Up to 85 of your social security benefits can be taxable. Roth iras offer tax free growth on contributions and earnings.

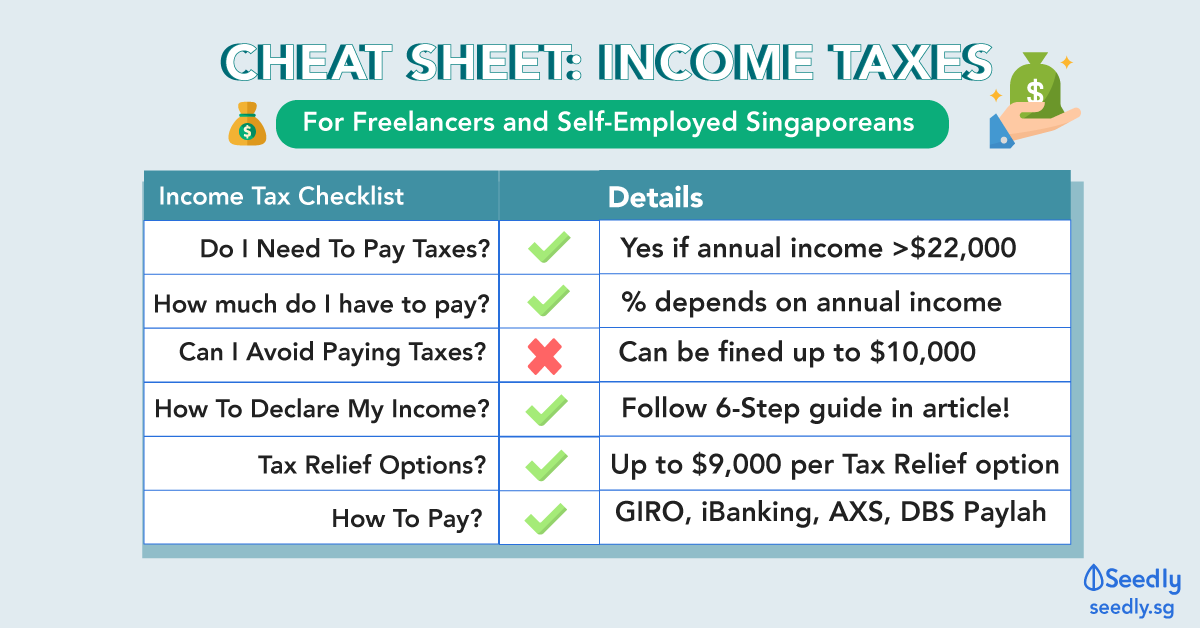

Are You Self Employed Don T Miss Out On Your Income Tax Or

Are You Self Employed Don T Miss Out On Your Income Tax Or

do i have to pay taxes on investment earnings

do i have to pay taxes on investment earnings is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in do i have to pay taxes on investment earnings content depends on the source site. We hope you do not use it for commercial purposes.

For tax advice please speak with a tax professional.

Do i have to pay taxes on investment earnings. When you have other income such as earnings from continuing to work investment income pensions etc. Do you have to pay capital gains on roth ira earnings. Withdrawals on earnings from a roth ira dont count as income but only if you make what the irs deems as qualified distributionsif you follow irs rules earnings grow tax free and you dont pay.

Although contributions to a roth are not tax deductible earnings grow tax. How to pay taxes on investment income estimate the investment income taxes you could owe to the irs. That makes the taxes similar to stocks where capital gains taxes apply b.

The earnings in tax deferred accounts such as a 401ks. Paying taxes on your investment income. Individual states may have their own taxes on investment earnings.

A roth ira can offer a tax advantaged way to save for retirement. There is no age limit for having to pay taxes on social security benefits if you have other sources of income along with the ss benefits. Tldr yes in the usa the irs says that cryptocurrency is taxed like property.

Up to 85 of your ss can be taxable. How much will you owe. Of all the benefits roth iras offerand there are manythe most significant is the way the taxes work.

Some taxes are due only when you sell investments at a profit while other taxes are due when your investments pay you a distribution. This is informational only.

Are You Self Employed Don T Miss Out On Your Income Tax Or

Are You Self Employed Don T Miss Out On Your Income Tax Or

Corporate Tax In Singapore How To Pay Tax Rate Exemptions

Corporate Tax In Singapore How To Pay Tax Rate Exemptions

/stocks-56a634905f9b58b7d0e0671f.jpg) Will I Have To Pay Taxes On Any Stocks I Own

Will I Have To Pay Taxes On Any Stocks I Own

6 Ways You Can Legally Reduce Your Income Tax For Ya 2020

6 Ways You Can Legally Reduce Your Income Tax For Ya 2020

5 Retirement Saving Strategies You Should Know About By

5 Retirement Saving Strategies You Should Know About By

Singapore Personal Income Tax Guide Guidemesingapore By

Singapore Personal Income Tax Guide Guidemesingapore By

Accumulating And Transferring Repsource Manulife Financial

Accumulating And Transferring Repsource Manulife Financial

You Don T Have To Pay Federal Income Tax If You Make This

You Don T Have To Pay Federal Income Tax If You Make This

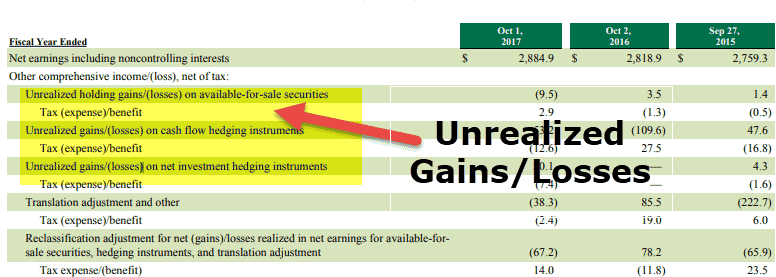

Unrealized Gains Losses Examples Accounting For

Unrealized Gains Losses Examples Accounting For

/TaxPolicy.Paul.4.2.1_-_figure_1-512c20575f6b4bc6bf23ef34dee0f9c4.png)

:max_bytes(150000):strip_icc()/TaxPolicy.Paul.4.2.1_-_figure_1-512c20575f6b4bc6bf23ef34dee0f9c4.png)