Hence your question on investments for the salaried will be useful for more than 60 crore indians hence i am excited to answer through my point of view. Investment plans premium features returns and maturity benefits.

6 Best Investment Options For A Salaried Person Fd Sip Nps

6 Best Investment Options For A Salaried Person Fd Sip Nps

best investment plan for salaried employees

best investment plan for salaried employees is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in best investment plan for salaried employees content depends on the source site. We hope you do not use it for commercial purposes.

I will list out few options here and will explain why a particular option is not go.

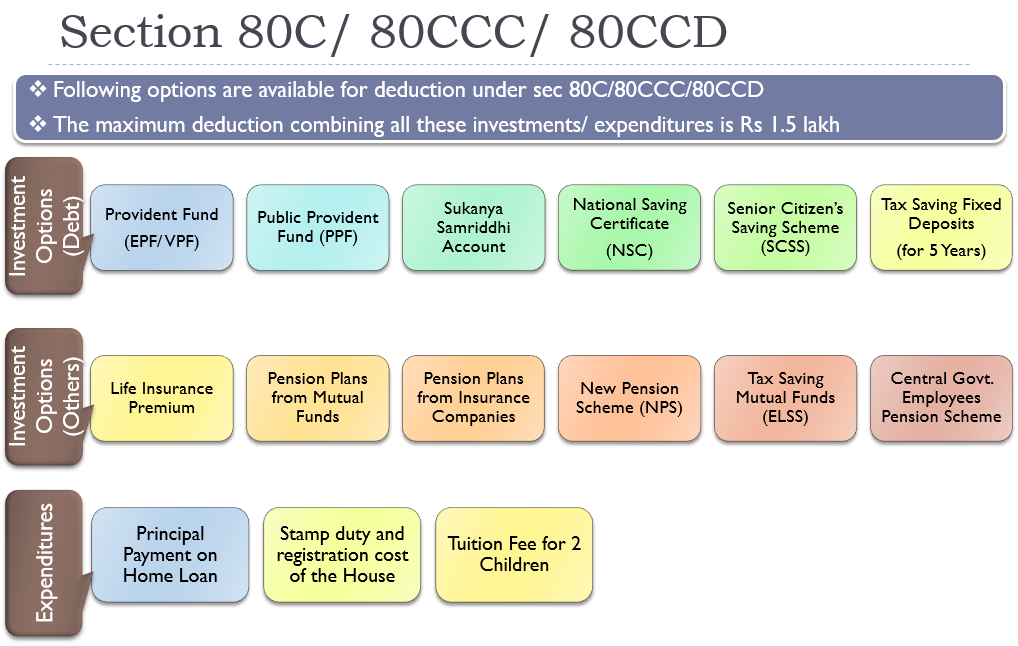

Best investment plan for salaried employees. Make sure that your immediate and mid year financial needs are covered as most of the tax saving investments have a minimum lock in period of five years. Some of the best investment options for salaried persons. Compare and buy online investment plans get free quotes and online support from easypolicy.

The location of the property is the single most important factor that will determine the value of your property and also the rental that it can earn. This investment option is one of the best for salaried person with medium income. 5 best options for those looking to invest upto rs 5 lakhs.

Points to remember in tax planning for salaried employees. 7 important steps to plan for your retirement. If you do not intend to live in it the second property you buy can be your investment.

Best investment plan for salaried employees 1. Best investment plan in india easypolicy. The employees provident funds came into effect on 4 march 1952.

Ulip is a unit linked insurance plan which is offered by a life insurance. There are ample of opportunities to invest your money but after having 3 years experience in chartered accountancy i have narrowed my options. Bank fds or fixed deposits are money invested in a bank for a fixed period fetching interest from the bank.

However it is a good tax planning option for salaried employees. There is no. Now let us look at the 5 best mutual fund plans for a salaried individual.

7 best investment options for a salaried person. It is vital to consider a number of investment options before making a final decision. National savings certificates also known as nsc is a saving bond mainly used for small saving and income tax saving investment in india part of the postal saving system of indian postal service india post.

What type of salaried perso. The below mentioned options are the best investment options for a salaried person. By sunil fernandes.

