Because investment fees and expenses are no longer deductible some accountants might consider a section 266 election to capitalize investment management fees as carrying charges to deduct. Investment management fees can be deducted directly from the accounts for.

Maximizing Pre Tax Investment Advisory Fees After Tcja

Maximizing Pre Tax Investment Advisory Fees After Tcja

can i deduct investment management fees

can i deduct investment management fees is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in can i deduct investment management fees content depends on the source site. We hope you do not use it for commercial purposes.

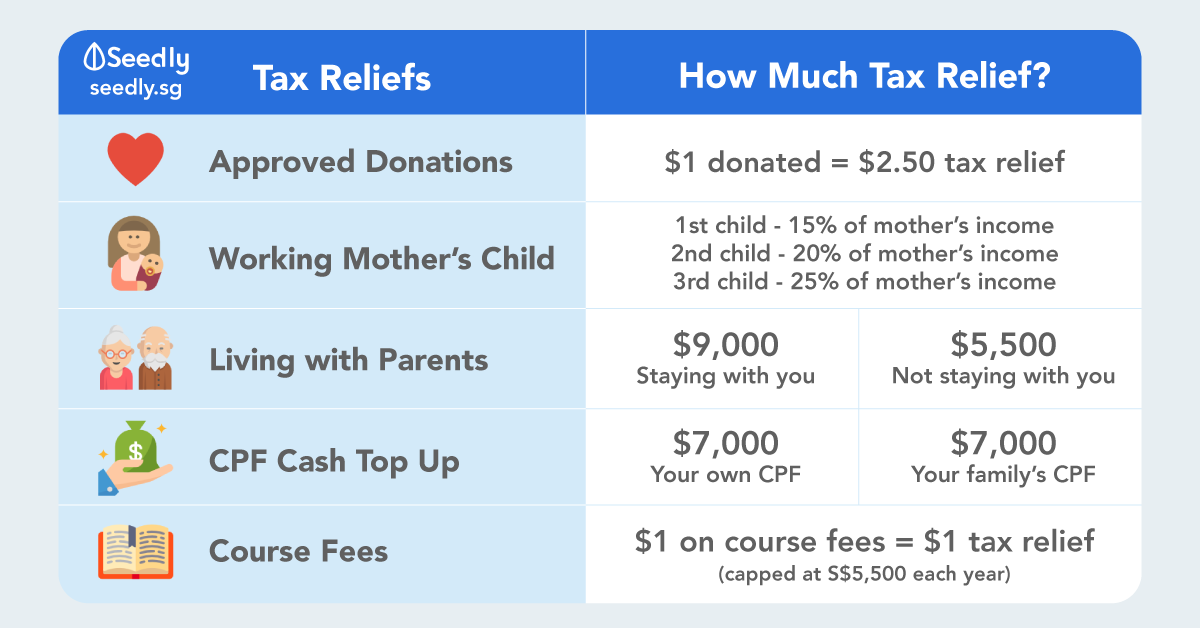

Investment management and financial planning fees were tax deductible through tax year 2017.

Can i deduct investment management fees. You can only deduct fees for investments that produce taxable income. However if the only earnings your investment can produce are capital gains you cannot claim the interest you paid. You can only claim fees that relate to taxable investment accounts like non registered investment accounts but not all fees.

Stockholders can include broker commissions and fees in their stocks cost basis. Commissions to buy or sell investments are not tax deductible on line 221. Many fee only advisors charge a percentage of assets under management.

See interpretation bulletin it 99 legal and accounting fees. Part of a successful financial plan is astute tax management. Some investments do not produce taxable income such as municipal bonds or mutual funds that distribute only tax exempt dividends.

By increasing your investment in a fund. Miscellaneous itemized deductions included expenses such as fees for investment advice. Even if you cant deduct investment management fees directly you can still pay a portion of the fee with pretax dollars.

If the interest expenses are more than the net investment income you can deduct the expenses up to the net investment income amount. If you arent sure check with you broker financial management company or financial advisor. Investment management fees can be deducted directly from the accounts for which they were charged.

