Why calculating irr is useful. The internal rate of return or irr is a common metric in commercial real estate and finance.

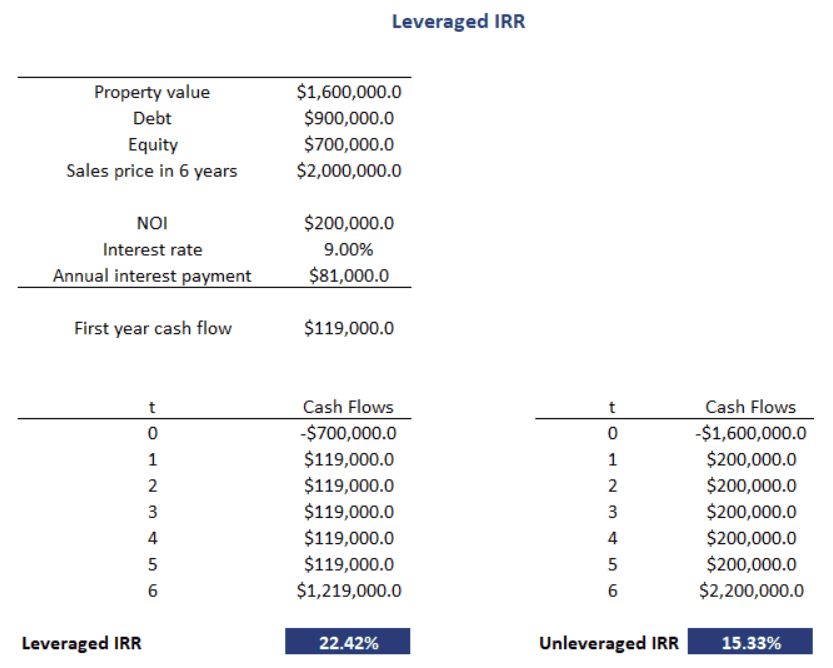

Leveraged Irr Real Estate Breaking Down Finance

Leveraged Irr Real Estate Breaking Down Finance

calculating irr on real estate investment

calculating irr on real estate investment is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in calculating irr on real estate investment content depends on the source site. We hope you do not use it for commercial purposes.

But few of those that use the internal rate of return irr in real estate know how to calculate it.

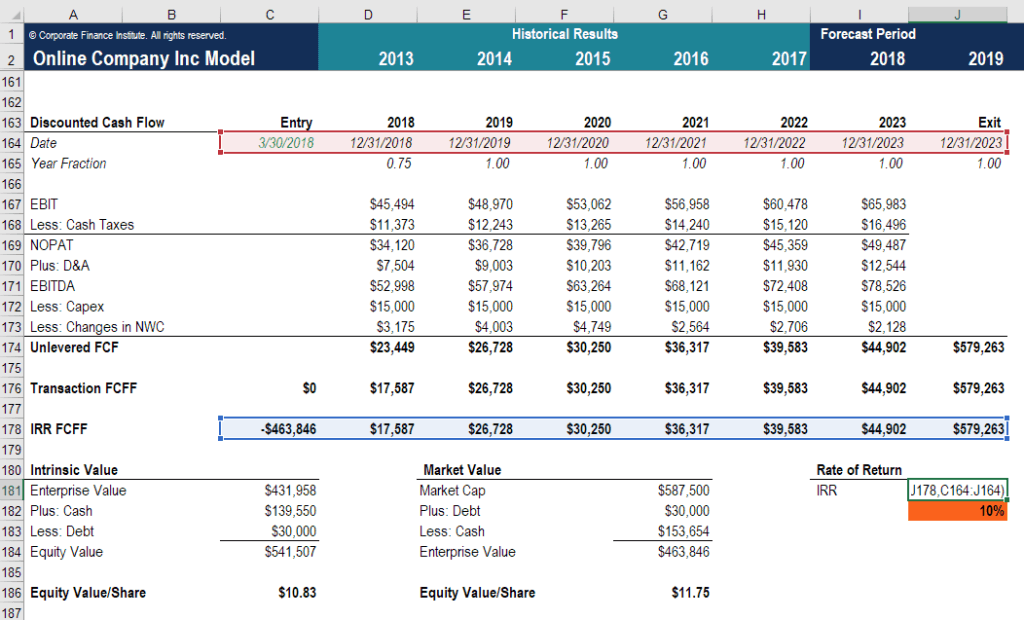

Calculating irr on real estate investment. Evaluating irr for real estate investments is a very important tool for investors to analyze different projects. By assigning projected cash flow distributions on a periodic basis along with any projected gain on sale upon exitat reversion we can calculate irr. Irr and real estate investments.

In this post well explore what irr objectives can tell us about a given real estate investment. Internal rate of return. Irr or the internal rate of return is defined as the discount rate at which the net present value of a set of cash flows ie the initial investment expressed negatively and the returns expressed positively equals zero.

In light of this one of the most commonly accepted ways to gauge the profitability of a real estate investment is by calculating its internal rate of return irr. To turn a profit on investments real estate investors need to know how to balance risks against potential rewards. In more simple terms it is the rate at which a real estate investment grows or heaven forbid shrinks.

Internal rate of return irr and return on investment roi are two of the most commonly used metrics for evaluating the potential profitability of a real estate investment. Calculating the return on investment roi of a real estate investment property can give you an estimated figure of what you can expect to earn for a fixed point in time. Calculating a historical or expected return may therefore require more effort.

Have you heard of internal rate of return in real estate investing before. Irr or the internal rate of return is a good thing to get familiar with if youre interested in measuring investment performance in commercial real estate. In fact after the cap rate capitalization rate it is the most widely used metric to measure the performance of income properties.

Unlike the cap rate the irr is a well rounded way to estimate a real estate investments profitabilitybecause the irr looks beyond the propertys net operating income and its purchase price which are used to calculate the cap rate you get a clearer picture of the kind of returns the investment will generate from start to finish. The internal rate of return allows investments to be analyzed for profitability by calculating the expected growth rate of an investments returns and is expressed as a percentage. Recall that irr is the average annual return an investor can expect to receive over a certain amount of time given a corresponding amount of cash flows.

While they serve a similar function and are sometimes used interchangeably there are critical differences between the two. Even though irr is commonly used throughout the investment and real estate industries it is one of the most widely misunderstood terms around.

What Can Irr Tell You About Your Real Estate Investment

What Can Irr Tell You About Your Real Estate Investment

Build An Irr Matrix For Real Estate In Excel

Build An Irr Matrix For Real Estate In Excel

How To Calculate The Internal Rate Of Return Irr

Internal Rate Of Return Irr A Guide For Financial Analysts

Internal Rate Of Return Irr A Guide For Financial Analysts

Decoding Real Estate Return Metrics Crowdstreet

Decoding Real Estate Return Metrics Crowdstreet

:max_bytes(150000):strip_icc()/irrexcel-5c3f54c446e0fb0001d5a8af.png) Internal Rate Of Return Irr Definition

Internal Rate Of Return Irr Definition

How To Calculate The Internal Rate Of Return Irr

Real Estate Investment Calculator Landlordo Com

Real Estate Investment Calculator Landlordo Com

How To Calculate Irr For Real Estate Investment Mashvisor

How To Calculate Irr For Real Estate Investment Mashvisor