Cost method is one of the most conservatives methods of accounting for investments where the investment stays on the balance sheet at its original cost unlike the fair value or revaluation method where the market factors and various internal management models are used for determining the fair value. Its the amount of ownership that decides the method of accounting.

Accounting For Investments In Common Stock Ppt Download

Accounting For Investments In Common Stock Ppt Download

cost method of accounting for investments example

cost method of accounting for investments example is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in cost method of accounting for investments example content depends on the source site. We hope you do not use it for commercial purposes.

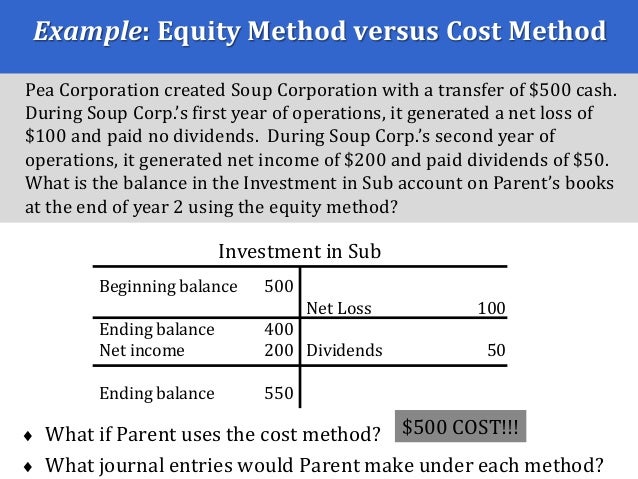

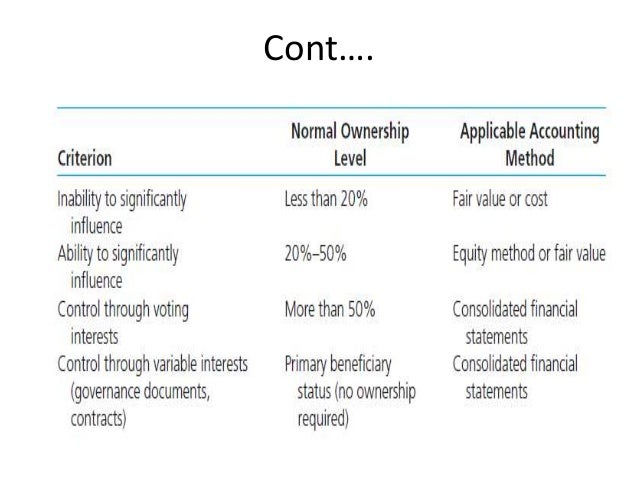

When a company owns less than 50 of the outstanding stock of another company as a long term investment the percentage of ownership determines whether to use the cost or equity method.

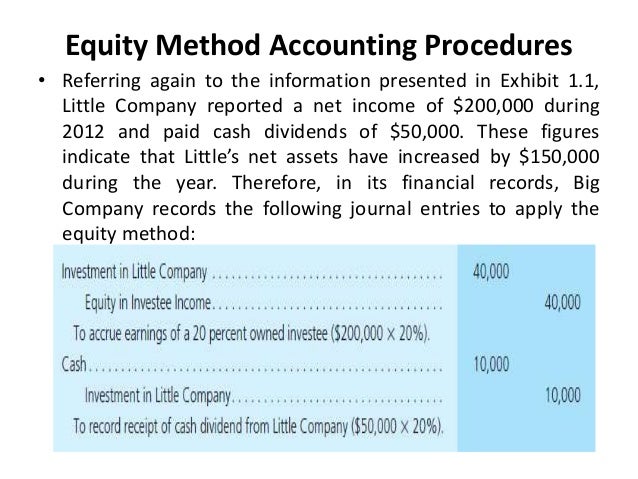

Cost method of accounting for investments example. Accountants use the cost method to account for all short term stock investments. The investor is deemed to exert significant influence over the investee and therefore accounts for its investment using the equity method of accounting. Ulike the consolidation method the terminology of parent and subsidiary are not used since the investor does not exert full control.

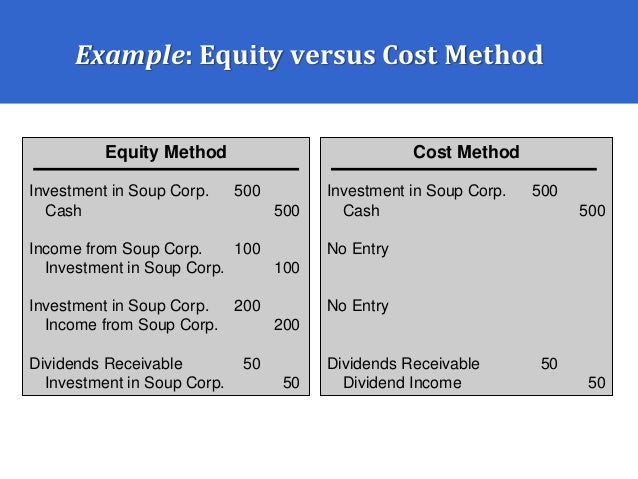

Here how a distinction is made between cost method vs equity method. Accounting for short term stock investments and for long term stock investments of less than 20 percent. Different ways like equity cost and consolidated can be employed when accounting for investments.

The equity method is a type of accounting used in investments. What is the cost method. In general the cost method is used when the investment doesnt result in a.

Initial equity method investment. Instead the term investment is simply used. When the ownership is lower than twenty percent cost method is employed but when.

It is considerably easier to account for investments under the cost method than the equity method given that the cost method only requires initial recordation and a periodic examination for impairment. The cost method is a type of accounting used for investments where the investor holds little to no influence over the investee. The cost method of accounting for investments is used to determine the profit and loss of any investment.

The cost and equity methods of accounting are used by companies to account for investments they make in other companies. The equity method is only used when the investor has significant influence over the investee. This differs from the consolidation method where the investor exerts full control.

Apart from that this method is also used to compute the return on investment of a certain investment. This method is used when the investor holds significant influence over investee but not full control over it as in the relationship between parent and subsidiary. To know more about this approach of accounting read on.

For investments where the. F or most investors the proper way to account for your investing profits and losses is with the cost method of accounting. This method is not the only choice however.

Suppose a business the investor buys 25 of the common stock of another business the investee for 220000 in cash.

Equity Method Accounting Definition Explanation Examples

Equity Method Accounting Definition Explanation Examples

Stock Investments By Arthik Davianti

Stock Investments By Arthik Davianti

Cost Method Definition Examples Guide To Accounting For

Cost Method Definition Examples Guide To Accounting For

Advansed Accounting Ch 1 The Equity Method Of Accounting

Advansed Accounting Ch 1 The Equity Method Of Accounting

Long Term Investments Types Examples

Stock Investments By Arthik Davianti

Stock Investments By Arthik Davianti

Advansed Accounting Ch 1 The Equity Method Of Accounting

Advansed Accounting Ch 1 The Equity Method Of Accounting

Investments And Financial Instruments Ppt Download

Investments And Financial Instruments Ppt Download

The Equity Method Of Accounting For Investments Ppt Download

The Equity Method Of Accounting For Investments Ppt Download

Equity Method Of Accounting For Investments

Equity Method Of Accounting For Investments