Most interest you pay on money you borrow for investment purposes but generally only if you use it to try to earn investment income including interest and dividends. The rest of the expenses are carried forward to next year. Thus trustees have been required to unbundle any fees that contain both categories of expense in order to distinguish which portion is subject to the 2 floor.

They fell into the category of miscellaneous itemized deductions and these deductions were eliminated from the tax code by the tax cuts and jobs act tcja effective tax year 2018. Even if you cant deduct investment management fees directly you can still pay a portion of the fee with pretax dollars. Any portion allocable to investment management an expense commonly or customarily incurred by an individual is a miscellaneous itemized deduction and subject to the 2 floor.

Investment Fees Are Not Deductible But Borrow Fees Are

Investment Fees Are Not Deductible But Borrow Fees Are

Are Investment Management Fees Tax Deductible

Are Investment Management Fees Tax Deductible

The New Tax Law S Impact On Investment Advisory Fees Iras

The New Tax Law S Impact On Investment Advisory Fees Iras

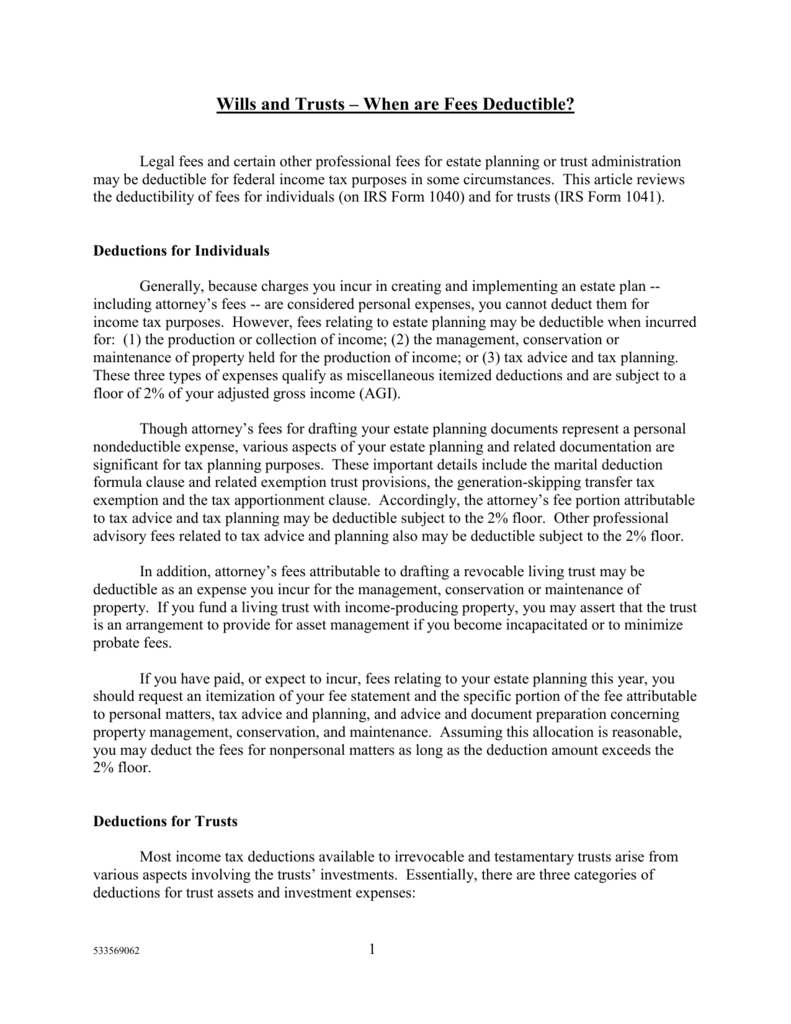

Basic Format Of Tax Computation For An Investment Holding

Basic Format Of Tax Computation For An Investment Holding

How To Reduce Current And Future Income Taxes Ppt Download

How To Reduce Current And Future Income Taxes Ppt Download

Reits How Can Cash Flow Be Artificially Boosted To Give

Reits How Can Cash Flow Be Artificially Boosted To Give

How Do Operating Income And Revenue Differ

Maximising Deductions For Your Investment Property The

Maximising Deductions For Your Investment Property The

This Investment Fee Tax Break Is Gone What That Means For

This Investment Fee Tax Break Is Gone What That Means For

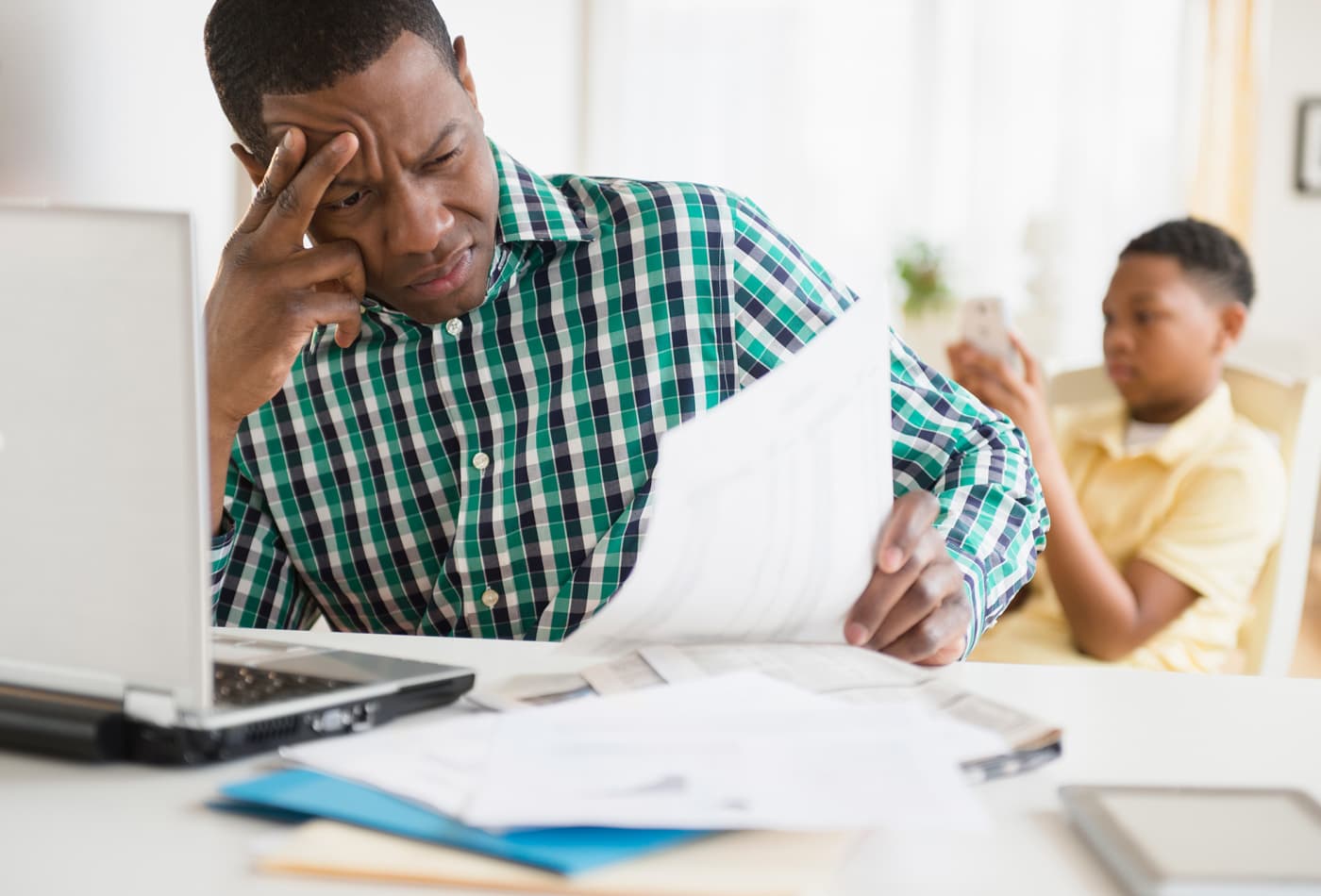

Your Cheat Sheet Personal Income Tax In Singapore Ya 2019

Your Cheat Sheet Personal Income Tax In Singapore Ya 2019

Operating Income Vs Gross Profit