Lets compare the two. Take that money and be grateful they offer it.

Contribute To My 401k Or Invest In An After Tax Brokerage

Contribute To My 401k Or Invest In An After Tax Brokerage

401k vs investing on my own

401k vs investing on my own is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in 401k vs investing on my own content depends on the source site. We hope you do not use it for commercial purposes.

When i didnt invest in my 401k taxes ate up the rest.

401k vs investing on my own. Slaying the myth of the 401k tax advantage. Thanks for this timely article. How should i invest in my 401kreal example of 401k portfolio and allocations my 401k investments and allocations.

Why you shouldnt contribute to your 401k. Use your own investing acumen. Investing myself ive been trying to understand why a tax deferring investment is any better than just paying the taxes right now when i have the income for it and what im finding is that the difference is really minimal.

I max out the 401k save 30 of my after tax own 1 house fully paid. It isnt as if i cant touch it i manage it. Leaving 3 of a 4 match on the table will cost you big time 40 years from now.

But is investing on your own one of those better options. I think what you are really asking is it better to put you. My gut tells me that i should drop my 401k contributions down to enough just to get the match from my employer and focus on using the extra cash to get more properties.

How to get the most out of your 401k plan. Ira is an investing tool individuals use to earn and. A brokerage window is a 401k plan option that gives the investor the capability to buy and.

401k depends on the time spent in the 401k and. Can i take my 401k in a lump sum. Free spreadsheet included you can follow the links here to.

Tax rates go up the answer for taxable vs. Every time i left a job i rolled the 401k into my self directed ira. Investing in a 401k is typically investing in stocks and mutual funds.

Contribute to my 401k or invest in an after tax brokerage account. I am obsessed with trying to max out my 401k mainly to lower my taxes for the year but i already own 5 rental properties and am looking for more. Im doing allmaxing my 401k maxing out our iras and investing in an after tax brokerage account.

All a 401k is is a tax shelter that holds your money and prevents it from being taxed until you take the money out. Dont think about it as if not being able to touch it except for borrowing against a 401k is a bad thing.

Roth 401k Might Make You Richer Millennial Money

Roth 401k Might Make You Richer Millennial Money

You Might Be Able To Beat A 401 K By Investing On Your Own

You Might Be Able To Beat A 401 K By Investing On Your Own

401 K Or Ira How To Choose Where To Put Your Money Ellevest

401 K Or Ira How To Choose Where To Put Your Money Ellevest

Keep The 401 K Or Pay Off The Mortgage Daveramsey Com

Keep The 401 K Or Pay Off The Mortgage Daveramsey Com

Contribute To My 401k Or Invest In An After Tax Brokerage

Contribute To My 401k Or Invest In An After Tax Brokerage

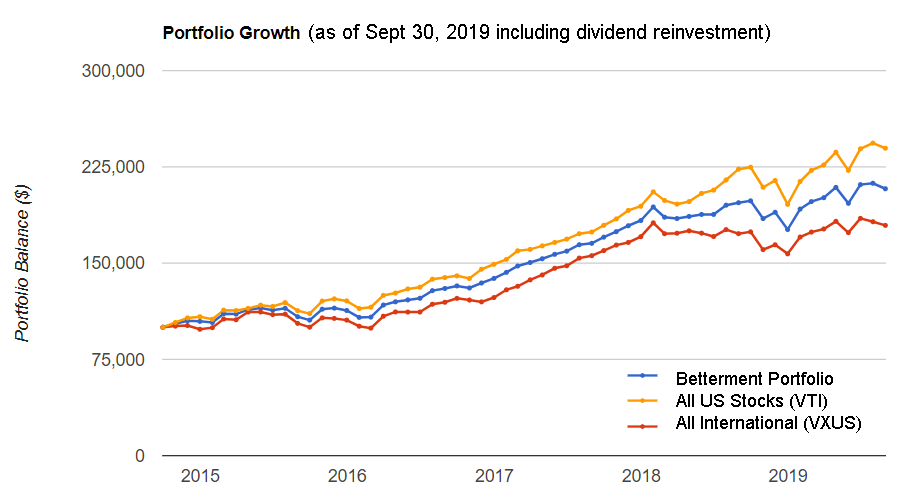

The Betterment Experiment Results Mr Money Mustache

The Betterment Experiment Results Mr Money Mustache

:max_bytes(150000):strip_icc()/roth_ira_401k_nesteggs_istock466132651-5bfc328ec9e77c00519bf2e6.jpg) 401 K Plan Vs Stock Picking What S The Difference

401 K Plan Vs Stock Picking What S The Difference

5 Top Funds For Your 401 K The Motley Fool

5 Top Funds For Your 401 K The Motley Fool

Growing A 401k Vs Liquidating To Invest In Real Estate Blog

Growing A 401k Vs Liquidating To Invest In Real Estate Blog

Traditional Vs Roth 401k Is The Roth Better Clever Girl

Traditional Vs Roth 401k Is The Roth Better Clever Girl

Roth Ira Vs Traditional Ira Which Is Better For You

Roth Ira Vs Traditional Ira Which Is Better For You