Roth iras are one of the best ways to save for retirement. For instance one common misconception is that iras have to invest in bank certificates of deposit because when you open an ira at a bank your only choice at that bank will typically be a cd.

Roth Ira How They Work Rules To Know Where To Begin

Roth Ira How They Work Rules To Know Where To Begin

do you have to invest your roth ira

do you have to invest your roth ira is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in do you have to invest your roth ira content depends on the source site. We hope you do not use it for commercial purposes.

But how much you can save may be limited by the amount and type of income you have earned and your contributions to other.

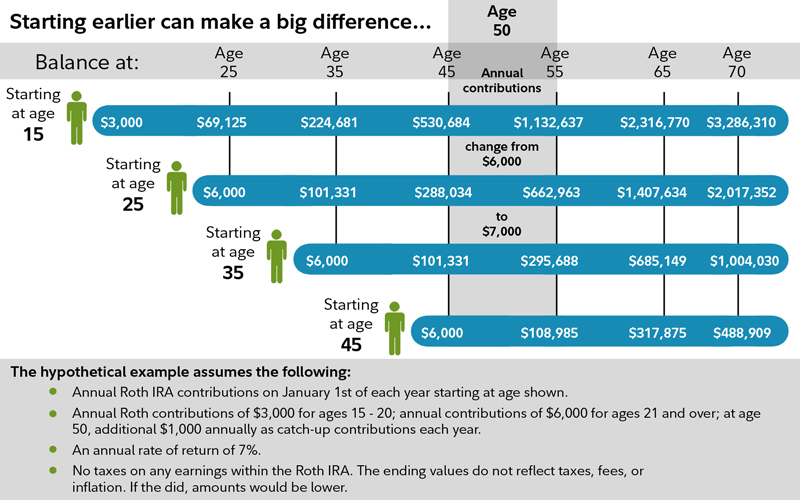

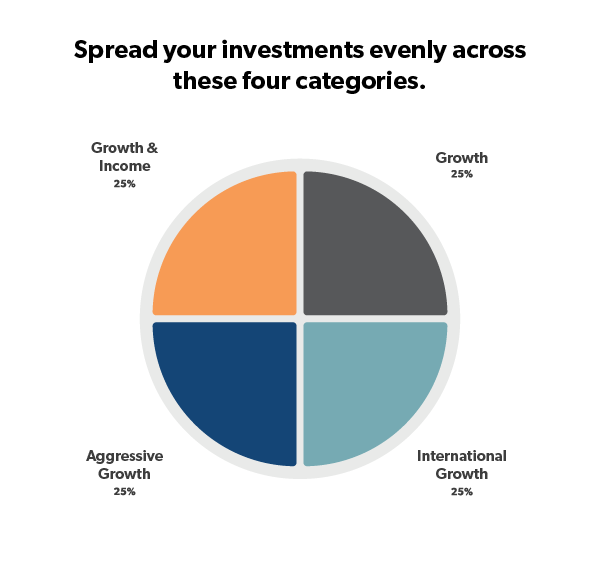

Do you have to invest your roth ira. 4 roth ira investing tips that could earn you thousands if youre strategic about moves you make with your roth ira you can accumulate even more in it and can set yourself up for tax free. Fidelity believes one of the best ways to do that over the long term is by considering an appropriate amount to invest in a diversified portfolio of stock mutual funds exchange traded funds etfs or individual stocks as you plan and implement an investment strategy that fits your time horizon risk preferences and financial circumstances. One of the smartest money moves a young person can make is to invest in a roth ira and setting one up is easy.

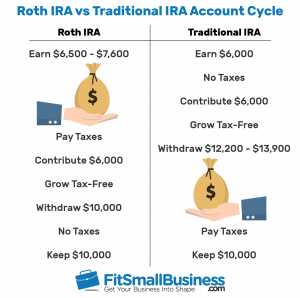

So where do you begin. How to invest in a roth ira. While theres no upfront tax benefit you get tax free income in retirementeven on the earnings that have accumulated over the years.

If you put in the maximum amount of 5500 or 6500 if you are 50 or older for 2014 or 2015 you are probably pretty happy. 1 how to start a roth ira. A roth ira individual retirement account is one in which your contributions are taxed at your current tax rate but the dividends that grow from those contributions wont be taxed when you withdraw them after the age of 59 12.

You have many options to choose from after youve maxed out your roth ira. There are limits to how much money you can put into iras each year. Test your retirement iq follow the rules and any money you put into one of.

Roth ira investment allocation. You just opened a roth ira or added to your existing one. For 2019 you can invest 6000 in either a traditional ira or a roth iraif youre 50 or older and need to catch up you can add an extra 1000 for a total of 7000.

There are thousands of investment options you can choose from. First its important to understand the answer to this question depends on.

Roth Ira How They Work Rules To Know Where To Begin

Roth Ira How They Work Rules To Know Where To Begin

Backdoor Roth Ira What It Is And How To Set One Up Nerdwallet

Backdoor Roth Ira What It Is And How To Set One Up Nerdwallet

How To Start A Roth Ira Daveramsey Com

How To Start A Roth Ira Daveramsey Com

Roth Ira Rules Contribution Limits Deadlines

Roth Ira Rules Contribution Limits Deadlines

Is A Roth Ira Considered A Brokerage Account

Is A Roth Ira Considered A Brokerage Account

Contributing To Your Ira Fidelity

Contributing To Your Ira Fidelity

Roth Iras How To Optimize Yours For 2019

Roth Iras How To Optimize Yours For 2019

Making The Maximum Ira Contribution Think Roth Vanguard

Making The Maximum Ira Contribution Think Roth Vanguard

Roth Iras How To Optimize Yours For 2019

Roth Iras How To Optimize Yours For 2019