Dear friend over 70 people in india are salaried i guess. Invesco india tax plan. Employee provident fund is a very.

The house that you live in is for self consumption and should never be considered as an investment. Epf employees provident fund which is popularly known as the employees provident funds are the first option for investment when it comes to a salaried person. This scheme aims to generate long term capital growth from a diversified portfolio of predominantly in equity and equity related securities.

6 Best Investment Options For A Salaried Person Fd Sip Nps

6 Best Investment Options For A Salaried Person Fd Sip Nps

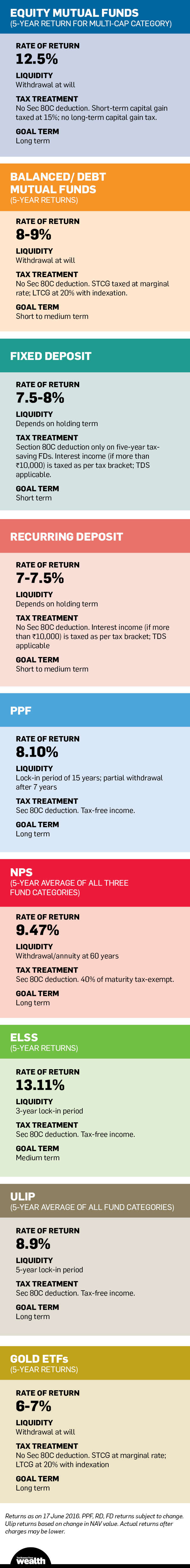

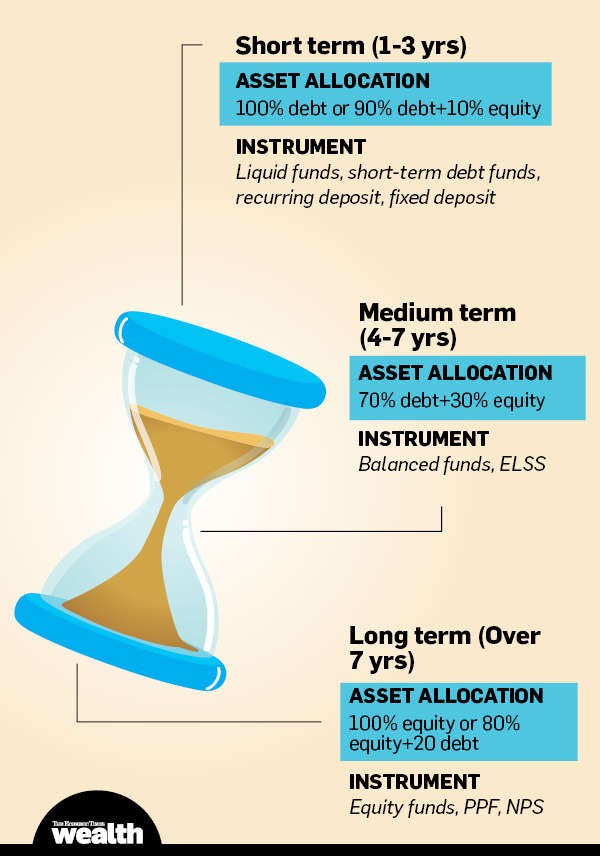

Best Investment Options Plans In India For Short Medium

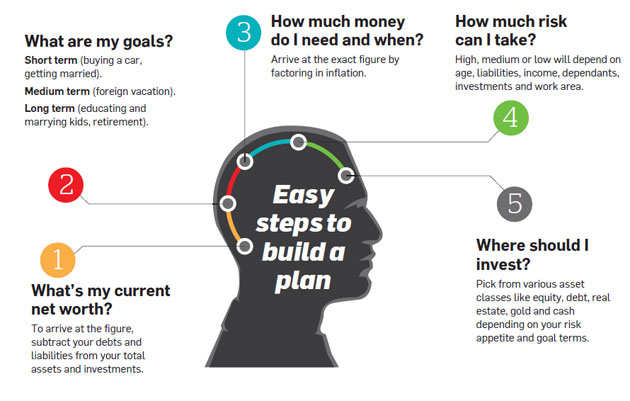

Eight Money Tips To Help Young Earners Plan Their Finances

Eight Money Tips To Help Young Earners Plan Their Finances

