The new 38 medicare tax on net investment income took effect on january 1. For individuals the calculation of the 38 medicare surtax is dependent on two components.

Mowery Schoenfeld On Twitter Be Wary Of The Surtax On

Mowery Schoenfeld On Twitter Be Wary Of The Surtax On

38 surtax on investment income

38 surtax on investment income is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in 38 surtax on investment income content depends on the source site. We hope you do not use it for commercial purposes.

Though the patient protection and affordable care act ppaca faces an uncertain future obamacare remains the law of the land for the time being.

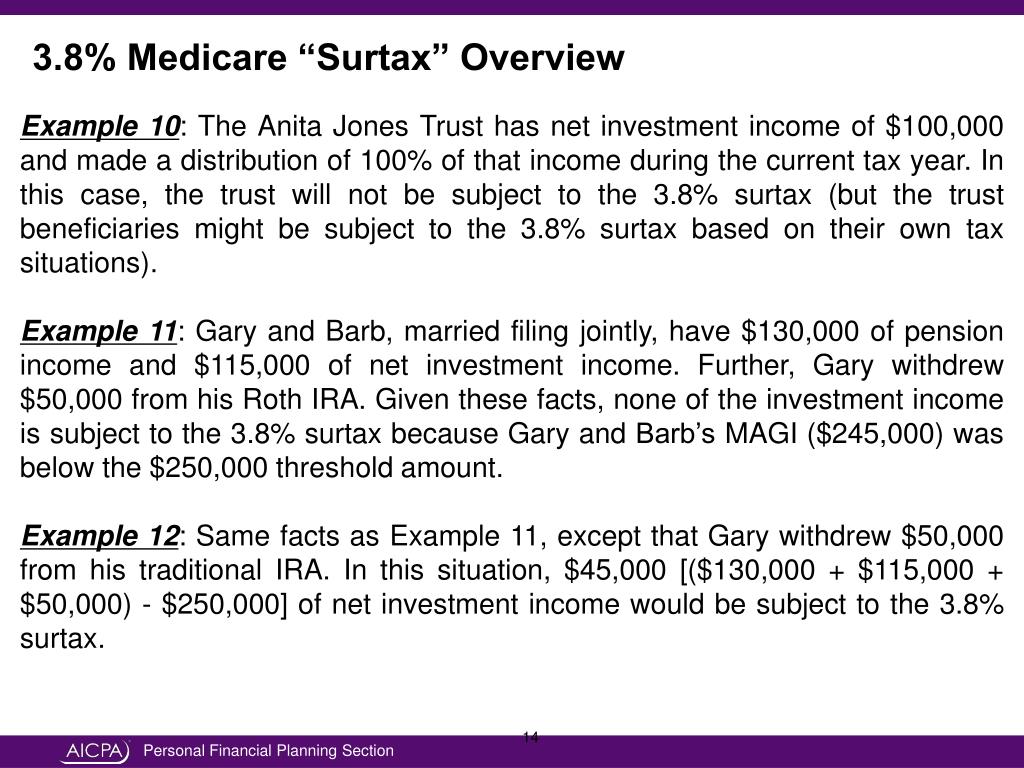

38 surtax on investment income. Here is what you need to know to navigate the 38 surtax on unearned investment income and the 09 additional tax on wages. The net investment income tax is a 38 surtax on a portion of your modified adjusted gross income magi over certain thresholds. B and c are subject to niit on the lesser of 225000 bs net investment income or 50000 the amount b and cs modified adjusted gross income exceeds the 250000 married filing jointly threshold.

Thankfully irs has made their position on this issue very clear. January 18 2019 admin leave a comment. For single filers the threshold is just 200000.

There is a flat surtax of 38 on net investment income for married couples who earn more than 250000 of adjusted gross income agi. In final regulations that cover the 38 surtax the irs expressly excluded nua from investment income. It only affects higher income individuals but that can include anyone who has a big one time shot of investment income.

The net investment income tax or niit is actually a 38 medicare surtax on investment income. 38 surtax on investment income. It hits high earners with significant investment income.

It might take a bite out of your finances even if you manage to avoid paying significant income taxes on your investment income through the use of deductions credits and other tax perks. Aarp health insurance plans pdf download medicare replacement pdf download aarp medicarerx plans united healthcare pdf download. The levy is only investment income above the thresholds.

B and c owe net investment income tax of 1900 50000 x 38. So after filing your 2014 return youve experienced the joys of. It first took effect in 2013.

On the other hand the gain is considered a capital gain which is typically considered investment income and therefore potentially subject to the surtax. 1 2013 individual taxpayers are liable for a 38 percent net investment income tax on the lesser of their net investment income or the amount by which their modified adjusted gross income exceeds the statutory threshold amount based on their filing status. If an individual has income from investments the individual may be subject to net investment income tax.

A taxpayers net investment income nii and his or her modified adjusted gross income magi. Another example of the marriage penalty at work in our tax code.

Ppt Planning Strategies In Wake Of The New 3 8 Medicare

Ppt Planning Strategies In Wake Of The New 3 8 Medicare

Fiscal Cliff Tax Planning And Reform Sarah Brown August 7

Fiscal Cliff Tax Planning And Reform Sarah Brown August 7

Net Investment Income Tax What It Is And Why It Might

Net Investment Income Tax What It Is And Why It Might

Some Investors Likely To Face New Tax Bite Wsj

Some Investors Likely To Face New Tax Bite Wsj

President Trump What Does It Mean For Your Tax Bill

President Trump What Does It Mean For Your Tax Bill

Indiana Manufacturers Medicare Surtax Article

Indiana Manufacturers Medicare Surtax Article

What The Senate S 3 8 Surtax Means For American Taxpayers

What The Senate S 3 8 Surtax Means For American Taxpayers

Time To Sell Your Appreciated Shares Marketwatch

Time To Sell Your Appreciated Shares Marketwatch

Fiscal Cliff Tax Planning And Reform Sarah Brown August 7

Fiscal Cliff Tax Planning And Reform Sarah Brown August 7

New Section 1411 Regulations Answer A Number Of Questions

New Section 1411 Regulations Answer A Number Of Questions