This estimate is based on the assumption that you have at least good credit or better. Average credit may get you approved but good credit is better.

Pros Cons Of A 30 Year Fixed Rate Mortgage A Wealth Of

Pros Cons Of A 30 Year Fixed Rate Mortgage A Wealth Of

30 year fixed mortgage rates for investment properties

30 year fixed mortgage rates for investment properties is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in 30 year fixed mortgage rates for investment properties content depends on the source site. We hope you do not use it for commercial purposes.

Why are mortgage rates higher on investment properties.

30 year fixed mortgage rates for investment properties. The table below enables you to compare non owner occupied mortgage rates and fees for leading lenders in your area. The difference in rates changes daily and varies with different banks but a 15 year loan is usually about 5 percent less than a 30 year fixed mortgage. The least you can put down on an investment property loan is 20 percent but you wont see the best available rates until you increase your down payment to 30 percent or more.

Investment properties appeal to those who seek to build wealth by perhaps flipping fixer uppers or buying rentals. Investment properties provide a vehicle that allows you to enjoy the potential for market appreciation while building equity each month. Today for example you might see around 4625 for a primary residence for a 30 year fixed rate mortgage and 525 to 550 for an investment property ianno said.

Rates are about 25 percent to 75 percent higher for these loans than for an owner occupied mortgage and youll be at the lower end of this range if your down payment is larger. You may be able to snag a discounted rate if you go with a 15 year fixed vs. The biggest advantage of a 15 year mortgage is the interest rate is less than a 30 year loan.

How much higher are mortgage rates for investment properties. Find and compare current investment property mortgage rates from lenders in. Investment property mortgage rates are higher.

The current rate of 37 on a 30 year fixed rate mortgage is based on data. More risk when you dont live in the property. For shorter mortgages like hard money loans with terms up to 3 years rates range from 75 13.

There tends to be a wider variation in loan terms for investment property mortgages which makes shopping multiple lenders more important. Va mortgages allow veterans active duty service members and their surviving spouses to obtain investment property loans with no money down and low mortgages rates. As with fha loans the only requirement is that the borrower live in one of the buildings units in this case for at least one year.

With todays low mortgage rates and many bargains available in the real estate market it may be an ideal time to invest in a rental property. Investment mortgage interest rates currently range from 475 to 13 depending on loan type and borrower qualifications. Investors will pay their own homes mortgage first.

Review current non owner occupied mortgage rates for january 11 2020. Buying rental properties is a great investment. But obviously the monthly payments will be higher as a result.

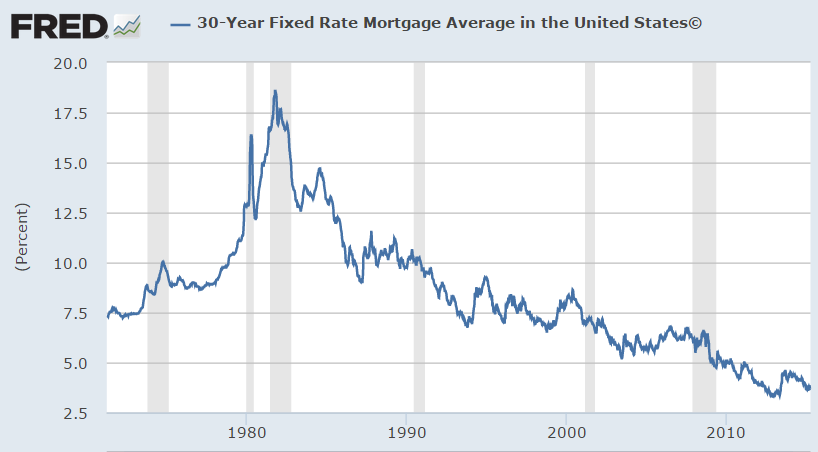

What Will Surging Mortgage Rates Do To Housing Bubble 2

What Will Surging Mortgage Rates Do To Housing Bubble 2

Interest Rates Real Estate Mortgage Rates Mortgage Tips

Interest Rates Real Estate Mortgage Rates Mortgage Tips

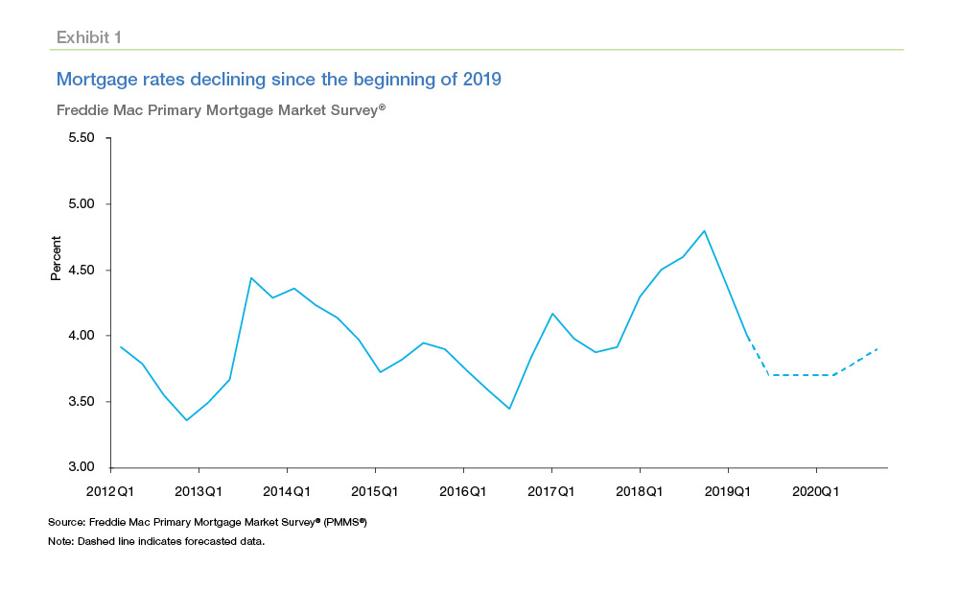

Will Mortgage Rates Stay Low Through 2019 Here S What

Will Mortgage Rates Stay Low Through 2019 Here S What

All American Investor 30 Year Conventional Mortgage Rate

Mortgage Rates Stay Subdued Bringing Relief To Slumping

Mortgage Rates Stay Subdued Bringing Relief To Slumping

What Will Surging Mortgage Rates Do To Housing Bubble 2

What Will Surging Mortgage Rates Do To Housing Bubble 2

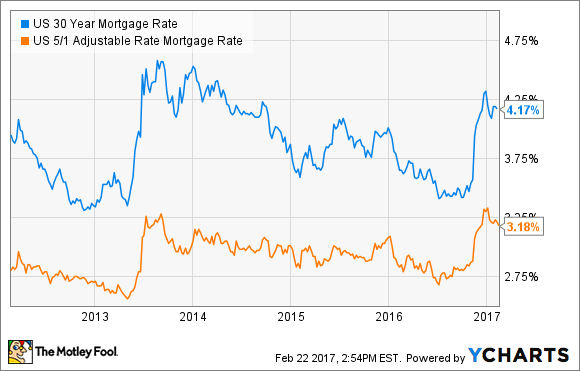

30 Year Vs 5 1 Arm Mortgage Which Should I Pick The

30 Year Vs 5 1 Arm Mortgage Which Should I Pick The

Understanding Treasury Yield And Interest Rates

Mortgage Rates Fall Further As Buyers Rush Into The First

Mortgage Rates Fall Further As Buyers Rush Into The First