Eight Money Tips To Help Young Earners Plan Their Finances

Eight Money Tips To Help Young Earners Plan Their Finances

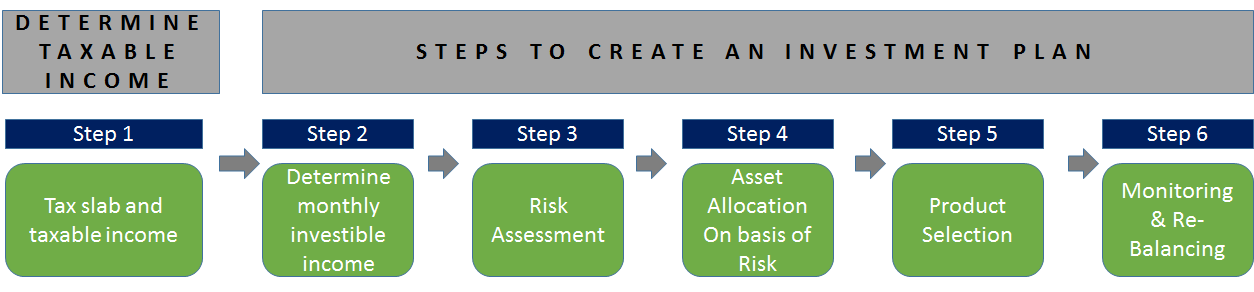

Download Complete Tax Planning Guide In Pdf For Salaried And

Download Complete Tax Planning Guide In Pdf For Salaried And

Eight Money Tips To Help Young Earners Plan Their Finances

Eight Money Tips To Help Young Earners Plan Their Finances

A Singaporean Guide Where To Invest 10 000 Right Now

A Singaporean Guide Where To Invest 10 000 Right Now

What Are The Best Saving Options For A Middle Class

What Are The Best Saving Options For A Middle Class

A Singaporean Guide Where To Invest 10 000 Right Now

A Singaporean Guide Where To Invest 10 000 Right Now

5 Best Investment Plans And Strategies For Salaried

5 Best Investment Plans And Strategies For Salaried

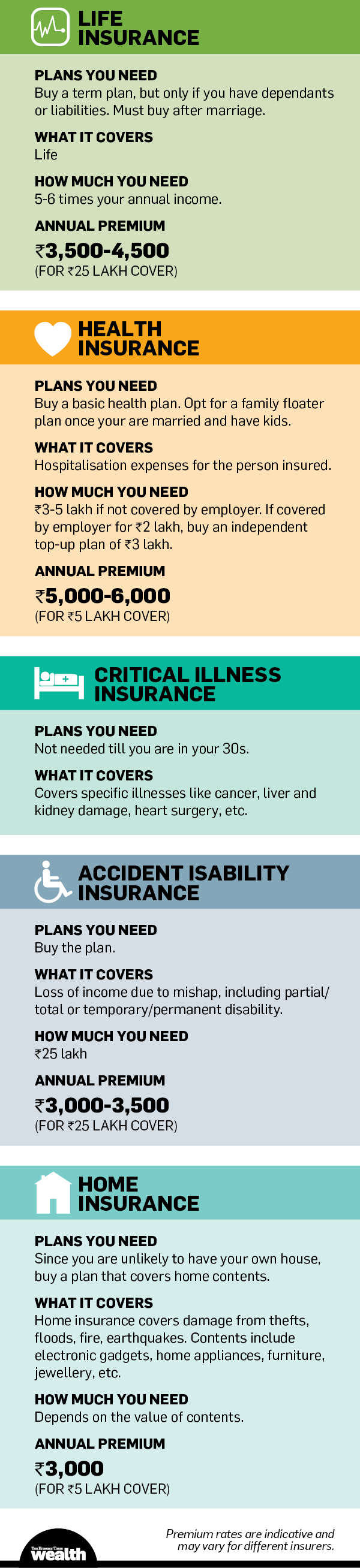

5 Golden Rules Of Financial Planning The Economic Times

5 Golden Rules Of Financial Planning The Economic Times