Can you have a 401k and an ira. If you want to invest and build wealth over time then this is the goal for you.

Can I Contribute To An Ira If I Have A 401 K At Work The

Can I Contribute To An Ira If I Have A 401 K At Work The

can i invest in ira if i have a 401k

can i invest in ira if i have a 401k is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in can i invest in ira if i have a 401k content depends on the source site. We hope you do not use it for commercial purposes.

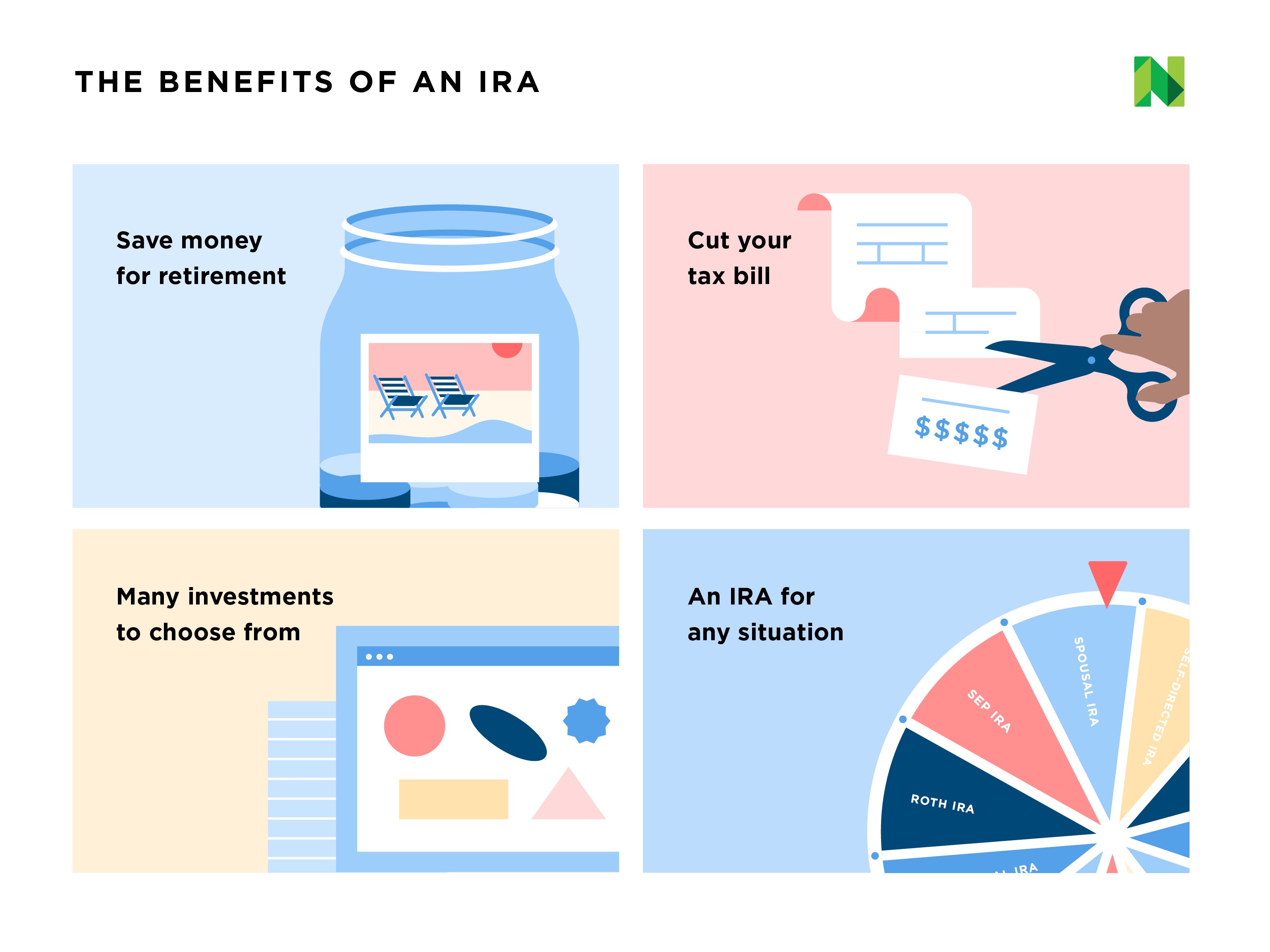

If you want to invest some of your retirement savings in say apple stock an ira can let you do that.

