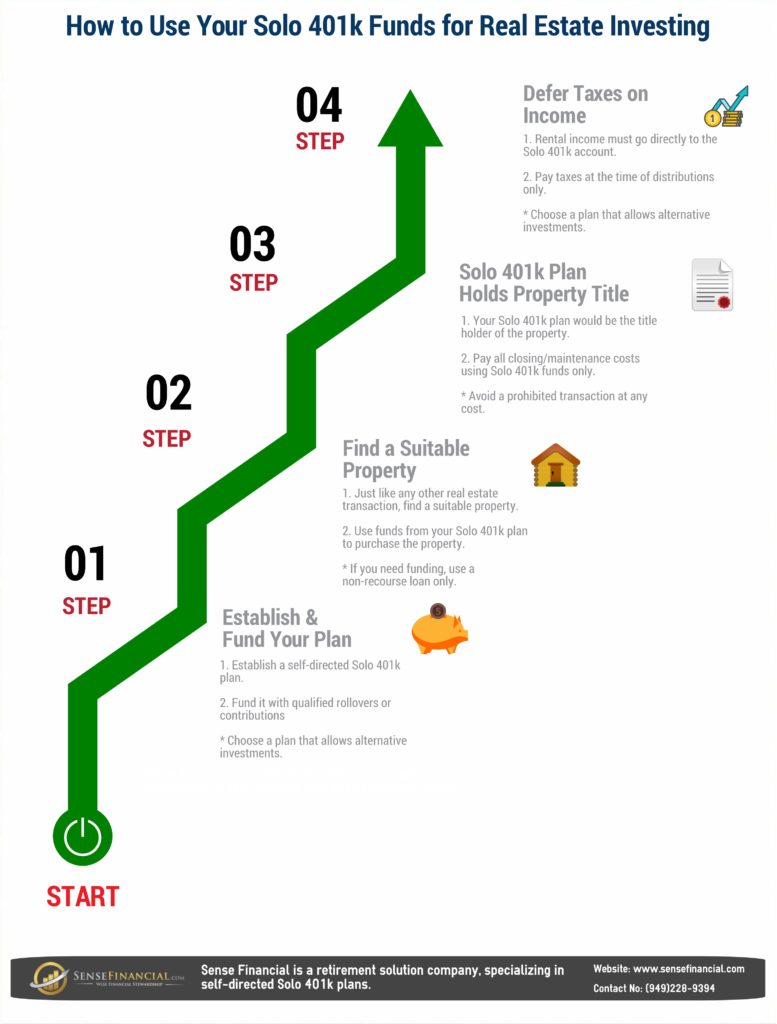

Infographic How To Use Solo 401 Plan Funds For Real Estate

Infographic How To Use Solo 401 Plan Funds For Real Estate

Should You Invest In Real Estate With Ira Money

Should You Invest In Real Estate With Ira Money

Non Recourse Loan Lender Self Directed Ira Benefits

Non Recourse Loan Lender Self Directed Ira Benefits