Can i invest in ira if i have a 401k. Can you invest in both an ira and a 401k. The answer is yes you can have both. Plus youll have a tax deferred account that makes saving a cinch through automatic payroll deduction.

However your ability to take advantage of the tax deduction for traditional iras may. Can i contribute to an ira if i have a 401k at work. A 401k lets you save 19500 a year 25000 if youre 50 or over and your company may match a portion of your.

Can you have a 401k and an ira at the same time. If you have earned income you can put money into both a 401k plan and an ira. If your employer doesnt offer a plan then an ira can be a good start to your retirement savings and another opportunity for your earnings to grow tax free.

And in some cases based on the fees in your 401k an ira might actually be a better place to invest your money. Yes you can invest in both an ira and a 401k or a roth 401k and a roth ira at the same time or any combination of those accounts. Can you have both a 401k and an ira.

Again this increases to 7000 for those who are age 50 or older. If you dont have a 401k through work you can contribute to both a traditional ira and a roth ira as long as your combined contributions dont exceed the 6000 annual limit as of 2019. An individual retirement account ira is an investing tool individuals use to earn and earmark funds for retirement savings.

This question comes up frequently when it comes to retirement. Can i contribute to a 401k and an irafortunately for your retirement nest egg you can contribute to both types of retirement accountsin fact both workplace and individual retirement accounts represent important building blocks in building your retirement savings. This is a great question.

This is an excellent goal type for unknown future needs or money you plan to pass to future generations. The internal revenue service does not bar anyone from making contributions to both an individual retirement plan and a 401k plan as long as you meet both plans eligibility requirements. For 2017 workplace plans allow you to contribute up to 18000 or up to 24000 if youre 50 or older.

The good news is that you can always max out a retirement plan at work like a 401k 403b or 457 plan and still max out an ira for the same tax year.

Can You Contribute To A 401k And An Ira In The Same Year

Can You Contribute To A 401k And An Ira In The Same Year

Can I Contribute To A 401k And An Ira

Can I Contribute To A 401k And An Ira

Can You Contribute To Both A 401 K And An Ira Betterment

Can You Contribute To Both A 401 K And An Ira Betterment

/GettyImages-580502931-fe55d88033904806bc9533ac85619abc.jpg) 401 K And Ira Contributions You Can Do Both

401 K And Ira Contributions You Can Do Both

:max_bytes(150000):strip_icc()/GettyImages-91837283-49f5b85ed6fd49e0973e2c6a1c37691d.jpg) Can I Fund A Roth Ira And Contribute To My Employer S

Can I Fund A Roth Ira And Contribute To My Employer S

How To Save For Retirement Without A 401 K The Motley Fool

How To Save For Retirement Without A 401 K The Motley Fool

Which Should You Fund First Your 401 K Or Ira

Which Should You Fund First Your 401 K Or Ira

:max_bytes(150000):strip_icc()/GettyImages-137513511-572b9ffb5f9b58c34c6a8244.jpg) 401 K And Ira Contributions You Can Do Both

401 K And Ira Contributions You Can Do Both

Secure Act Spotlight Roth 401 K And Roth Ira Accounts

Secure Act Spotlight Roth 401 K And Roth Ira Accounts

How And Where To Open An Ira Nerdwallet

How And Where To Open An Ira Nerdwallet

Why You Should Increase Your 401 K Or Ira Contributions By 1

Why You Should Increase Your 401 K Or Ira Contributions By 1